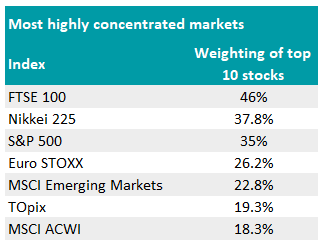

Passively investing in an index is supposed to provide exposure to a wide net of stocks, but some are highly concentrated in a handful of names, new data from Trustnet has found.

Several indices contain hundreds of names but weightings are often based on market capitalisation, meaning a few of the largest companies take up a large chunk of an index.

Trustnet looked at seven of the most popular indices from around the world and ranked them based on how highly concentrated their top 10 holdings were, with the FTSE 100 taking the top spot.

Source: London Stock Exchange, Nikkei, S&P Dow Jones, Qontigo, MSCI, Tokyo Stock Exchange

The 10 largest constituents accounted for 46% of the whole index, with their collective market cap of £980bn taking up a large portion of the FTSE 100’s total value of £2trn.

To put that into context, Shell alone – the largest company in the index – was bigger than the 39 smallest companies combined in the large-cap index.

A report from OmNis Investments pointed out that the FTSE 100 is not therefore reflective of the biggest UK companies as a whole, but of just a few names.

Source: London Stock Exchange

It said: “When we read about how the FTSE 100 is performing, this tends to be a reflection of those top 10 companies, not the top 100. If you invest in a passive tracker fund that follows the FTSE 100, you’re relying on these companies to perform strongly.”

Indeed, FundCalibre research analyst Chris Salih said the biggest companies had ballooned in size over recent years “as investors have got scared and increasingly migrated towards large-cap stocks”.

He noted that this has happened in many markets, particularly the US where mega-cap technology companies have become “oversold”. The 10 largest companies in the S&P 500 – eight of which are tech stocks – make up 35% of the index as a whole.

With the popularity of passive funds and exchange-traded funds (ETFs) on the rise, Salih warned that this issue with index concentration could get worse.

As a few large-cap companies dominate more than a quarter of Japan’s Nikkei 225 (where the top 10 account for 37.8% of all holdings) and Europe’s Euro STOXX (26.2%), Salih said investors could benefit from avoiding these highly concentrated markets and looking to smaller companies.

“Overall we think the market is getting less efficient and, as a result, we much prefer smaller companies at this point,” he added.

“Not only have they typically outperformed larger companies over the longer term, they also have better growth prospects, cheaper valuations and are also more likely to be taken over by private equity. We think now is a good time to buy active smaller companies' funds for the long term.”

Likewise, Fidelity associate director Ed Monk also highlighted smaller companies as a way for investors to diversify their portfolios and reduce exposure to a few large-cap names.

“If you attempt to balance your investments away from the index, the return you get will be less correlated to it,” he said. “Fine if you get your choices right, but painful if you don’t.

“It could be smart to consider funds which balance out your risks. Increasing your exposure to smaller stock markets, or to smaller companies within the same market, will have this effect.”

Having a high weighting towards a few names can lead to a particularly harsh impact on an index as a whole in a downward market, Monk warned.

He highlighted the S&P 500’s performance last year, which fell 8.3% after its most dominant names suffered in a high inflation and interest rate environment.

“Anyone buying broad exposure to the US would have ended up with high proportions of these companies, so their fall last year led to big losses overall,” Monks added.

“This is always a risk if your investments correlate to market indices, as most funds do to some degree or other, but there’s reason to think that the risk of your investments becoming concentrated in just a few stocks is rising.”

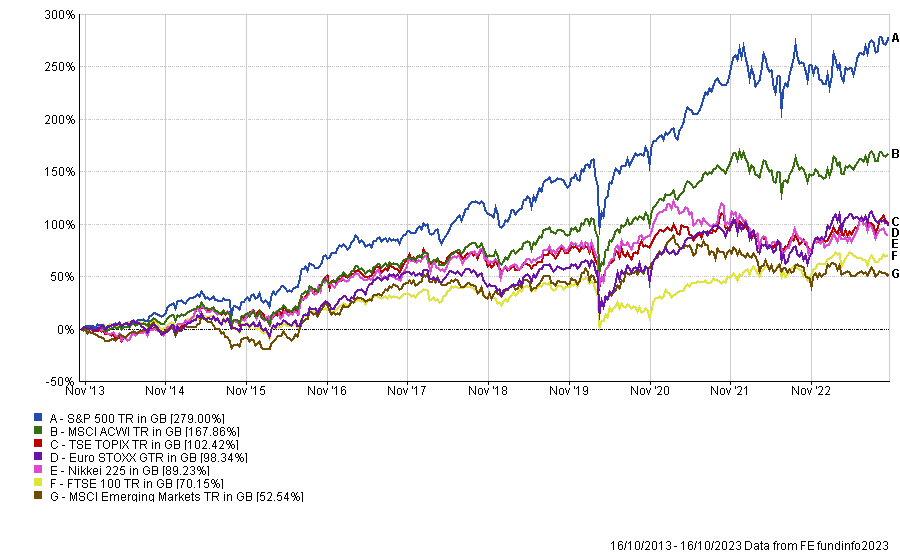

Markets may have become more concentrated over time as mega-cap companies swell in size, but the S&P 500 was still the best performing index of all the ones ranked over the past decade.

Total return of indices over the past 10 years

Source: FE Analytics

It generated a total return of 279%, while the MSCI ACWI index – the least concentrated on the list, with its top 10 holdings accounting for 18.3% – came in second with 167.9%.