Sentiment towards the UK is beginning to recover and the country’s long-awaited revival is starting to come true, according to Neil Veitch, manager of the SVM UK Opportunities fund.

In the past few years, macro concerns have not only kept potential investors away but also actively pushed the current ones away, who have been liquidating their investments in the domestic market, as most recently showed by April fund flows data.

But now the tables are turning and the stars finally aligning, with multiple factors finally coming together to conjure up a “much more stable” economic and political backdrop for the next five years than in the past 10, making the UK a much more interesting market to invest in.

“The economy proved to be more resilient than had been anticipated, consumer confidence is rebounding, unemployment is still low and housing transactions are beginning to pick up again”, said Vietch.

But it’s politics where he finds the most interesting developments.

“We've had a change in prime minister and went from the chaos of the Boris Johnson government to something that is much more stable and conservative. This has led to a decline in the risk-premium to UK assets as well as to another main outcome since last autumn's disastrous [Liz] Truss Budget, which is largely overlooked,” he said.

“During the past 10 years of virtually free capital, governments haven't had to worry too much about bond market sanction. Truss tried to pursue an unconventional economic policy, which might have worked had the markets been educated a bit better, but it failed spectacularly.

“Now whoever is on top over the next five years, whether liberal or conservative, is going to follow a very conventional, very centrist and zero-surprises economic policy in order to avoid doing anything that might upset the bond market.”

To further improve the picture, other tail risks have faded for the next five to 10 years, including Scottish independence and a labour government with a leftist tangent, according to Veitch.

The UK is also conducting “sensible” relationships with Europe, with the signing of the Windsor Framework on 27 February (an agreement to address the challenges around Northern Ireland following Brexit).

“All of this encourages people to think: the grown-ups are back in charge, the UK is re-engaging with the world. Potentially, it’s somewhere I can invest in,” said the manager.

This is also happening at a time when the bull market in the US dollar may be coming to an end.

“We're at the peak of the US interest rate cycle and potentially preparing for a US recession in 2023 to 2024, and dollar weakness typically bodes well for other perceived to be high-beta asset classes, whether that's emerging market equities or whether it's UK all caps, or UK small and mid-caps.

“Against a trade-weighted basket of currencies, the US dollar is still at 50-year highs and has the potential to weaken from here and there are signs that international investors, especially from the US, are beginning to be engaged with the UK again,” he concluded.

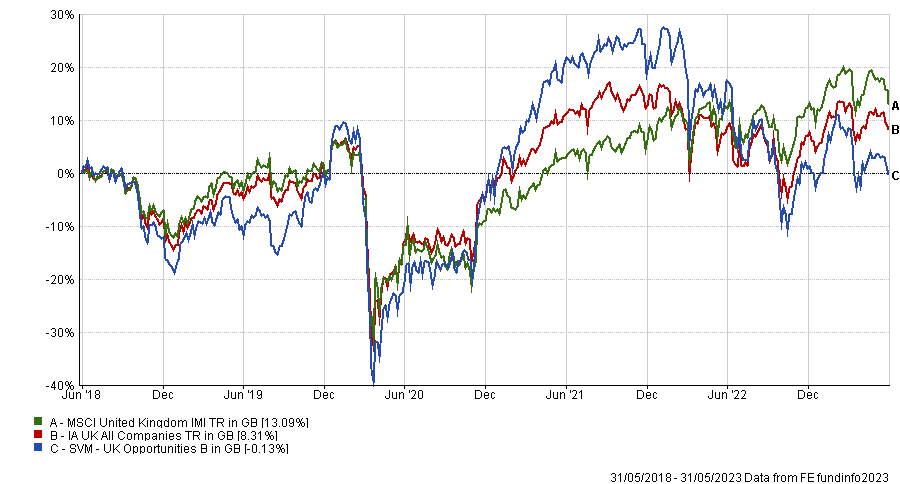

Performance of fund over 5yrs against sector and index

Source: FE Analytics

In his SVM UK Opportunities fund, Veitch invests in UK companies with a split of 50% in larger and the rest in a balance of mid and smaller companies, through a “valuation-aware” strategy.

He invests in “resilient” companies applying a broader definition of “resilience” which also includes businesses that might be exposed to short-term economic cycle volatility.