Investors have become more interested in cash in recent months, after interest rates hikes made it increasingly attractive to park money in savings accounts.

Last week, the Bank of England took its base rate to 5.25% – its 14th hike in a row and the highest since 2008 – in its continued battle to bring surging inflation down towards its 2% target. What’s more, the Bank said it expects rates to remain high for at least two years.

Some cash ISAs are offering rates just under 6% and are proving to be an attractive lure, but there are arguments for remaining in the stock market.

Below, David Aujla, fund manager on Invesco’s Multi Asset Summit range, offers four reasons why staying invested makes sense over the long run.

Doing nothing will cost you

The first reason that Aujla highlighted is the impact that holding cash can have in times of high inflation. The latest figures from the Office for National Statistics show that UK inflation rose to 7.9% in the 12 months to June, the sixth highest since the 30-year high peak of 11.1% in October 2022.

In wealth terms, this means investors would need £10,790 today to buy what would have cost £10,000 just 12 months ago – a £790 loss of purchasing power.

“Whether metaphorical or not, keeping your cash ‘under the mattress’ will see the value of your savings fall in real terms due to inflation,” the manager said. “This concept is nothing new, but never in modern times has it been as much of an issue as it is today.”

Illustrating this, he also pointed out that it would take around eight years for cash savings to halve (assuming no returns on cash) at today’s inflation rate. When inflation is at 2% – the Bank’s target rate and the average for much of the past three decades – this would take 34 years.

Years it takes for £10,000 to halve at different levels of inflation

Source: Invesco

The money illusion

Next, the Invesco manager flagged up what American economist Irving Fisher called ‘the money illusion’, or the tendency for the average person to see their wealth in nominal terms (i.e. as pound signs) instead of real terms (what their money will actually buy).

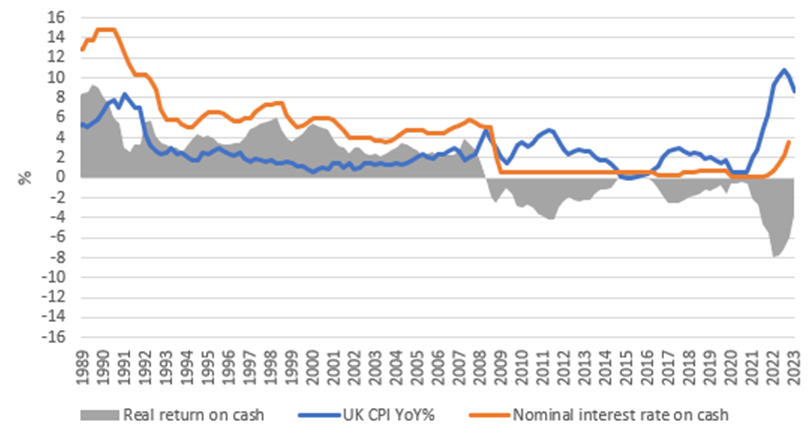

While the higher rates available on cash are catching savers’ eyes, Aujla noted that these are not leading to a higher real income. Nominal interest rates in the UK have increased as the Bank tightens policy but the differential between nominal interest rates and the rate of inflation in the UK (i.e. the real return on cash) is at its lowest level in years.

Investing in cash today is less attractive in inflation-adjusted terms

Source: Bloomberg as at 30 Jun 2023 based on quarterly data. Proxy used for nominal interest rate on cash is the Bank of England base rate.

“Conclusion: The real return on cash is as unattractive as it has been for decades, which means your purchasing power is at risk of erosion,” the manager said.

Time in the market, not timing the market

Periods of market volatility often cause some investors to dump risky assets in an attempt to shield themselves from further losses, but Aujla argued that this is the worst time to exit the market.

“Future returns are often more attractive once markets have fallen. A second reason is that this decision relies on re-entering the market at the right time. And we know that the average investor typically waits too long to do so,” he explained.

“The best days for markets tend to follow the worst. As such, even if you think you can avoid the worst, you are probably likely to avoid the best too.”

Return of global equities investment vs if the best 10 days were missed

Source: Bloomberg as at 30 Jun 2023

The above chart shows the performance of £10,000 invested in global equities in 1999. The blue line is the performance of an investor who stayed in the market over the entire period while the orange one shows an investor who missed the 10 best days of the market.

As can be seen, the return of the second investor is almost half as much of the one who stayed put.

A more recent example is an investor in the S&P 500 who shifted to cash after the first 25% decline during the global financial crisis. Their portfolio would still be in loss-making territory, while those who stayed in the market broke even in mid-2013, less than five years after the crisis.

Let’s keep it real

Finally, Aujla said the one of the positives from a market correction like the one seen in 2022 is the chance of higher future returns as valuations normalise.

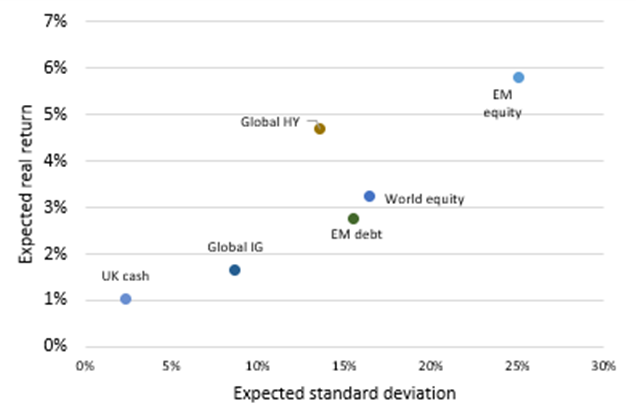

Invesco’s capital market assumptions research into more than 170 asset types currently suggests cash will deliver very little ‘real’ return over the coming 10 years. But other assets are expected to do better in real terms, as shown below.

Expected real returns and standard deviations in GBP

Source: Invesco as at 30 Jun 2023

“Equities are a good example. At first investors will discount equity valuations at a higher interest rate due to rising inflation. This is to compensate for the fact they are worth less in today’s money,” the manager concluded.

“In time, equities can often act as a buffer against inflationary pressure. How? Well, inflation leads to increased nominal revenues for those companies that can maintain their pricing power, and ultimately increased earnings for those who can also manage their input costs. Earnings in particular are a powerful driver of share prices over time.”