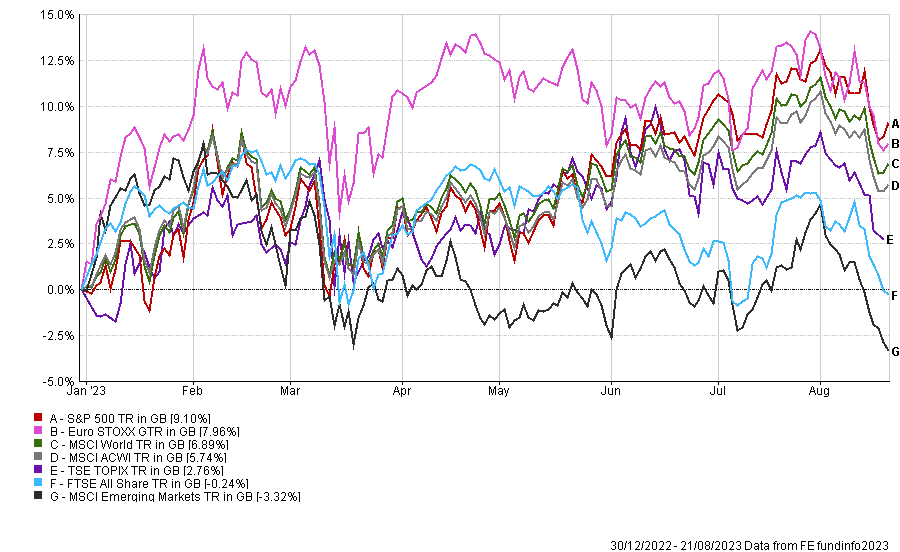

US stocks have surged over the past year on the back of an artificial intelligence (AI) revolution, with the S&P 500 index of large-cap stocks outperforming all other major markets over the course of 2023.

It follows a decade-long run of excellence for the American stock market, during which time it has made 277% – more than double the return of European, UK, Japanese and emerging market companies.

As such, investors may wonder whether the market is overvalued – something that some experts have opined for years but have been left dumbfounded as shares continue to rise.

Performance of indices over YTD

Source: FE Analytics

The main reason for bearishness at present is higher interest rates, which have a negative effect on growth stocks that dominate the US market such as technology and healthcare.

With investors able to get high returns on their cash now, there is less need to spend on speculative growth in the future as has been the case for the past decade of ultra-low interest rates.

However, Jeremiah Buckley, portfolio manager at Janus Henderson, believes it does not matter that rates are rising as American companies are not highly valued at present.

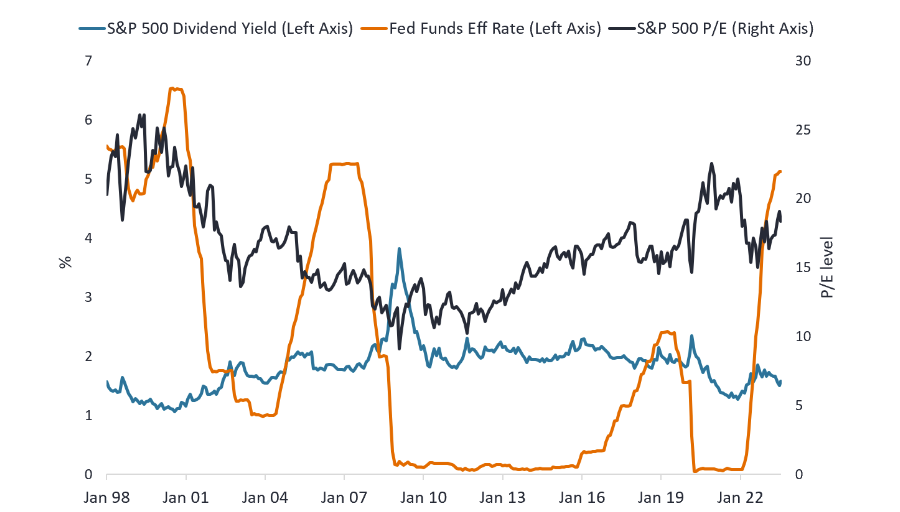

“Valuations in the US equity market over the past 25 years have tended to remain consistent, despite significant fluctuation in rates,” he said.

The price-to-earnings (P/E) multiple on the S&P 500 is normally in the mid-to-high teens with a dividend yield of approximately 1.7% to 2%. The chart below shows this has been the case not only when the federal funds rate was close to zero, but also when it was as high as 4% to 5%.

S&P 500 P/E, S&P 500 dividend yield, and Federal Funds Effective Rate

Source: Janus Henderson, Bloomberg

“Higher interest rates certainly impact demand from consumers and corporations, and the increase in financing costs has impacted our earnings estimates for 2023 and 2024. The upshot is that, based on these adjusted estimates, we think equity multiples are still in a normal historical range, despite the target fed funds rate now being much higher than a year ago,” he said.

The key for investors will be deciphering earnings growth – something that has not been relevant so far this year as the market has been moved by a narrow band of companies in the AI space, suggesting the gains have been through share price multiples expanding rather than better performance from the underlying stocks.

-

If earnings are to play a key role for the remainder of the year and into 2024, Buckley is bullish for the immediate future. AI could well be a good theme, with companies focusing on productivity enabled by the rise of the technology.

Labour markets too remain healthy – despite fears that the robots will take away jobs – and supply chains have begun to normalise following the Covid pandemic, which should lower business costs.

“Although we expect a volatile and bumpy ride, we are bullish on earnings growth prospects for the rest of the year and into 2024, even assuming a scenario of slow-to-flat real economic growth,” said Buckley.

Nevertheless, there are real concerns that the global economy – led by the US – could enter into recession. He noted that it would “one of the most anticipated we’ve ever witnessed”, with much already priced into the market.

Additionally, with interest rates now above where the manager expects the long-term normal to be, central banks have some tools to combat any weakness in growth.

For investors that share a similarly optimistic outlook, Buckley said it is important to focus on companies with pricing power.

“In our view, companies that have flexibility on their balance sheet and consistency in their cash flows have an advantage over competitors that are more reliant on looser financial conditions,” he said.

“Furthermore, we believe companies whose products and services have created incremental value for their customers for years have earned the right to raise prices to cover inflationary costs and maintain profitability.”