At the age 66, UK workers become eligible for State Pension. While some will choose to stay professionally active, for many, it will mean the end of their career and an income earned through work.

With a life expectancy of 80.9 years in the UK, according to the World Bank, individuals reaching this life stage can expect to live at least 14 more years, yet with only passive incomes to subsist.

Hopefully at this point, those individuals will have fully repaid their mortgage and if they had children, they should normally have left the parental house.

Therefore, people entering retirement will have an investment objective to ensure they have enough money for the remainder of their life and to provide support to their children and grandchildren in case of need.

Trustnet asked Jason Hollands, managing director at Bestinvest, what the portfolio of a new retiree should look like.

The portfolio aims to continue to provide growth ahead of inflation over the long term through exposure to equities, but tempered by diversification to bonds, gold, infrastructure and income generation to support drawdown.

Asset allocation

Equities

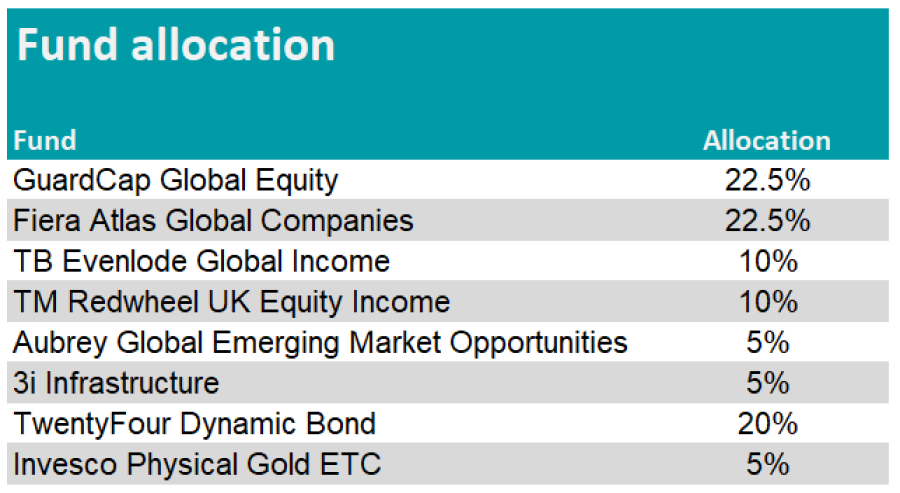

For the global allocation, Hollands picked three funds: Fiera Atlas Global Companies, GuardCap Global Equity and TB Evenlode Global Income, with each of them bringing something different to the table.

He said: “The Fiera Atlas Global Companies fund is a concentrated portfolio of quality-growth stocks, of which around two-thirds are US businesses. Lead portfolio manager Simon Steele expects to produce long-term capital growth with lower risk of capital loss than broader global equity markets over a full investment cycle of between five and seven years.

“Steele, supported by three other fund managers – Neil Mitchell in the London office, David Naughtin in Hong Kong and Andy Gardner in Sydney, Australia – uses a fundamental, bottom-up investment approach. The team select stocks with a competitive advantage, management teams that allocate capital wisely and that possess runways for sustainable growth.”

Total return of fund vs benchmark and sector since launch

Source: FE Analytics

The fund is offshore and was launched in 2017. It has been a top quartile in the Offshore Market Equity - International sector over one and five years.

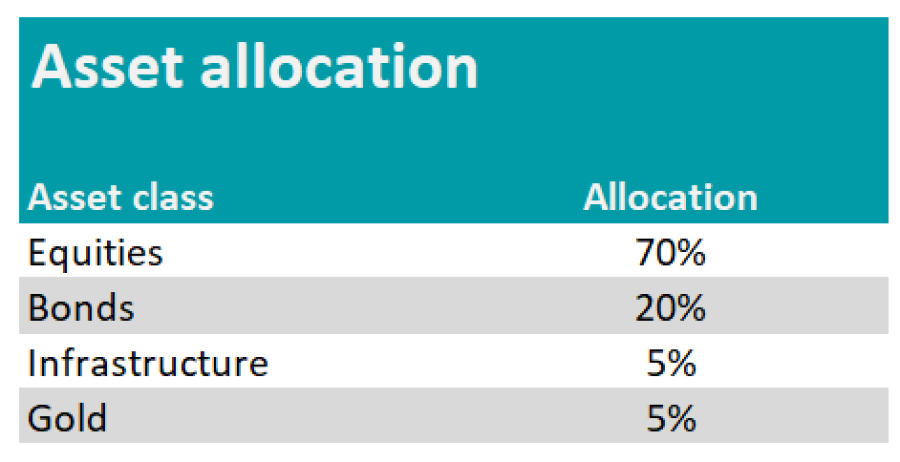

The GuardCap Global Equity fund is less heavily weighted to the US . While it is also a concentrated portfolio, the approach seeks out businesses with resilient characteristics. Hollands said that the approach has historically worked well in tougher markets, with the managers focusing on quality, sustainable growth and value.

Total return of fund vs benchmark and sector since launch

Source: FE Analytics

Since launch in January 2017, the fund has also been top quartile of the Offshore Market Equity - International sector over one and five years.

Finally, the third fund global fund, TB Evenlode Global Income, adds an income dimension.

Hollands said: “We are big fans of this Oxfordshire based boutique fund manager, who works collaboratively and have a clear focus on typically larger, international businesses, with capital-lite business models and strong free cash flow generation.”

Total return of fund vs benchmark and sector since launch

Source: FE Analytics

TB Evenlode Income was also launched in 2017 but is part of the Investment Association universe unlike the two previous funds. It has been a top-quartile fund in the IA Global Equity Income sector over one and five years.

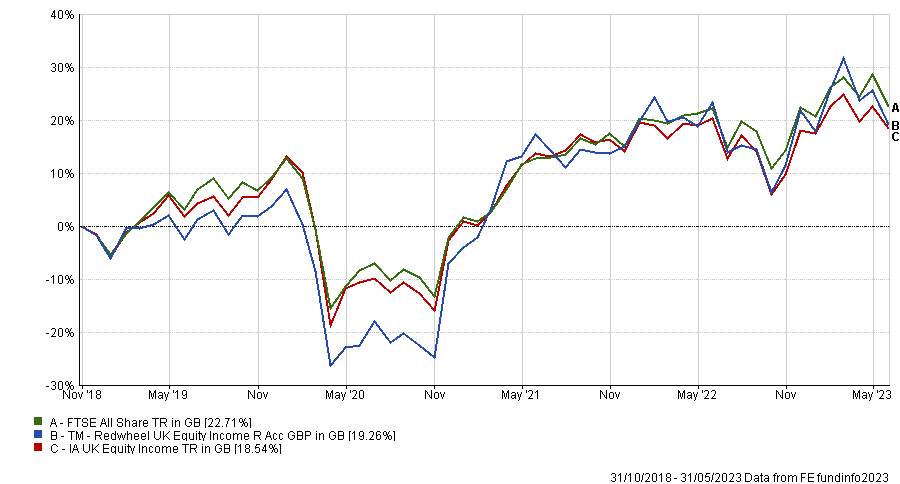

As the UK is an important market for income seekers, Hollands included TM Redwheel UK Equity Income to boost the portfolio’s exposure to this market.

He said: “The team focuses on identifying businesses that are trading at discounts to their intrinsic value, which adds some style diversification to the overall portfolio.”

Total return of fund vs benchmark and sector since launch

Source: FE Analytics

The fund was launched in 2018 with the aim of delivering a dividend yield in excess of the FTSE All Share Index and a long-term capital growth. The fund is top quartile in the IA UK Equity Income sector over three years but is having a difficult year so far.

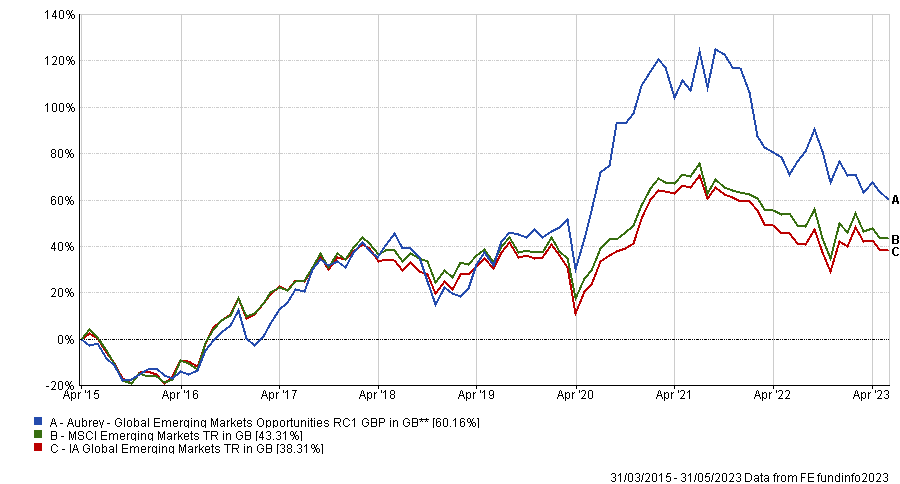

The last equity fund, Aubrey Global Emerging Market Opportunities, provides exposure to Asia and emerging markets.

Hollands said: “This fund, managed from Edinburgh by a highly experienced team, focuses on business that will benefit from the rising influence of the emerging market consumer.

“It is heavily weighed to India, in my view the market with the most exciting potential over the next decade with a young and fast-growing population.”

Total return of fund vs benchmark and sector since launch

Source: FE Analytics

The fund was launched in 2016 and is in the second quartile over five years. Its three largest country weights are China, India and Indonesia with a 14% overweight to India versus the MSCI Emerging Markets index.

Fixed income

The portfolio’s 20% allocation into bonds is entirely invested in the TwentyFour Dynamic Bond fund. The fund is part of the IA Sterling Strategic Bond sector and is top quartile over 10 years.

Total return of fund vs sector over 10yrs

Source: FE Analytics

Hollands said: “This is a best ideas strategic bond fund, with the flexibility to invest across the fixed income markets including government and corporate bonds, and across the credit spectrum.

“TwentyFour is boutique within the Vontabel group, that focuses exclusively on fixed income and has strong expertise in asset backed securities and risk management.”

Alternatives

Hollands included two alternative asset classes, infrastructure and gold, in the portfolio with an allocation of 5% for each of them.

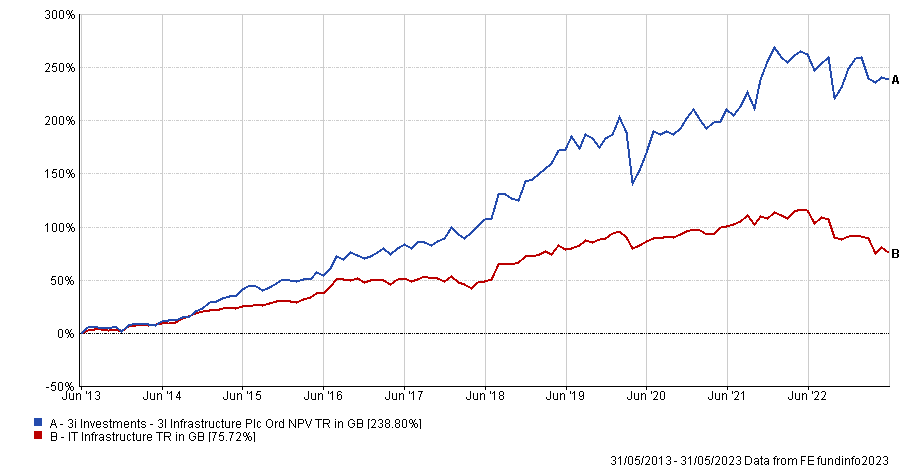

The inclusion of infrastructure aims to both diversify the portfolio and generate income. For this purpose, Hollands chose an investment trust, 3i Infrastructure, which has exposure to operational projects.

He said: “The long-term contracts that underpin such projects make this asset class quite resilient throughout the economic cycle and the asset class has also historically proven a decent inflation hedge.”

Total return of trust vs sector over 10yrs

Source: FE Analytics

Finally, Hollands picked an ETC (exchange traded commodities) to gain exposure to gold, which serves as an “insurance policy” in times of market uncertainty and stress.

He said: “I’ve added a modest weighting to physical gold via an exchange traded commodity, the Invesco Physical Gold ETC. It is backed up physical gold bars stored securely in the deep London vaults of JP Morgan Chase Bank.

“Each of these shining bars was minted post-2012 which means that they adhere to the LBMA Responsible Gold guidance. This was set up to combat issues such as terrorist financing and money laundering in the gold supply chain.”