HSBC Holdings’ third quarter results contained some good news this morning with its third share buyback for the year and solid growth across all its businesses. The bank, which clung onto its buy rating from Jefferies, stands out as the best performer in an unloved sector.

Standard Chartered also kept its buy rating last week after a complex set of results, but Jefferies downgraded Natwest today to ‘underperform’ from ‘buy’.

Russ Mould, investment director at AJ Bell, said Barclays, Lloyds, Standard Chartered and NatWest all released “lukewarm figures or cautious outlooks on lending margins (or both),” meaning that “the big lenders remain unloved”.

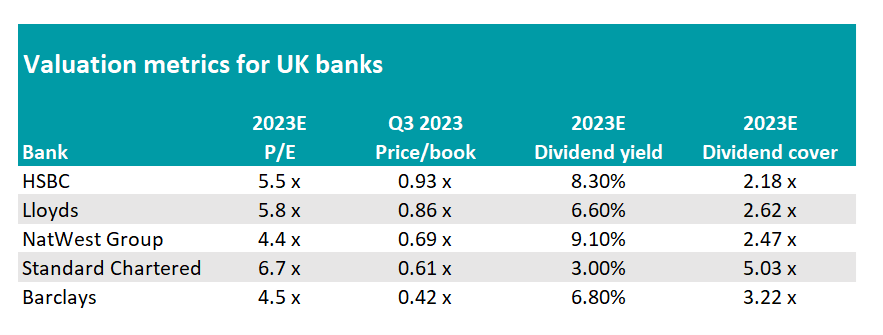

All five UK lenders including HSBC are trading on earnings multiples at a significant discount to the FTSE 100 and four of them offer a premium dividend yield. None of them trade at a premium to net asset value, as the table below shows.

Source: Company accounts for historic book value per share figures, Marketscreener, consensus analysts’ forecasts, Refinitiv data

“Markets clearly believe there are substantial risks attached to the earnings and dividend forecasts – even if no increase in aggregate profits is expected in 2024 – and are demanding higher returns (by paying low prices and farming high yields) to compensate themselves for those dangers,” Mould said.

“Where a one-times multiple of book value could be seen as a floor when the good times are rolling and return on tangible equity is consistently in the double-digits, it could become a valuation ceiling if markets feel more difficult times are on the way.”

Mould is concerned that net interest margins may be reaching a ceiling, after rebounding from the lows of late 2020. “The combination of political pressure, competition and consumers’ ability and willingness to shop around for the best deals on deposit accounts and loans does seem to be putting a cap on net interest margins,” he said.

“Aggregate net interest income across the big five FTSE 100 banks fell quarter-on-quarter for the third time in a row in third quarter of 2023, to £18.1bn. That is still £5.4bn higher than in the third quarter of 2021, but it is some £2bn below the fourth quarter peak of 2022, so if bad loans increase and investment banking operations falter (at those who have them) then that could accentuate the impact of falling income.”

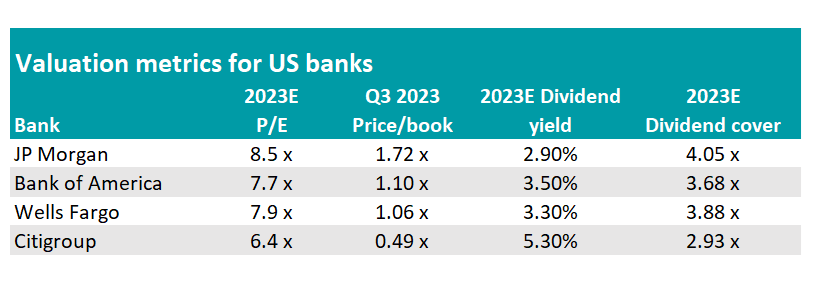

Looking across the Atlantic, American banks’ valuations are better supported than their UK counterparts, reflecting the more buoyant economic outlook. Citigroup is the only one of the big four ‘main street’ banks trading at a discount to NAV.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts, Refinitiv data

Nonetheless, US banks are still undervalued compared to the broader stock market, as is the case in the UK.

US banks are trading on single-digit price/earnings (P/E) multiples, whereas the S&P 500 is trading on around 19x forward earnings for 2023, according S&P Global.

America’s banking sector is “not immune from the suspicion that a sandbagging from financial markets or the global economy or both may be just around the corner,” Mould said.

The impact of the US regional banking crisis earlier this year and the failures of Silicon Valley Bank, First Republic Bank and Signature Bank continue to weigh on investor confidence.

Banks on both sides of the Atlantic are also grappling with rising interest rates, which can be a double-edged sword.

On the positive side, HSBC’s CEO Neil Quinn said higher rates were one of the reasons profit before tax increased by $4.5bn to $7.7bn in the third quarter of 2023 compared to the same period the previous year. “There was good broad-based growth across all businesses and geographies, supported by the interest rate environment,” he said.

Although higher rates help to shore up net interest margins, they also create problems for banks’ customers, pushing up borrowing costs and leading to increased defaults.

In a rising rate environment, investment bank deal flow tends to be stymied as initial public offerings dry up and merger and acquisition activity slows down.

US lenders also face unrealised losses on sovereign bond holdings, whose prices have fallen as yields have risen. American banks were sitting on $311bn of unrealised losses on held-to-maturity securities at the end of June, according to the US Federal Deposit Insurance Corporation.

“The good news is accounting rules mean they no longer have to mark-to-market and book those losses each quarter. The bad is that any unexpected run on deposits could force banks to liquidate to raise cash, thus crystallising those losses (rather as happened at Silicon Valley Bank in the spring),” Mould explained.

“If the banks can hold the securities – which include a lot of US Treasuries – until maturity, then all may be well, but these potential losses are sitting in plain sight and so are the risks.”