Stocks have risen in 2023’s opening five months but investors should be concerned that returns were concentrated in a very narrow slice of the market, market pundits have warned.

Following a terrible 2022 for stock markets, equities have been on the up this year as inflation started to peak in the US and investors eyed an eventual pause in central banks’ interest rate hikes.

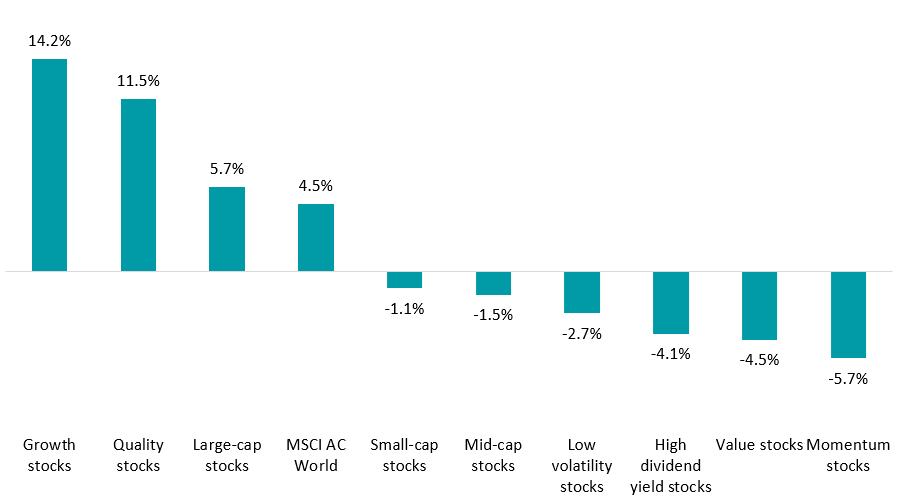

FE Analytics shows the MSCI AC World index made a 4.5% total return between the start of the year and the end of May. As the chart below shows, this has been led by growth stocks (especially the US tech sector, which bore the brunt of 2022’s sell-off) while the value style has underperformed.

Performance by investment factor over Jan-May 2023

Source: FinXL

Things haven’t been as strong in fixed income markets, with the Bloomberg Barclays Global Treasury and Bloomberg Barclays Global Aggregate Corporates indices both falling. Commodities have also eased this year, after energy and food prices fell back from their spikes in 2022.

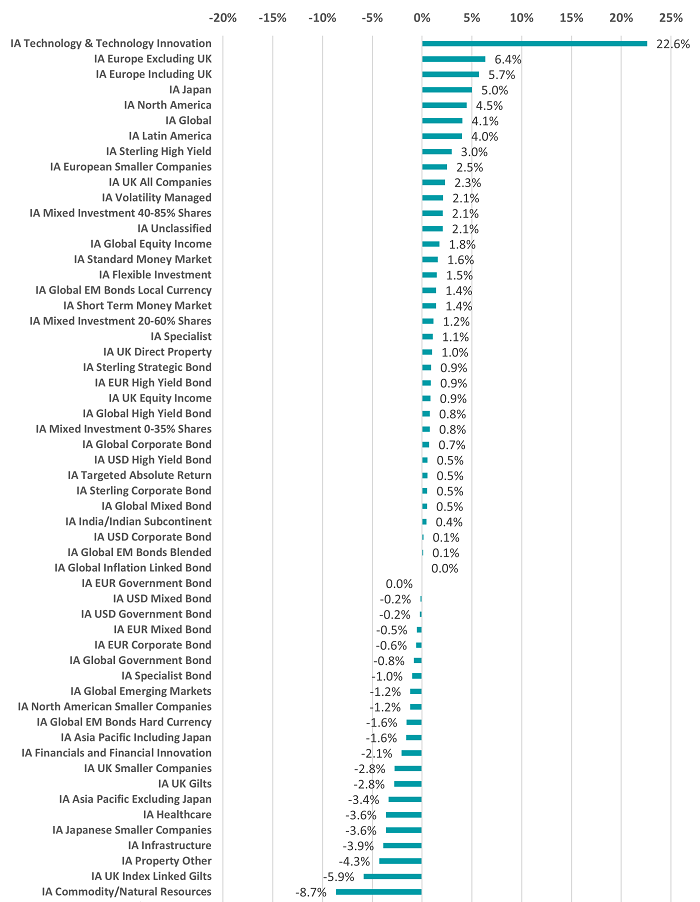

This translates into mixed fortunes of the 57 sectors in the Investment Association universe – as can be seen in the average returns made by each over the past five months.

Average performance of Investment Association sectors

Source: FinXL

As would be expected given the backdrop, equity sectors are the ones making the highest average returns although there are exceptions.

Smaller companies funds are struggling, reflecting concerns over the health of the global economy. Of the four smaller companies sectors, only IA European Smaller Companies has made a positive average return this year.

The IA China/Greater China sector has tanked; after a strong opening rally, the Chinese stock market has sold off on worries about slower growth, a weak yuan, developers’ debt and geopolitics. Fund sectors with high exposures to China, such as the Asian equity peer groups and IA Global Emerging Markets, have been dragged down with it.

By far the biggest return has come from the IA Technology & Technology Innovation sector, where the average fund is up 22.6%. As noted above, tech stocks have surged this year – the Nasdaq 100 is up 27.3% (in sterling), compared with a 3.5% fall for the old-economy Dow Jones.

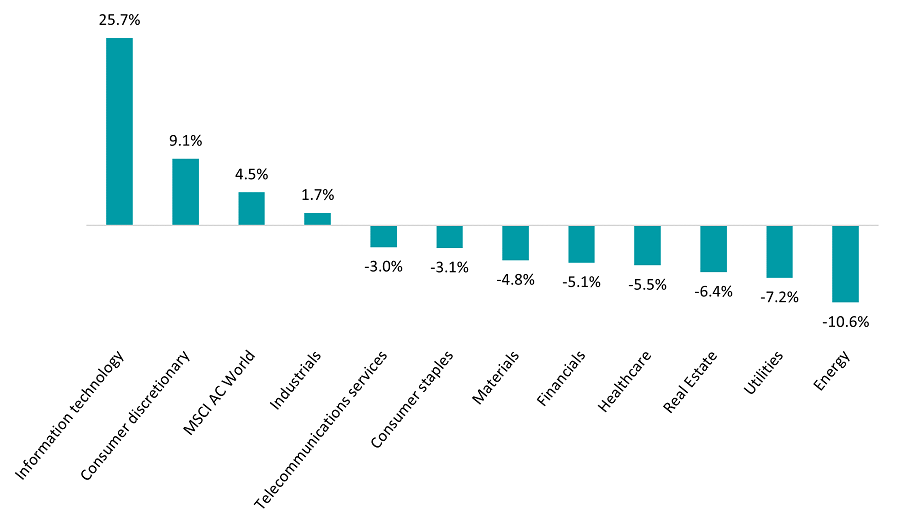

Performance by stock industry over Jan-May 2023

Source: FinXL

The outperformance of tech stocks and the funds that focus on them isn’t too surprising when the year to date returns of the industries within the MSCI ACW World index are seen next to each other, as in the chart above.

However, this dynamic has sparked concern among some professional investors.

Nigel Green, chief executive and founder of deVere Group, pointed out that the ‘Magnificent Seven’ stocks of Apple, Microsoft, Nvidia, Amazon, Meta, Tesla and Alphabet account for around 90% of gains in the S&P 500 this year.

“The prospect of a less aggressive Federal Reserve has fuelled the surge in these stocks,” Green argued.

“But it must be remembered that the Fed is almost certainly not done yet with interest rate hikes, especially following Friday’s robust jobs report. Even if the central bank takes a pause this month, we do expect further rate rises are on their way before they bring their hiking programme to an end. This could potentially hit these powerhouse stocks.”

Green believes these mega-cap tech stocks should be part of almost every investor’s portfolio thanks to their robust fundamentals and exposure to future trends, especially in AI, but is worried that too much attention is directed towards the performance of the ‘Magnificent Seven’.

“The volume is getting louder and the frenzy is reaching fever pitch,” he said. “This hype is dangerous as it could lead investors to assume that these stocks are a silver bullet to build long-term wealth – and they are not, at least not on their own.”

Instead, he argued that a backdrop of cooling but still sticky-high inflation and fears of a recession means sectors that do well in a stagflationary environment should also be included in portfolios.

“These include commodities, such as oil, as their prices typically rise in response to inflation; consumer staples like food and hygiene products, as demand is likely to remain relatively stable; healthcare, as it provides essential services that are less affected by economic cycles; and utilities, including electricity, gas, and water as demand will also be pretty consistent,” he finished.