UK investors wanting a sustainable tilt to their portfolios do not need to look far from home to find companies that fit their philosophy, according to Matt Evans, primary manager of the Ninety One UK Sustainable Equity fund.

He aims to back “solution providers” that can deal with some of the “largest global challenges” and has pinpointed five must-haves across the market cap spectrum that are well positioned to answer global challenges while delivering returns to investors.

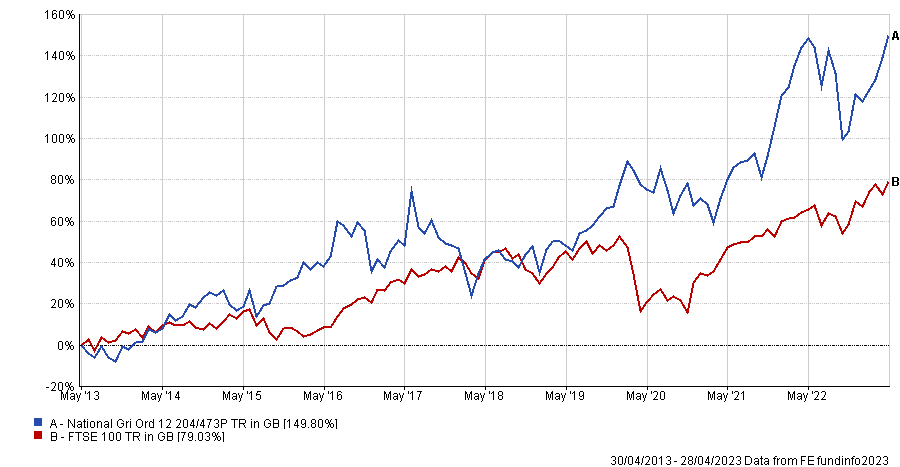

National Grid

In the energy space, Evans is optimistic about the prospects of FTSE 100 constituent National Grid. The company runs energy networks primarily in the UK but also generates a significant part of its revenues from activities in the US. But with the energy transition, Evans said there is more to come.

He noted: “More electrification will require significant capital investment. To deliver that we need businesses that have deep knowledge and an ability to deliver very significant capital projects. We think National Grid is particularly well placed to deliver on that.”

Performance of share vs index over 10yrs

Source: FE Analytics

With plans to expand offshore wind energy in the UK, National Grid is in a good position to provide the required onshore grid connection and cabling.

Evans added: “Today, it is generating a healthy return but it has the potential for additional growth, which we think over the medium-to-long term will provide very credible returns while delivering the infrastructure that the UK absolutely needs as we look to transition.”

Convatech

Staying in the FTSE 100, Evans mentioned Convatech, a UK healthcare business that he likes among others for its wound care and ostomy products. The company has gone through a programme of improvement following the appointment of Karim Bitar as chief executive in 2019.

Performance of share vs index over 10yrs

Source: FE Analytics

Evans said that the company suffered from underinvestment for a few years but that it is now stabilising, giving it a chance to improve margins.

He added: “It is taking that improvement and reinvesting it back for future products, which should stimulate more growth in some areas.

“There is a long road for recovery, but it has got a much longer trajectory of growth, because we're beginning to see the new products come through. Its growth rates has grown 1 or 2 percentage points quicker than it has historically, with improving margins still coming through.”

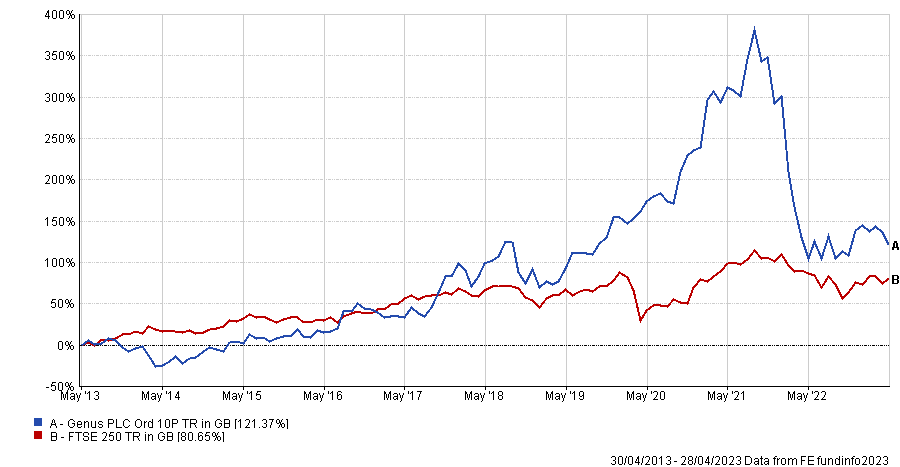

Genus

Turning to the mid-cap space, a more sustainable economy is not only about power generation but also decarbonising some industries such as agriculture. This is the sector FTSE 250 firm Genus operates in through its work in selective animal breeding.

Evans said: “It takes the good traits in animals and breeds them to create animals that have the right characteristics to help farmers improve yield.

“One of the statistics that it has utilised over the past 10 years is dairy. Cattles in America produce 50% more milk than they would have years ago. That improvement in yield means you need fewer animals for greater output in an industry that is under huge pressure to become more efficient.”

Performance of share vs index over 10yrs

Source: FE Analytics

Evans added that Genus should experience compelling growth going forward as the company provides a useful service and is a global market leader in this sector.

Smart Metering Systems

There are also opportunities in the small-cap space with firms such as FTSE AIM-listed Smart Metering Systems. The company installs smart metres for businesses and homeowners and gets rental fees from utilities firms. Yet, it is considering delving into additional markets where it could replicate this business model.

Performance of share vs index over 10yrs

Source: FE Analytics

Evans said: “It started investing heavily in battery storage. It is a developer, so gets all the planning permissions and then installs batteries, which are going to be essential in managing grids and load factors for electricity.

“It sets up those batteries that can take in power when there's more wind, store it and then release it when the energy network needs it. It's going to be a really important part of the energy sector going forward.”

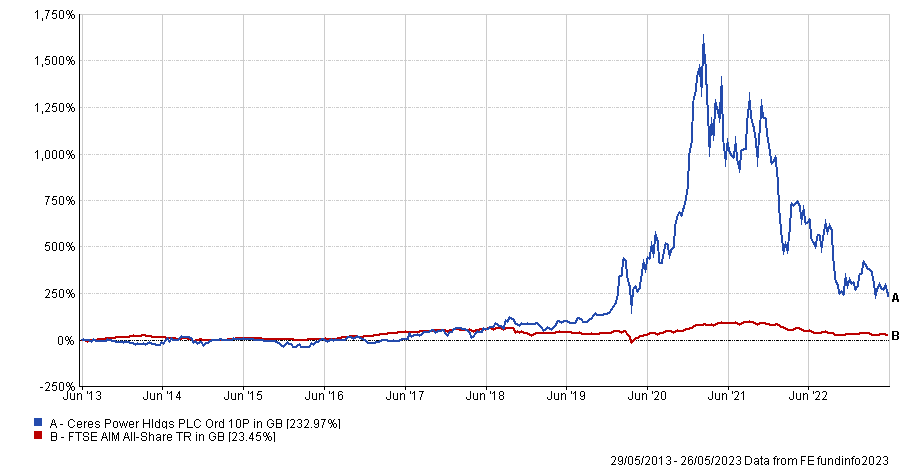

Ceres Power

Ceres Power is another FTSE AIM stock in the energy sector that Evans finds worth keeping an eye on. The company is a developer of power generation and hydrogen technologies.

Evans said: “Its technology could be very useful in industries where you can use an existing process, install Ceres Power’s solid oxide electrolyser to produce hydrogen that you can then utilise through the industrial process, making it a very efficient producer of hydrogen.

“What we really like about Ceres Power is that it has adopted a licence and royalty model. It deploys the technology and will earn a royalty as it gets adopted.”

Performance of share vs index over 10yrs

Source: FE Analytics

He warned, however, that it is on the riskier side of the investment spectrum as the company is still in its early development stage.

Evans said: “It is still a couple of years away from significant revenues, but we think the opportunity set, business structure and the solutions are gaining more traction.

“The issue is it's a high-risk investment, because it has very limited revenue today and requires the adoption of that technology over time.”

So far, Ceres Power has sealed partnerships with European and Chinese businesses, such as German multinational firm Bosch. It is also working on potential partnerships with US firms.