Auto-enrolment into a pension scheme has allowed more people to invest than ever but the funds automatically selected by the provider aren’t always the best choice.

By keeping an eye on their comparative performance, investors can get a better idea of whether they’re stuck in an underperforming fund and perhaps consider switching to another strategy.

Below, we look into the mixed-asset options offered by Scottish Widows and how they compare with their benchmark.

For this study, we focused on the Series 2 units of their products, which commenced on 31 October 2000 for group personal pensions.

Within the ABI Mixed Investment 0-35% Shares, only one of three Scottish Widows funds has outperformed its industry peers and made more than 22.8% over the past decade.

Source: FE Analytics

Scottish Widows Defensive Managed Pension invests 57% of its portfolio in UK fixed interest and 20% in UK income equities – together with some global fixed interest and property exposure. The Cautious Portfolio Pension version is more focused on global equities instead and invests a small percentage in emerging markets. Both are managed by Philip Chandler.

In thrid position, the SW Jupiter Distribution Pension, run by Jupiter, didn’t stand out over the longer term but is among the top-quartile performers over one year.

The strongest performance in the 20-60% Shares sector came from the Scottish Widows-managed Cautious Pension fund, which beat the average 10-year return of its peers (33.4%) by six percentage points.

Source: FE Analytics

SW Invesco Perpetual Distribution Pension was another outperformer, with co-managers Ciaran Mallon and Edward Craven investing mainly in global fixed interest (42.9%) and in particular US treasuries. The fund has remained in the top-quartile of performance over five, three and one year, only dropping to second over 10.

In contrast, SW Henderson Cautious Managed Pension has struggled over most timeframes.

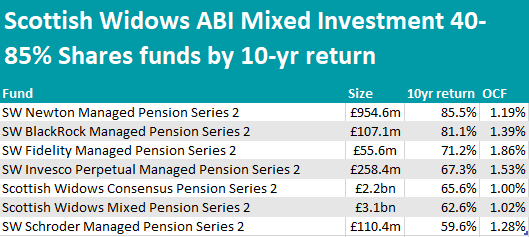

Scottish Widows’ own managed funds still outperform the sector as we move towards the higher-risk spectrum, but with less impressive results than those managed by third parties.

Source: FE Analytics

Scottish Widows Consensus Pension and Mixed Pension are the largest in the list – meaning that most investors’ money destined for a managed scheme is invested here – but are sitting 20 percentage points below the best performer of the list, SW Newton Managed Pension, which gains the top spot with a 85.5% return.

This FE fundinfo four-Crown vehicle is managed by Tim Wilson, who maintains a 20.6% exposure to North American equities.

Consensus Pension and Mixed Pension also come out worse than SW BlackRock Managed Pension, SW Fidelity Managed Pension and SW Invesco Perpetual Managed Pension.

The only vehicle falling just below the sector’s 61.3% average return is SW Schroder Managed Pension.

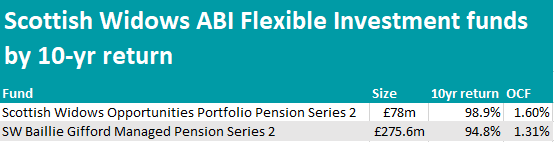

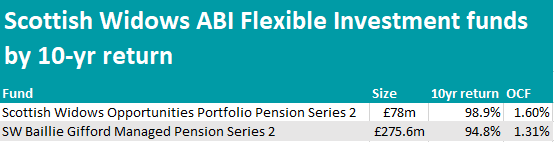

Finally, in the ABI Flexible Investment sector, both strategies offered to Scottish Widows clients significantly outperformed the wider sector.

Source: FE Analytics

Scottish Widows Opportunities Portfolio Pension and SW Baillie Gifford Managed Pension both succeeded in significantly distancing themselves from the average peer’s 10-year return of 76.2%, beating it by approximately 20 percentage points and almost doubling their assets in the space of 10 years.

The former fund, which has achieved an FE five-Crown rating, mainly invests in UK equities (28.1% against Baillie Gifford’s 19.5%), and international equities (22.1%).

The latter is more biased towards European stocks (18.3% against 3.8% is with Scottish Widows) and is also more exposed to the North American market (20.2% versus 13.3%).