‘Things are never as good as you hope, nor as bad as you fear.’ The old adage appears to be holding good in the world’s grain markets at the moment; with the ‘hope’ applicable to investors and presumably farmers, who wish for higher prices and the ‘fear’ relating to consumers and governments of facing higher food costs.

Those fears seemed to be fanned almost daily by scary stories in the press of drought, famine and shortages ahead. But of course, a story that just suggests prices and supplies are going to remain in balance doesn’t generate much interest.

On 17 July, the news that Russia had announced the termination of the Black Sea grain deal, which has enabled the export of more than 30m tons of Ukrainian wheat in the past 12 months in spite of the conflict, was naturally expected to cause a substantial rise in the global price of wheat. And it did for about a week.

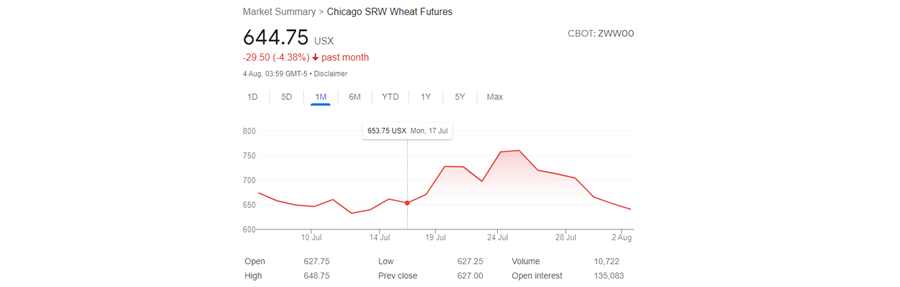

As you can see from the chart, the near month contract for Chicago Wheat Futures rose sharply, but then fell back just as quickly and today stand lower than the day of the announcement. Even those dramatic pictures of water pouring through a sabotaged Ukrainian dam a month or so back, while undeniably drowning huge swathes of fertile crop growing acres, seemed to have had little or no impact.

So, is this a surprise? Well, perhaps not. Just as Russian crude oil is reaching the market, bought under a price cap by China and India at a discount to the official market price, so the wheat from the world’s largest exporter is still finding a home with willing buyers in Africa and Asia.

According to our in-house ‘wannabe spy’, who watches military satellite footage, listens in to Russian soldiers on Telegram etc, about a dozen grain ships have slipped the supposed blockade unscathed since it was imposed a couple of weeks ago.

Russia is not going to expend too many precious munitions on grain silos, doesn’t want to have to deal with PR disasters explaining its actions to its customers, but does need the money from getting its commodities to market.

From a price perspective, the reality is that Russia had a record wheat crop in 2022-2023 and according to the US Dept of Agriculture, is expected to have an even larger one in the current year: a statement that was incidentally released on the same day of the Russian Black Sea grain deal announcement. Is it just possible that one followed the other to counter any price move in either direction.

The other joker in the pack for global crop production is El Niño, the weather phenomenon that occurs on a reasonably regular cycle and has now been declared a likely event this year. This is expected to have a dramatic heating effect on the North American continent (and is doing so currently) which has a fair chance of damaging the grain crops there too. But considering the US has the highest level of stocks in about 30 years, I don’t expect that is going to be enough to move the needle either.

The often-overlooked fact about El Niño is that it giveth as well as taketh away; the consequence to producing a drier North America also tends to lead to a wetter South America, where the likes of Argentina will be delighted to receive greater than average rainfall and produce more than they usually would expect to do.

If wheat prices were going substantially higher than here, then what are they waiting for? Last year’s spike was down to speculators chasing the prices of grain and fertiliser higher on the unknown impact of Russia’s invasion of Ukraine.

But there is an old saying with commodity prices; ‘the cure for higher prices, is higher prices’ and sure enough back down they came. You can’t fool people with the same story again, so something new and different is required.

This is not to suggest that the grain markets and other soft commodities ranging from soyabeans to cocoa cannot be an investment theme for investors to follow. The ever-warming globe has had one undeniable consequence thus far: less predictable and more extreme weather that does not conform to established patterns.

More than anything it is this which impacts prices of foodstuffs in the short term, but these are not ‘buy and hold’ investments. With commodities, which are a factor of production rather than an asset, the advice I would give is summed up by another old saying applied to expensive ‘toys’: “If it floats or flies – Rent, don’t buy.”

Julian Wheeler is a partner at Shard Capital. The views expressed above should not be taken as investment advice.