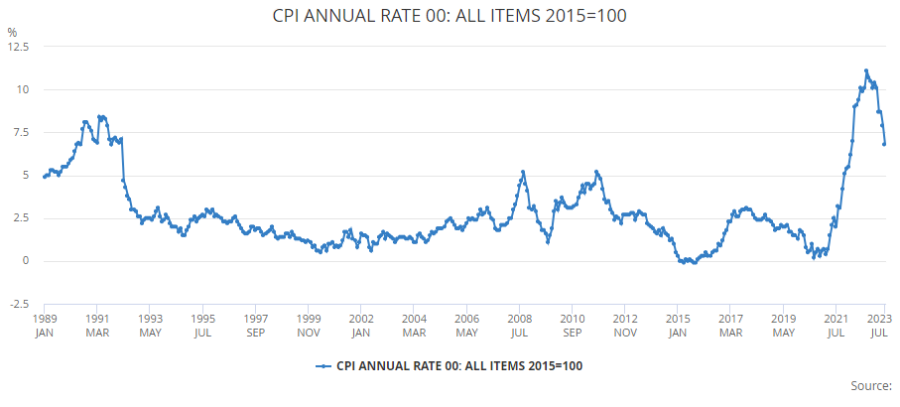

UK inflation fell to 6.8% in July, down from 7.9% in June, according to data from the Office for National Statistics, but the Bank of England (BofE) still has work to do to bring down price rises, experts have warned.

Falling energy prices provided relief to people struggling through a cost-of-living crisis, with the introduction of a new energy price cap helping to ease the pressure on gas and electricity bills.

Food price rises also continued to slow, with some products now cheaper than they were a year ago, although services inflation rose from 7.2% to 7.4%.

The figures follow GDP numbers last week which showed the UK economy was more resilient than expected, while labour market data this week revealed the unemployment rate has increased from 4% to 4.2%, while wage growth was at 8.2%.

Source: Office for National Statistics

All of these numbers give the Bank of England a difficult choice to make moving forward, as interest rate rises tend to have a lag. Rachel Winter, partner at Killik & Co, said she thought that the fifth consecutive month of falling inflation “may stop the Bank of England opting for another rate hike in September”.

However, most experts were less optimistic. Oliver Blackbourn, multi-asset portfolio manager at Janus Henderson Investors, said the UK central bank had a “headache” as it will want inflation to stabilise at a lower level and prove less volatile.

“In contrast to indications for the Federal Reserve and European Central Bank, investors remain more sceptical about the BofE’s ability to return inflation consistently to the 2% target over the longer term,” he said.

“UK 10-year breakeven rates continue to price in a larger inflation premium, indicating less confidence in the BoE’s ability to fulfil its mandate.”

Markets are pricing in two to three hikes for the remainder of the year, although he noted that the central bank is aware that overdoing it will impact the economy.

David Henry, investment manager at Quilter Cheviot, said the bank was at a “tricky point”, but that surprise earnings growth and a better-than-expected economy suggest “more interest rate rises are required to get the job done”.

He warned that the toll on the economy could be “quite severe” now that interest rates have hit 5% and could tip the UK into a recession – even if there are no further increases.

“With the Federal Reserve now increasingly looking like they may now pause interest rates rises, this could naturally feed into the BofE’s thinking given how they have seemingly followed in the Fed’s footsteps in the past. But with inflation remaining especially elevated, and this being the primary reason for rate rises to date, the BofE is left in somewhat of a no-win situation,” he said.

Because of this juggling act, Hussain Mehdi, macro & investment strategist at HSBC Asset Management, said the BofE could tread more cautiously.

There is a “good chance” of another 25 basis point rate hike at its next meeting, similar to the one earlier this month, but a 0.5 percentage point increase (like the one in June) is “unlikely”.

“For us, this is consistent with a cautious stance on UK equities, with risks also emanating from restrictive policy elsewhere in developed markets. We prefer gilts on a 12-month horizon given the possibility of earlier-than-expected rate cuts and lower yields in a recessionary scenario,” he said.