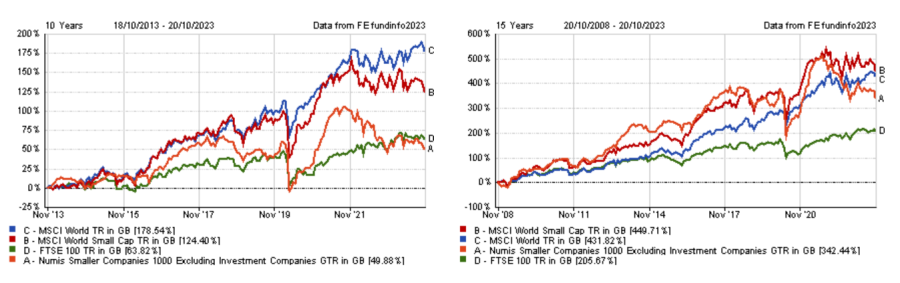

The past decade has been difficult for small-caps as they have underperformed large-caps, both overseas and domestically. While recognising those challenges, Peter Ewins, manager of The Global Smaller Companies Trust, argued that it’s been the best part of the market to be in over the long-term, as small-caps have outperformed over 15 years.

Yet, Ewins is worried about the future of UK smaller companies, as he is witnessing the “incremental disappearance” of this market.

He said: “The UK small-cap market is gradually disappearing. Virtually every day, we're seeing UK-listed companies being taken over. There is a drought of IPOs and challenges remain in terms of equity flows. The long-term worry for people like me running smaller companies portfolio is that we will have a smaller pool of things to choose from.”

Performance of indices over 10 and 15yrs

Source: FE Analytics

This is also something that Alex Wright, manager of Fidelity Special Values is seeing happening in his portfolio, which has about 60% of its allocation in UK mid- and small-caps.

He said: “There's a lack of IPOs globally, which means there aren't new companies listing in the UK. On the top of that, there's a huge number of takeouts because of the low valuations. So, the number of stocks available is reducing.”

This year alone, several companies in Wright’s portfolio, such as The Restaurant Group and Finsbury Food, have been taken private through takeovers, while John Wood Group has been approached by a US private equity firm.

“Since mid-2021, UK smaller companies funds have seen strong outflows, which is negatively affecting the valuations particularly at that part of the market,” he said.

One area that small-caps have thrived however is in the US, where Ewins said the economy “is on a better dynamic than the UK and Europe” and where companies do not have the headwinds of high energy prices and higher exposure to rising interest rates.

“It's fair to say that we're thinking more favourably on companies with exposure to North America,” he said.

In spite of this, the UK accounts for more than 24% of Ewins’ portfolio, the largest country allocation after the US, with the manager particularly drawn to the international exposure of UK businesses.

He said: “Where a company is listed does not necessarily mean where it is exposed. We hold a company called 4imprint, which has done stunningly well over the last couple of years. It is listed in the UK but it is almost entirely a North American business.”

Despite the market conditions, in recent times the Brunner Investment Trust has also been adding some UK small-cap names in its portfolio, although it remains underweight the UK on a relative basis.

Julian Bishop, senior portfolio manager of the trust, said: “We see value in this space, with a lot of free cash flow and strong dividends. UK companies are not the greatest in the world, but they are good at what they do.”

Yet, Bishop added that the UK remains an old economy market, skewed toward mature sectors such as energy, resources, traditional banks and insurance. Therefore, he does not see a strong potential for growth investing in the UK.

He said: “In the UK, you have an abundance of yields but also a lack of quality and growth by international standards.”

Some, however, do not think the UK smaller companies market is alone in its struggles. JPMorgan Global Growth & Income manager Amit Parmar hasn’t been adding to small-caps, whether in the UK or overseas, although the trust’s mandate allows it to allocate to this part of the market.

He said: “We currently don't hold any small- or mid-cap company within our portfolio. We have no shortage of ideas amongst the 2,500 companies we cover, so we do not feel we need to go down the market-cap spectrum at present.”