Many investors often gravitate towards larger funds under the assumption that there is safety in numbers. They may feel more confident putting their savings in a strategy that so many other investors have conviction in, but there are some tiny funds vastly outperforming their larger peers.

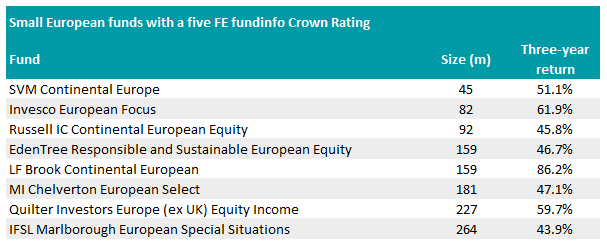

Trustnet found eight funds in the IA Europe Excluding UK sector with less than £300m in assets under management (AUM) that had gained a five FE fundinfo Crown Rating.

Only the top 10% of funds in the investment association (IA) universe are awarded the full ranking after having displayed superior stock picking, consistent performance and risk control.

Source: FE Analytics

The smallest fund in the sector to get a full five crowns was SVM Continental Europe, with £45m in AUM.

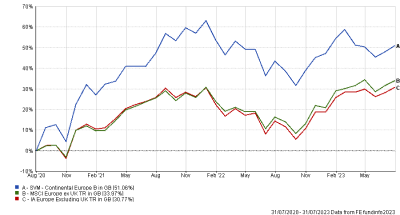

Crown ratings are based on a fund’s three-year track record, during which time SVM Continental Europe soared 51.1%, 20.3 percentage points ahead of the sector average.

It’s long-term lead on its peers is even wider, with manager Hugh Cuthbert generating a 407.5% return since taking charge in 2006 compared to the 228.9% gain made by the average IA Europe Excluding UK fund.

Total return of fund vs benchmark and sector over 3yrs and under Cuthbert’s management

Source: FE Analytics

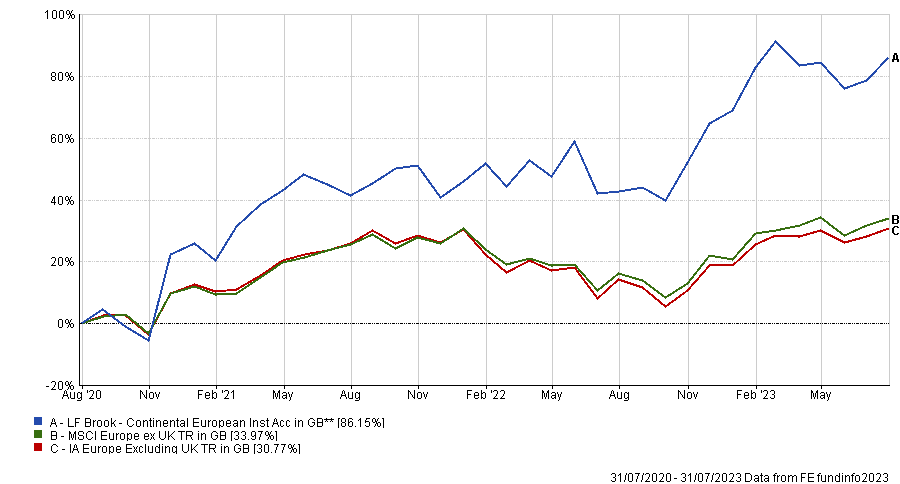

However, the fund to make the largest return over the past three years was LF Brook Continental European, which was up 86.2%.

The £159m fund was the best performing fund in the sector over that period, beating a number of rivals much larger in size. Its outperformance can be credited to the proven stock picking skills demonstrated by FE fundinfo Alpha Manager Oliver Kelton, who has run the fund since 2015.

Total return of fund vs benchmark and sector over 3yrs

Source: FE Analytics

Source: FE Analytics

To gain the title Alpha Manager, they must demonstrate some of the highest risk-adjusted alpha and consistent outperformance across all the funds they have managed in their career.

Like the crown ratings, only 10% of all managers are awarded the title, so those who have it are deemed to be among some of the most skilled in the industry.

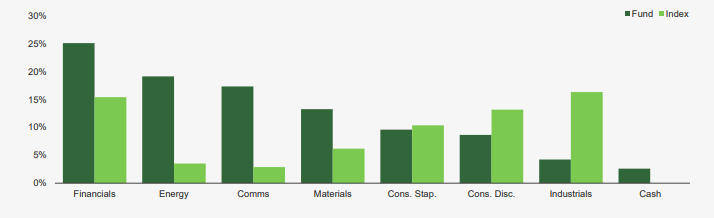

Kelton could have gained most of his alpha over the past three years with his much higher allocation to the energy and communications sector compared with his peers, who favoured consumer discretionary and industrial stocks instead.

Fund’s sectoral allocations vs the index

Source: Brook Asset Management

It may have been the best performer, but it was also the most volatile on the list at 23.5%, although some might argue that the bumpier performance was worth it for the better return.

Contrastingly, the largest fund to make it onto the list – IFSL Marlborough European Special Situations with £264m in AUM – was the worst performer.

Its 43.9% total return over the past three years was still 13.1 percentage points better than the sector average, but there were other names on the list that beat it.

Even so, it was a top-quartile performer over the period under the stewardship of FE fundinfo Alpha Manager David Walton.