Investment firm Lindsell Train does not have sufficient risk management in place, according to Emma Wall, head of investment analysis and research at Hargreaves Lansdown.

In a research note, Wall said managers Nick Train, Michael Lindsell and James Bullock are not tested enough on their decisions and there is not enough oversight by other parts of the business.

“At present, we don’t feel that the investment risk framework currently in place is sufficiently robust, nor that Lindsell Train have the correct capabilities, to provide strong independent oversight and challenge of the investment team,” she said.

This is not to say that the managers are not good at what they do, she noted, with their long-term, buy-and-hold approach serving investors well over many years.

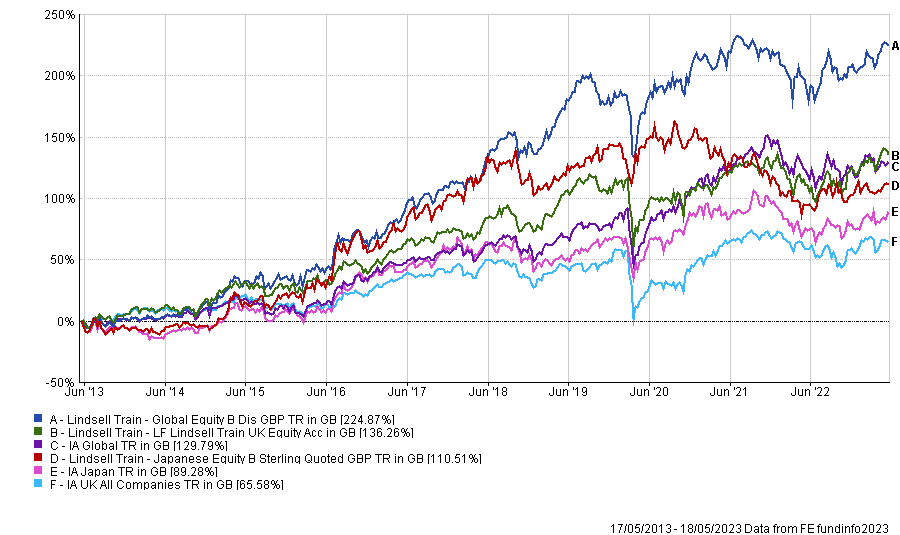

Indeed, all three Lindsell Train funds with a 10-year track record (Global Equity, Japanese Equity and UK Equity) have been top-quartile performers over the past decade. However, all have dropped to the bottom quartile of their respective sectors over three years.

Performance of funds vs sectors over 10yrs

Source: FE Analytics

“This isn’t a recommendation to make any changes to a portfolio. Investors should make sure any investments match their investment goals, attitude to risk and are held as part of a diversified portfolio,” said Wall.

The report was part of the firm’s ongoing monitoring and analysis of funds, which includes looking at the manager, process, culture, ESG integration and performance.

While not included in Hargreaves Lansdown’s Wealth List, Lindsell Train Global Equity and Lindsell Train UK Equity were both on the Wealth 50, the predecessor to the list and still fall within the firm’s coverage. They were removed to avoid a potential conflict of interest, as Lindsell Train is a significant investor in Hargreaves Lansdown.

“Our analysis highlighted some concerns around the capabilities and resource that the Lindsell Train business has in place to provide effective challenge to investment teams. We believe specific capabilities and resource are required to deliver effective oversight in line with industry good practice,” said Wall.

“Following a period of engagement with the team at Lindsell Train, we do not feel that the pace of progress has been satisfactory. We will continue to monitor the situation and let investors know if our views change.”

It is the first time criticism of this nature has been levied on such a well-known fund manager since the collapse of Woodford Investment Management, when investors discovered disgraced fund manager Neil Woodford was investing in illiquid stocks.

This resulted in swathes of withdrawals from the group’s funds, their suspension, and ultimately the demise of the investment firm. One of the myriad issues pointed to by investment experts at the time was that the manager did not have a strong enough oversight over his investments.

Lindsell Train invests exclusively in large- and mid-cap companies and there is no indication that liquidity is an issue with these funds.

A spokesperson for Lindsell Train said: "When considering investment risk, our primary aim is to avoid losing permanent capital value for our investors and we believe that risk can best be mitigated by investing in high-quality companies. In addition, we monitor and control other aspects of risk including portfolio concentration and liquidity. We should add that our Global, UK, Japanese and North American Equity Funds invest only in listed companies, there is no exposure to unlisted securities.

"The independent oversight of risk is already the responsibility of a risk and compliance committee, chaired by an independent non-executive director with considerable experience in this area. We have also recently hired an executive focused on the monitoring of risk. We will continue to commit resources to this important part of our business."