September was a mixed bag for investors as niche funds rose to the top of the charts while mainstream asset classes stayed relatively flat.

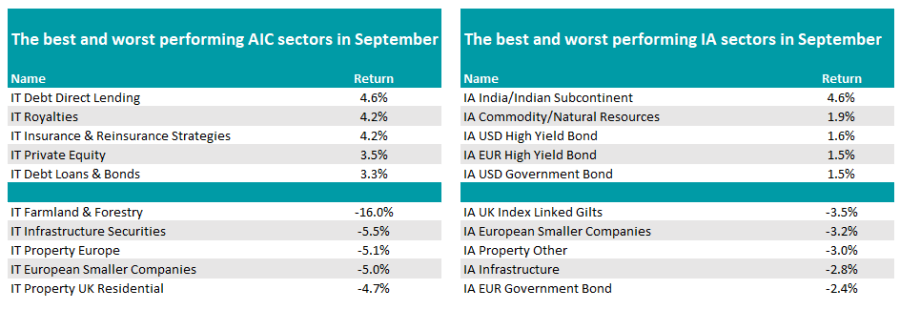

In the open-ended fund world, Indian equities topped the performance table, with the average IA India/Indian Subcontinent fund up 4.6%. It was the only peer group to make more than 2%, with the IA Commodity/Natural Resources in second, gaining 1.9%.

Ben Yearsley, director at Fairview Investing, said: “The Indian market is always expensive and remains so today but seems to justify this with long-term earnings keeping pace with growth in the economy – something China always seemed to struggle with.

“The Indian economy has benefited massively from buying cheap oil from Russia – supposedly at a discount of $30 per barrel – and some estimates suggest that embargoed oil now accounts for 40% of consumption, up from 4% pre the Ukraine invasion.”

Source: FE Analytics

On commodities, he noted that gold had a poor month, off around $100 at $1,865 per ounce, but oil (as represented by the Brent cruse spot price) has risen in recent months, ending September at $95.31, around $9 more than the month prior.

Investors attracted by high bond yields during the current era of higher interest rates had a mixed month. The remaining three of the top five Investment Association (IA) sectors were all dedicated to fixed income, including two US dollar-denominated sectors, which benefited from a strengthening US currency.

However, the worst performer of the month also focused on bonds: IA UK Index Linked Gilts. The Bank of England paused rates last month after weaker-than-expected inflation figures, which may have caused investors to sell their holdings on hopes that rates have peaked. It was a mixed bag at the foot with bonds, property, equities and infrastructure all represented.

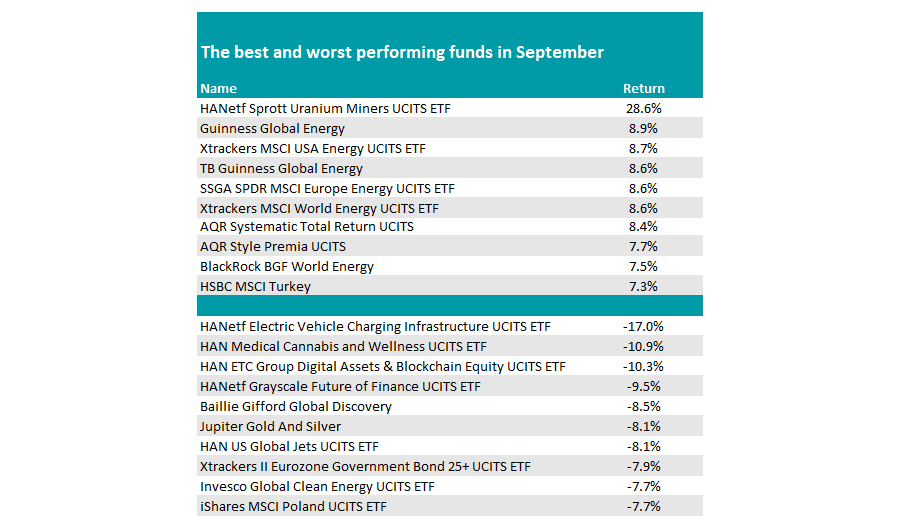

Turning to individual funds and trusts, both lists were dominated by niche assets. On the open-ended side, exchange-traded funds (ETFs) made up the bulk of the top 10 with HANetf Sprott Uranium Miners UCITS ETF taking the top spot, up 28.6%.

Energy was the main winner however, with six of the top 10 funds investing in this part of the market, including the only two active funds – Guinness Global Energy and BlackRock BGF World Energy.

Yearsley said: “Central bankers must be getting nervous about the impact [a rising oil price is having] on inflation. Energy equity investors on the other hand can rub their hands in glee as this will help continue the oil train (gravy train just didn’t seem the right phrase).

“Don’t forget the likes of Shell and BP cut costs drastically during Covid lowering the cost of producing a barrel – expect more buybacks, dividends and calls from clueless politicians for more windfall taxes.”

Source: FE Analytics

The other end of the spectrum was also dominated by ETFs, particularly those investing in niche areas such as cannabis and blockchain.

Despite energy prices rising, there were some clean energy-related funds also among the bottom 10 as investors moved away from renewables. Last month prime minister Rishi Sunak announced he was rolling back some of green initiatives, casting doubt on the government’s commitment to net zero.

Some Baillie Gifford funds suffered another month of disappointing returns, with Baillie Gifford Global Discovery among the 10 worst performers while Baillie Gifford Health Innovation was just outside the top 10.

“Global Discovery is the small-cap fund that, until last year, had Tesla as one of the biggest holdings. You can always tell what kind of market it is by seeing where Baillie Gifford funds are,” said Yearsley.

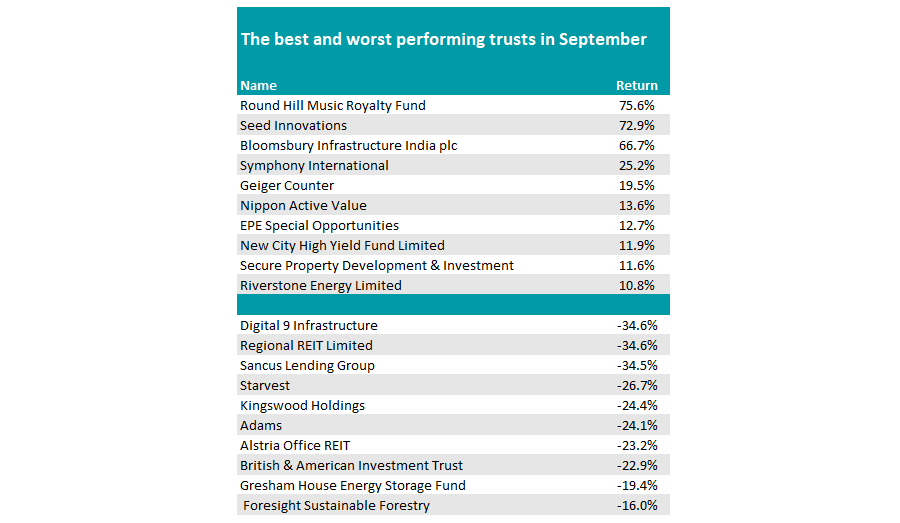

On the investment trust side, it was a good month for investors in Round Hill Music Royalty Fund after the investment trust agreed to a takeover by US music firm Concord. Shares made a groovy 75%.

Source: FE Analytics

However, the only other fund in the sector, Hipgnosis, flatlined after “more board room shenanigans and a deal to sell part of the catalogue to a linked fund of the manager”, Yearsley said.

At the foot of the table, it was a poor month for specialists as digital infrastructure firm Digital 9 announced it was abandoning the dividend and warned it was running short of cash. Shares were down more than a third in September.

Yearsley said: “Hot the on the heels of Civitas and Home REIT earlier this year these specialist trusts could do with better corporate governance. Once the darling of the trust world, it feels like many specialist trusts have a lot of work to do to regain investors’ interest.”