With a £1.8bn market capitalisation, Templeton Emerging Market (TEMIT) remains the biggest trust in the IT Global Emerging Markets sector, but it has struggled in more recent years.

Formerly run by veteran stockpicker Mark Mobius and Carlos von Hardenberg – both of whom now run the Mobius investment trust – TEMIT has been in the fifth performance decile of its sector peer group over five and 10 years, but fell to the seventh over three and one years.

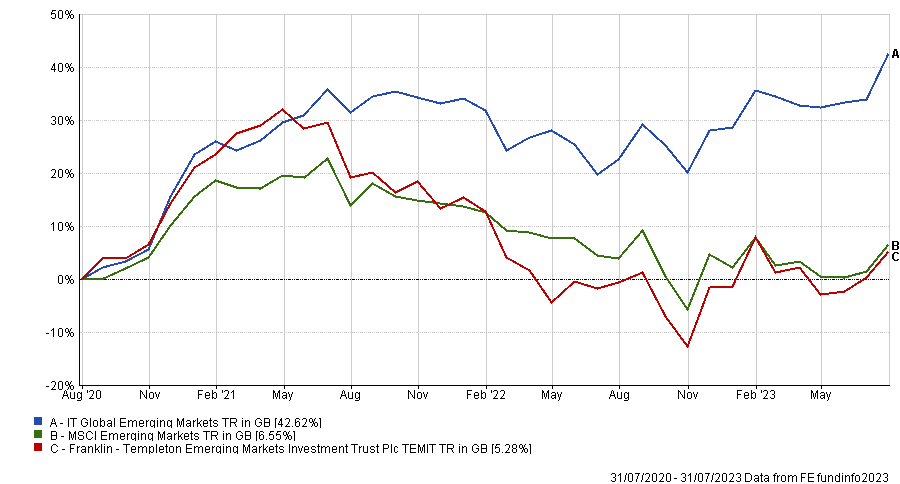

Over three years the trust has lagged its peers and the benchmark (as highlighted below) partially due to its holdings in Russia, which has contributed to its discount reaching 13%.

Performance of fund vs sector and index over 3yrs

Source: FE Analytics

Below, Sehgal explains why he isn’t concerned about the upcoming continuation vote next year and discusses the new way of investing in emerging markets, as the structural story moves from demographics to other themes such as electrification, renewable energy, and artificial intelligence (AI).

What are your process and investment philosophy?

We look for stocks with sustainable earning power that are trading at a discount. What we look at is structural stories, what we invest in is companies with sustainable earnings and what we practice is stewardship. It's as simple as that.

The first part refers to whether a company can consistently have better return on capital and can generate more free cash flow than its competitors given the policy environment. We also don't want to pay too high a price to buy those stocks.

And then the last leg is that we want to be good stewards by investing in companies with good governance, but should things not work out our way, we are out there to try to rectify the situation in favour of shareholders.

What do you identify as structural stories?

Traditionally, demographics has been a big theme, together with the cost of manufacturing and of resources. But there's been a lot of change in emerging markets. The traditional sectors still exist but, as a percentage of the index, they are much smaller now.

Now we have electrification and digitalisation of everything becoming a big theme in the portfolio, be it in terms of batteries for electric vehicles or renewable energy. Another theme that has emerged is the use of AI to gain productivity.

How are you geographically positioned at the moment?

We are – and have been for quite some time – overweight South Korea and also Brazil. Korea is one of the leaders in the electric vehicle battery industry, which wasn't a strong sector four or five years ago, plus it is one of the two large players in semiconductors.

Generally, valuations have been quite compelling and corporate governance has been improving. It also works as a diversifier and has a free trade agreement with the US. It ticks a lot of boxes.

On the other hand, we are slightly underweight China, though it remains the largest position of the trust, and India.

The Chinese environment was tough during but also after Covid and it was also wounded from the property sector bust. Policymaking and the challenging geopolitics also didn’t help, so it didn't surprise us that it will take much longer for China to come back to a pre-Covid scenario.

What have been your best and worst calls of the past 12 months?

One that has played out for us is a company called Doosan Bobcat, which owns the Bobcat brand used in the construction equipment business in the US. People expected a recession in the US and construction activities to go down, but what has happened is that it started spending on creating manufacturing capacity. Doosan Bobcat benefited from that as well, and it's up around 100% since we first bought it.

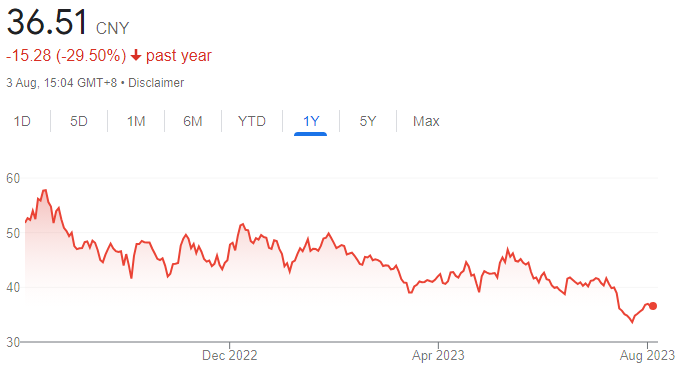

Guangzhou Tinci, the largest provider of salts and electrolytes for the electric battery industry, has been the biggest drag on returns.

Performance of stock over 1yr

Source: Google Finance

The recent correction in electrolyte and salt prices as a result of overcapacity in the sector, as well as the decline in lithium prices, has impacted the company’s performance. Demand for electric batteries we believe will still allow it to deliver strong earnings over the medium term.

What are the misconceptions about emerging markets?

The nature of emerging market companies is changing. Companies in the index are far more globally competitive than they used to be. Think of TSMC.

Similarly, you will see across sectors that some of the best companies are from emerging markets and a lot of people with global asset allocations are now taking new positions. If you want to invest in best-of-breed companies, there are enough of those within EMs.

And as that becomes a larger percentage, people start appreciating it more. The fact that you're discounted just because you're part of an emerging market index is something that will go away.

How confident are you about the upcoming continuation vote?

We have a tender offer predicated on our performance, and we are ahead of the tender requirements right now. One of the reasons people speculate that the discount has widened is because the fund is actually performing and the chances of the tender offer have reduced.

As long as we continue to outperform, we have no reason to believe that the shareholders will not have faith in us. We had a five-year performance target and we’re doing slightly better than that at this juncture. Obviously, things can change, but we are hopeful that we should be able to meet the tender conditions.

What do you do outside of fund management?

Family, friends and attempts to be fit keep me busy. I also play ping pong, chess and a lot of board games.