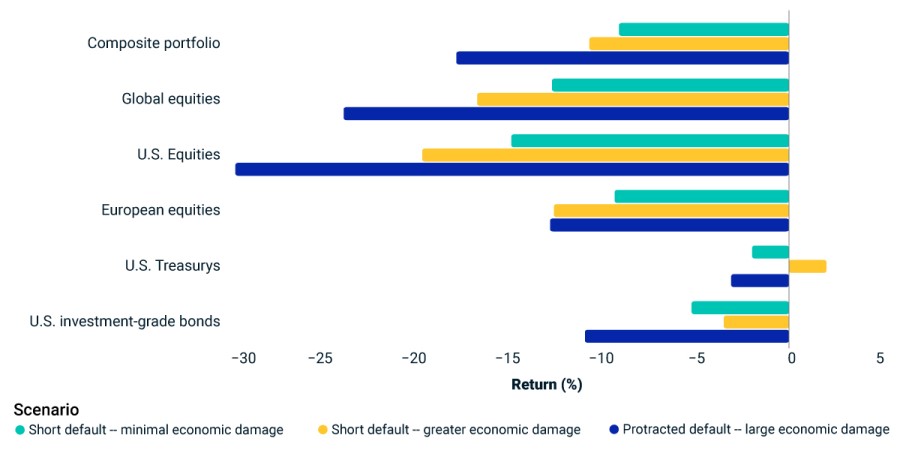

Investors with a diversified portfolio of global equities, US bonds and real estate would lose between 9% and 18% should US lawmakers fail to reach a last-minute agreement on the country’s debt ceiling, according to analysts at MSCI.

If not agreed by 5 June, the country will run out of money and could plunge not just the US, but the global economy, into recession. The Democrats and Republicans have been battling over the issue, with the Republicans demanding an increase in the US borrowing limit comes with spending curbs and other concessions.

The proposed bill would increase the $31.4trn debt ceiling for two years and looks set to be passed, according to experts. Stephen Innes, managing partner at SPI Asset Management, said the saga was “limping towards its inevitable conclusion”.

However, Susannah Streeter, head of money and markets at Hargreaves Lansdown, cautioned that markets remain nervous.

“Limits on spending are being imposed just as America looks set to head towards recession, which could make it harder for growth to snap back,” she said.

Nigel Green, founder of deVere, added that using the country’s debt as a political weapon “undermines confidence of investors in the US government” and will make it harder to borrow money in the future.

“This could lead to higher interest rates and weaker economic growth and also erodes some of the current global reserve currency’s credibility and reputation as a ‘safety asset’, which could have far-reaching repercussions for the US.”

Yet there is no guarantee that the bill will be passed, which could leave markets in turmoil. Thomas Verbraken, Andy Sparks and Dora Pribeli, analysts at MSCI, said a US default could leave investors with nowhere to hide.

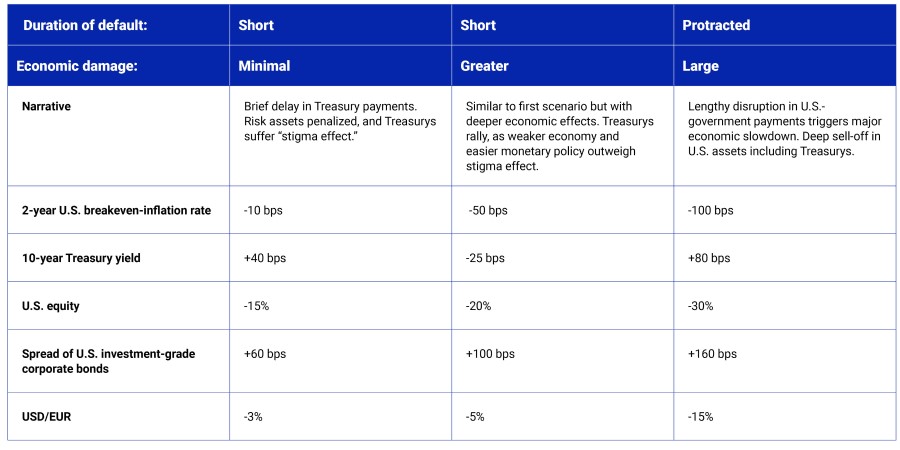

They outlined three potential scenarios, with losses for a diversified portfolio of global equities and US bonds and real estate ranging between 9% and 18%.

Source: MSCI

“Our first scenario assumes a short-lived technical default, where payments are delayed but ultimately paid. Significant economic damage is avoided, but a general aversion to risky assets drives equity prices 15% lower and credit spreads 60 basis points [bps] wider,” they said.

US Treasuries would suffer from a “stigma effect” resulting from the newly established precedent that the US can default as well as investor concern that future debt crises could become more frequent. Yields on 10-year Treasurys would rise 40 bps.

The negative impact on the economy is greater in the second scenario, but the default remains shallow. “Slower growth makes Treasuries more attractive, partly because of a greater decline in inflation and because of expectations of looser monetary policy,” they said.

“The result is a rally in Treasuries, but wider corporate-bond spreads and lower equity prices. Despite being at the centre of the turmoil, Treasuries dampen portfolio losses.”

Source: MSCI

Lastly, a protracted default would have significant economic damage. In this doomsday option, US equities would fall by 30% and corporate spreads widen by 160 basis points.

“Many Treasury securities would miss payments for an extended period of time. Ultimately payments are made but investor confidence is shaken. Ten-year Treasury yields would rise 80 basis points and the dollar could weaken 15% versus the euro as investors search for opportunities outside of the US,” they said.