Investors may prefer to invest in passive funds as they produce on average superior results than their actively managed rivals. Yet, another important benefit of index trackers is that they charge significantly lower fees than active funds.

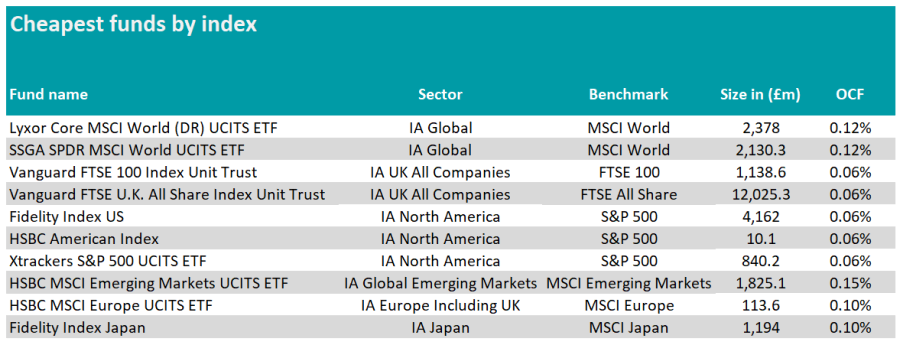

As such, Trustnet researched the cheapest trackers in the Investment Association universe for the major indices, excluding offshore funds.

The cheapness of a fund can be measured with the ongoing charges figure (OCF), which is the cost (excluding transaction fees) that investors pay for holding a fund.

Starting with global funds, passives have been a popular choice among investors in this region. The market is dominated by the US, which has been the best performing major market over 10 years, making it difficult for active managers to outperform.

The MSCI World is by far the most commonly tracked index and the cheapest options for it are Lyxor Core MSCI World (DR) UCITS ETF and SSGA SPDR MSCI World UCITS ETF. They both charge 0.12% and roughly have the same size, with over £2bn of assets under management (AUM).

Both funds are relatively new, having been launched in 2018 and 2019 respectively. Over four years, the latter fund has a slightly lower tracking error, 0.09%, compared to 0.11% for the former.

Turning to the US, putting money in a passive fund tracking the S&P 500 has been one of the most efficient ways to invest for much of the past decade and has therefore been a strong option for investors.

With an OCF of 0.06%, Fidelity Index US, HSBC American Index and Xtrackers S&P 500 UCITS ETF are the cheapest funds to track the performance of the 500 largest US firms.

While the two former trackers were launched in the 2010s, Xtrackers S&P 500 UCITS ETF has only been on the market since last year. It also has the best tracking error figure, 0.03%, over one year. In comparison, Fidelity Index US has a tracking error of 7.99% and HSBC American Index of 8.22% in the same period.

Closer to home, there are two ways to approach the UK market. Investors can either focus on the 100 largest businesses through the FTSE 100 or track all listed firms through the FTSE All Share.

The cheapest fund to track the FTSE 100 is Vanguard FTSE 100 Index Unit Trust, with an OCF of 0.06%. The fund was launched in 2016, has more than £1bn in AUM and a tracking error of 1.20% over five years.

The FTSE All Share is the index investors want to track to gain exposure to all UK-listed businesses, although around 80% is weighted to the largest 100 names. The most cost-effective way to do that is to hold Vanguard FTSE U.K. All Share Index Unit Trust. The £12bn fund charges 0.06% and has a tracking error of 0.80% over 10 years.

Elsewhere, capturing the growth of businesses in developing markets can be done via a passive fund tracking the performance of the MSCI Emerging Markets.

HSBC MSCI Emerging Markets UCITS ETF is currently the cheapest fund to do so, with an OCF of 0.15%. The £1.8bn fund has a tracking error of 1.60% over 10 years.

Cheapest funds by index

Source: FE Analytics

Lastly, for investors interested in tracking the performance of European and Japanese stocks, HSBC MSCI Europe UCITS ETF and Fidelity Index Japan are the cheapest options.

We have combined the two here due to the similarity of the funds on the list. Both were launched in 2014 and charge 0.10%. The European fund, which is benchmarked against the MSCI Europe index, has a tracking error of 0.73% over five years, while the figure for the Japanese tracker against the MSCI Japan index over the same period is 2.78%.