Sometimes something catches an investor’s eye that makes the complex suddenly simple. This was the case for Martin Currie chief investment officer Michael Browne, who came across a table produced earlier this year by Credit Suisse that he described the most helpful guide to investing he has come across in his career.

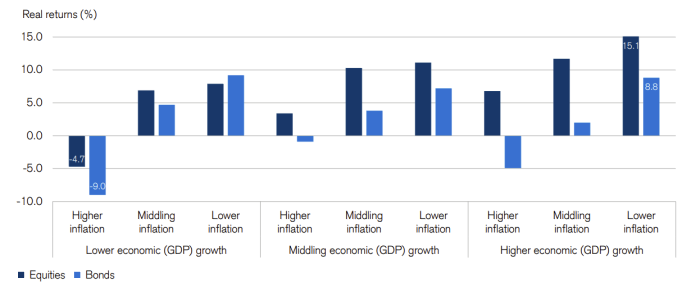

Published in the Credit Suisse’s 2023 yearbook, it shows what returns equities and bonds have made in differing economic environments.

Given the uncertainty around the future of markets – and following on from a year in which both bonds and stocks disappointed – Browne said the table is an excellent guide for investors to manage their expectations and plan ahead.

Real equity and bond returns versus inflation and GDP growth between 1900 to 2022

Source: Credit Suisse

“If you want one guide to life, I think that's the best thing I've seen in 35 years in the city because it tells you exactly what your strategy should be going forward over time and gives you a real sense of where you can extract really good equity returns, especially relative to bonds,” he said.

“You’re probably wondering what happens next and where we are in the economic cycle, so you can use this as a guide to work out where you should be and what returns you should be looking at.”

There is only one situation out of the nine economic scenarios where bonds outperform equities with Browne noting that, over the long term, there are “great real returns to be taken from the equity market” that are “significantly better than being involved in the treasury markets”.

However, he said markets could be moving into the only environment where bonds can make better long-term returns than equities.

Last year was a worst case scenario in which low economic growth and high inflation dragged the returns on both equities and bonds into the red, but the tide is changing.

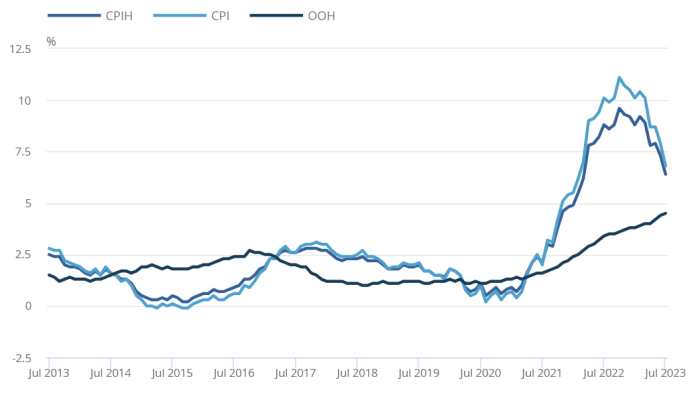

Inflation in the UK is well above target but has slowed significantly from its 11.1% peak in October to 6.8% in the latest readings, making the prime conditions for bonds to thrive.

UK Inflation rates over the past 10 years

Source: Office for National Statistics

Browne said: “We're moving away from higher inflation and coming into this area of low growth and, as we get more traditional levels of growth in the UK, you can use that to start making some decisions.

”You're getting a really significant capital rate of return [from bonds] because you're buying at a high yield and making a good rate of return on your capital basis as well.

“That mathematics is working in your favour to time the bond market. That's why as you go into that low inflation, low economic growth environment, it’s very beneficial for bonds.”

Many other experts also highlighted the unique entry point available to investors wanting bond exposure – they told Trustnet yesterday that young people buying fixed income today can make a greater return on bonds than equities over the long term.

This contrasts with the more conventional conditions in which young people take more risk by going heavily into equities for a greater possible return.

However, IBOSS chief investment officer Chris Metcalfe said that investors shouldn’t necessarily move over to fixed income as they get older simply to follow the standard path.

As Browne’s table shows, the majority of economic conditions are overwhelmingly in favour of equities, meaning even older investors could benefit from having a hefty exposure to stocks.

Nevertheless, Browne said the current economic direction is painting a very favourable case for investors wanting to time the market and allocate to bonds.

He added: “That will go on for a period of six to seven months but what happens next? In 2025, it will be about interest rate cuts and where we're going to move on that sort of basis.

“That's going to be the big debate going forward, especially as we look at what the long-term rate of growth and inflation is likely to be after the electoral cycle in 2024. It’s going to be extremely important.”