Covid has long been out of the centre of our attention, but it still has repercussions on multiple areas of the market, according to Francesco Conte, manager of the £593.7m JPMorgan European Discovery Trust, the second-largest vehicle in the IT European Smaller Companies sector.

The pandemic is still altering some sectors of the economy, but its effects (including inflation) are finally fading. Below, he talks about which sectors are still suffering, why a goldilocks scenario is possible and explains why he moved out of positions in the medical sector.

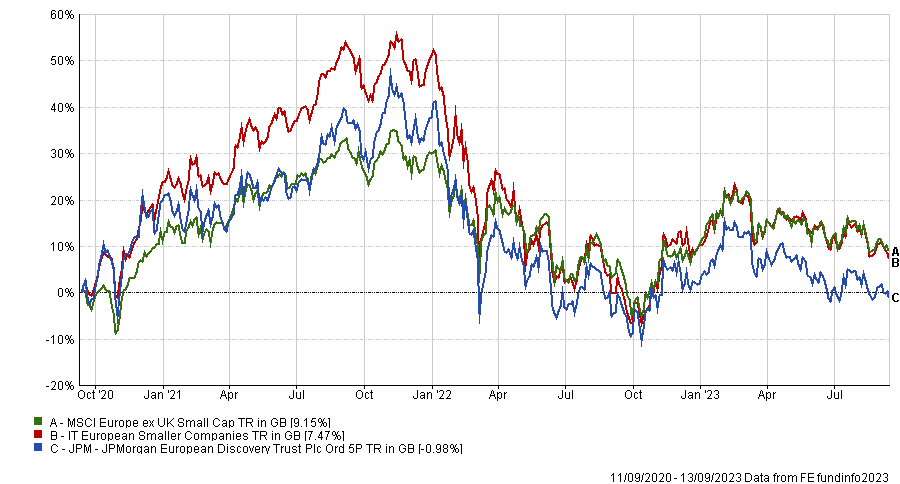

Performance of fund vs sector and index over 3yr

Source: FE Analytics

What is your philosophy and investment process?

We're seeking to find companies that are cheap, good quality and have momentum, and we find them in industries that are improving. We measure that through positive earnings revisions or price momentum. It isn’t a thematic strategy but themes emerge naturally where many companies have good earnings momentum in a particular field.

Where do you find those companies now?

Today, there's a desire to use less oil and the only way to realistically do that is to use more electricity, and therefore you need, for example, high-voltage cables. That's an area where things are improving.

It can also be a new piece of technology driving a sector, for example a new hearing aid or dental implant, or Chinese people suddenly buying European luxury goods after the prolonged lockdowns.

Historically, we’ve owned a lot of medical equipment and luxury goods companies as well.

You say historically, have you sold them now?

The medical space is an important case. Historically, in uncertain economic times, it would have been the go-to sector because it would continue growing despite economic slowdowns. Today, we don't have any of those companies, for various reasons.

Very often it’s for valuation reasons; in other cases, such as diagnostics, it’s because they’ve had a very big tailwind from Covid, which is still in the numbers but declining. That process is not finished yet and it will probably take another six to eight months before all Covid benefits are out of the way.

Do you still see effects of Covid elsewhere too?

In terms of direct impact, there are only a few sectors where you still see some of it. We do see distortions, however, for example in consumer goods. The whole sector of household appliances or cycling equipment looks like it’s only bottoming out now.

In terms of product demand, Covid is also now coming out mostly, but in terms of price we're still seeing effects. I'm sometimes shocked when I look at results and price volume metrics. In many cases, volume is down but price increases can still be double digits.

In a broader sense, we're still living with Covid and we see it everywhere, because it has such an impact on import prices that are still affecting the entire economy. The whole inflation that we're living is also Covid-related, really.

Will inflation also decline soon, like other Covid effects?

Some say a goldilocks scenario [one where a reduction in inflation doesn’t cause a recession] is impossible because it never happened before. I think it is possible. Inflation was not caused by too much demand but the main problem was rather that you couldn't make products because of missing components, such as semiconductors.

That's why we could get a situation where inflation does keep coming down and where demand remains soft but we don't go into some kind of enormous recession.

What role will the war in Ukraine play?

At the moment, there seem to be lots of concerns about the oil price having gone back up to $90. I'm not so worried, because the biggest impact that Europe faces is the gas price rather than oil price.

At the same time, there'll be two impacts. One is that people and companies have genuinely reduced the amount of energy they use. But also there’s more usage of renewables. So hopefully, the impact of oil is going to be less. It's a trend that's been coming down since the 1970s oil crisis, that we use less and less oil per capita.

What were the best and the worst calls of the past 12 months?

The main detractor was Bravida, a Swedish provider of electrical, heating, plumbing and other technical services. It suffered mainly because of its high single-digit exposure to new builds and housing, which caused a huge amount of derating. It detracted 0.9% from the portfolio, but we still believe in it. The cycle is going to be nowhere as bad as the share price is suggesting and it has other lines of business too, which should be much more defensive.

French industrial laundry services provider Elis added 0.8% to our portfolio, benefiting from the end of the lockdowns and the much lower gas prices. The same drivers also brought Rallia up, again a French company that manufactures glass bottles, which is a very protected business because you can transport glass very far and, to a certain extent, it is replacing plastic because it can be recycled. It contributed 0.7%.

How do you use gearing?

We deploy it when we think things are cheap. On balance, we’re keener to add to gearing on pull backs and we could potentially go up to 20% if we're super bullish.

Our feeling now is that we're past peak pain so it's likely that we will trickle it in over time as we find interesting opportunities to invest.

What do you do outside of fund management?

I read. I walk. I run eight to 10 kilometres a week. And I’ve also discovered in the past few years walking in the Dolomites, which I love.