More than two-thirds (68%) of all Investment Association (IA) funds failed to beat UK inflation over the past five years, data from FE Analytics has found.

The goal for many investors when holding funds is to outpace inflation, yet the majority of portfolios were unsuccessful in fulfilling their most basic goal.

Indeed, 2,690 of 3,954 funds with a five-year track record underperformed the 22.9% increase in the Consumer Price Index (CPI) over that period, with investors losing out in real terms.

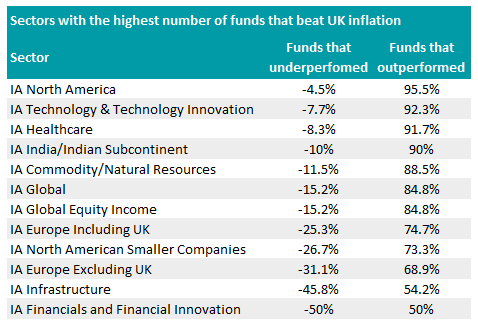

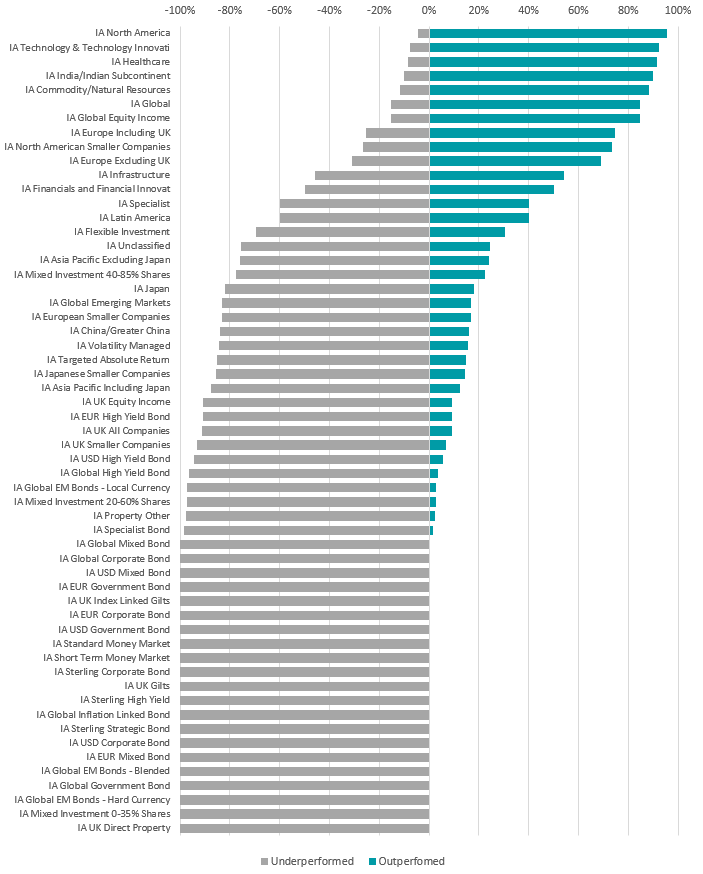

On a sector level, there were only 12 of the 57 Investment Association (IA) sectors where more than half of funds outpaced UK inflation over half a decade.

The greatest number of outperformers came from US-dominant sectors such as IA North America, IA Technology & Technology Innovation and IA Healthcare, so investors who had a large position to the US market were better protected against inflation.

Source: FE Analytics

On the other hand, there were 12 sectors – the majority of which were in the fixed income space – where no funds beat inflation over the period.

UK-dedicated sectors failed to outpace inflation in their home market, with 93.2%, 91% and 90.7% of the funds in the IA UK Smaller Companies, IA UK All Company and IA UK Equity Income delivering lower returns respectively.

Most funds recommend investors hold them for a minimum period of three-to-five years, so those who have held them for half a decade expecting to keep pace with inflation will have been disappointed.

Sectors that outperformed UK inflation the most over the past five years

Source: FE Analytics

The average IA fund across all sectors made a total return of 17.4% over the past five years, dropping 5.5 percentage points behind inflation.

Investors who held a fund over the past three years – a period that captured higher inflation than the initial two years in the study – had an even narrower chance of outpacing CPI, with 70.2% of all portfolios underperforming.

Over the past 10 years, however, annual inflation hikes were closer to the Bank of England’s 2% target. Just over a fifth (21.9%) of all IA funds underperformed CPI over that period, meaning longer-term investors had a greater chance of increasing their savings in line with (or in excess of) inflation.

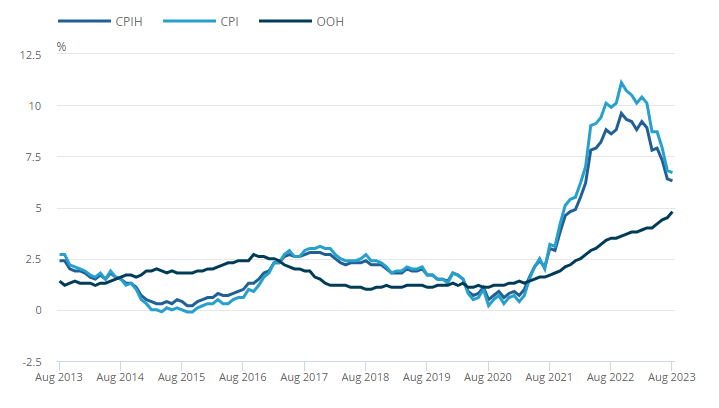

Inflation in the UK is on the decline, with the annual CPI rate dropping to 6.7% in August from its peak of 11.1% in October last year, but it could remain significantly higher than average over the coming decade according to some.

UK inflation over the past year

Source: Office for National Statistics

Orbis Global Balanced manager Alec Cutler told Trustnet a return to 2% is unrealistic, with 4% annual hikes more likely over the coming decade.

Nevertheless, investors continue to allocate as though markets are returning to normal despite most economic drivers pointing to the contrary. Funds could continue to struggle in beating inflation if rates remain higher over the foreseeable future.

“It just blows me away because people want to believe it so badly,” Cutler said. “That’s the biggest asset that central banks have – people's willingness to believe in 2%.

“But that doesn't mean you should be setting up your retirement portfolio on that. What if it isn't? How are you set up for that? If you're just sitting there with American growth stocks and the dollar, you're not set up very well.”