Investors attempt to diversify their portfolios by spreading their savings across an array of investments but there are multiple assets classes that are highly correlated.

Experts told Trustnet about several sectors that investors often hold together not realising that they do little to diversify their portfolios.

Jason Hollands, managing director of Bestinvest, said the likelihood of investors unknowingly holding multiple funds that perform the same role is higher today than it has been in the past as correlation between asset classes has grown substantially over the past decade, which has “eroded the traditional benefits of a diversified portfolio to some degree”.

One area where this is most notable is in global and US equity funds – they are two of the most popular sectors among UK investors, yet the overlap between them is significant.

Hollands noted that many investors buy global funds to broaden their exposure across many regions, but 69.7% of the MSCI World index is held in US stocks.

Total return of indices over the past 10 years

Source: FE Analytics

The main reason for this is due to US mega-cap stocks ballooning in size over the past decade. Indeed, all of the MSCI World’s top 10 holdings (representing one fifth of the index) are US companies with a collective market capitalisation of $11trn.

To put that into context, Hollands highlighted that Apple alone has a greater weighting in the index than all UK stocks combined.

“When you choose both a global equity and a US equity fund for a portfolio, there is a high chance that you will just be doubling up positions in many of the same stocks making this a somewhat imperfect pairing,” he added.

However, the main pairing that fund experts said investors needed to be wary of was IA Asia Ex Japan and IA Global Emerging Markets.

Gavin Haynes, investment consultant at Fairview Investing, said people can sometimes buy multiple funds in these sectors to get exposure to the high-growth prospects the regions offer without realising that performance is “almost identical at times”.

Total return of sectors over the past 10 years

Source: FE Analytics

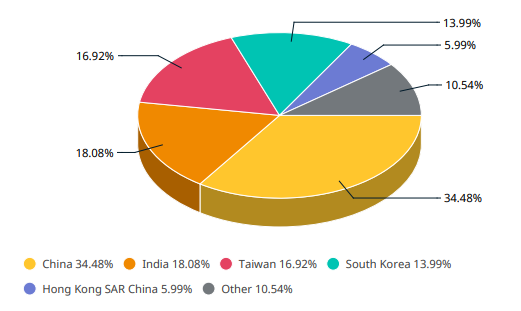

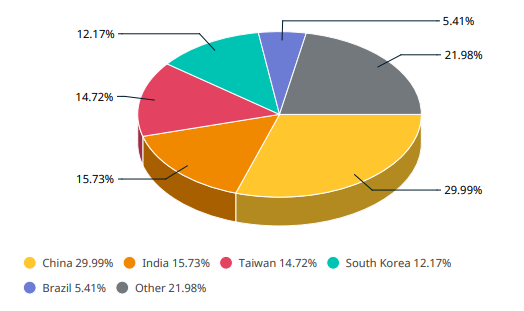

Indeed, the composition of the two main benchmarks used funds in these sectors – MSCI AC Asia Ex Japan and MSCI Emerging Markets – are very similar (as exemplified below).

Both share eight of the same names in their top 10 positions, meaning that “investors need to understand that Asia exposure will dominate most emerging market equity funds”.

Haynes added: “This can make it particularly challenging if you are looking to allocate to both areas separately within a portfolio. It is going to need careful fund selection if you are not to replicate country allocation and duplicating holdings. This is particularly the case if using passive fund or core actively managed funds with a low active share.”

Country weightings of MSCI AC Asia Ex Japan and MSCI Emerging Markets

Source: MSCI

Rob Morgan, chief investment analyst at Charles Stanley, also cautioned investors holdings funds in either sector, noting the economic conditions in China – the largest regional position in both – can dictate the performance of either index.

“Sentiment towards the wider region tends to be heavily influenced by Chinese economic fortunes and political risks,” he explained.

“Meanwhile, non-Asian emerging markets such as Latin America or Eastern Europe, which are largely unrelated, are small weights in global emerging markets benchmarks and funds.”

As such, it is “best to consider the two sectors together” to avoid having two funds that do the same thing.

“It can be best to pick funds with different styles for exposure, for instance one income and one more growth orientated, rather than pick one of the same type from both the Asian and GEM sectors in order to get broader exposure to different areas and types of company, as well as greater diversification benefits.”

Likewise, FundCalibre senior research analyst Chris Salih had a word of warning for investors with gold in their portfolios.

He said holding this asset class alongside treasury inflation protected securities (TIPS), which are a kind of inflation-protected bond, can perform a similar function in portfolios.

“Gold typically trades off real yields such as TIPS,” Salih added. “Higher real yields will hurt your inflation-linked bonds, as we've seen the past couple of years, but it's also likely to hurt your gold holdings as well.

“If you can get a higher risk-free return above inflation from a developed market government, like the US or UK, then demand for gold - which is usually used as a means of preserving capital and purchasing power – will fall. There's nothing wrong with owning both asset classes in the same portfolio, but it is a correlation to be very aware of.”