The UK equity market has had a tough couple of years but now offers fertile ground for bargain-hunting value investors and income seekers.

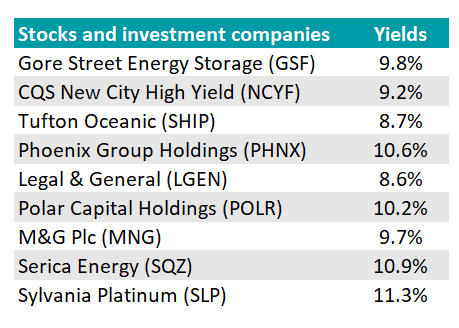

So undervalued is the market that Edward Allen, investment director at Tyndall Investment Management, was able to compile a list of nine stocks and investment companies yielding around 10%, which he described as “worthy investment cases being questioned by the market”.

For investors drawing down from their portfolios, a high level of income is useful, although 10% is so high that it starts to beg the question of why. Many of the companies in the list have battled significant headwinds and their share prices have fallen as a result.

“If it’s yielding 10% it tells you the market is deeply uncomfortable with that asset. If we’re wrong, you could lose a lot of money. It’s an illustration of the risk the market sees,” Allen noted.

That being said, such a high dividend looks compelling. “The difficulty is weeding out the ones who will deliver on that promise from those who will cut dividends and disappoint,” he said. “I do think that amongst them are some real opportunities.” He owns most of the stocks and trusts in his list.

Stocks and trusts yielding around 10%

Sources: Tyndall Investment Management, FE Analytics, London Stock Exchange, data as of 17 Nov 2023.

Sources: Tyndall Investment Management, FE Analytics, London Stock Exchange, data as of 17 Nov 2023.

Allen has owned Gore Street Energy Storage for a long time but admitted that he – and the wider market – underestimated how volatile its revenues would be. The trust owns batteries and leases them to the National Grid and other grids internationally.

The UK has been a poor market for battery storage this year but Gore Street anticipated this and diversified its revenues abroad, so the trust still has a high income.

It takes a long time to connect a battery project to the network. As such, by the trust’s September 2023 results the portfolio was only 25% operational. It should reach 40% by year’s end and be 70-80% operational by the end of 2024.

The 10% dividend is not covered yet but it should be by the end of next year. “It’s a fiddly story by we think there’s real value,” he explained.

Total return of trust vs sector over 3yrs

Source: FE Analytics

Another investment trust owned by Allen is CQS New City High Yield, which is managed by Ian ‘Franco’ Francis who Allen described as “an extremely good operator in the space” with a long track record. “Franco thinks in an absolute return manner and carefully considers credit [risk] before buying,” he explained.

While nervous about high yield against the backdrop of higher borrowing costs and a potential recession on the horizon, Allen pointed out that the trust is relatively short duration so it has not suffered as much as other high yield strategies. The trust also has the flexibility to invest up to 20% in equities.

Performance is top quartile over three and five years compared to other trusts in the IT Debt –Loans & Bonds sector, but third quartile for the past 12 months.

Total return of trust vs sector over 3yrs

Source: FE Analytics

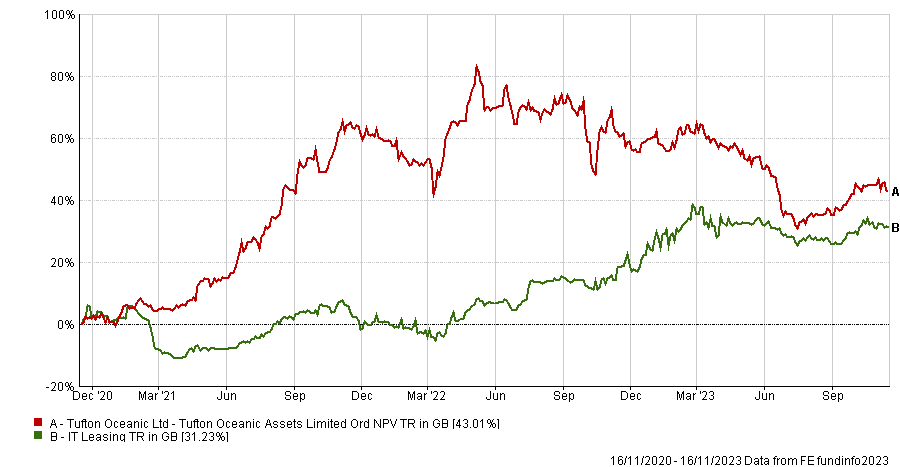

Staying with investment trusts, Allen bought Tufton Oceanic Assets in 2021 and saw the share price almost double to a peak of $1.42 in late 2021, although it has come back to about $1 now.

Meanwhile, the trust’s net asset value (NAV) has gone more or less sideways: it was $1.37 in October 2021 and was $1.37 again last Monday. What has changed is that the trust is now trading at a 30% discount to NAV reflecting concern about global trade, the weakness of China and a potential recession.

“Tufton has been really smart in the way it has managed through this cycle,” Allen said. It made significant profits from container ships which it subsequently sold out of and rotated into tankers and bulkers (ships that transport dry goods in bulk). The value of bulkers has gone sideways since 2021 and the same applies to tankers since 2022 but the value of container shipping has halved.

“We are holding it for yield but also because we think there’s a lot of value there,” Allen explained.

On the face of it, this investment looks like a diversifier but it is quite closely correlated to equity markets and is sensitive to global trade and economic growth. The trust also does well when the price of steel rises because that increases the scrappage value of ships.

Total return of trust vs sector over 3yrs

Source: FE Analytics

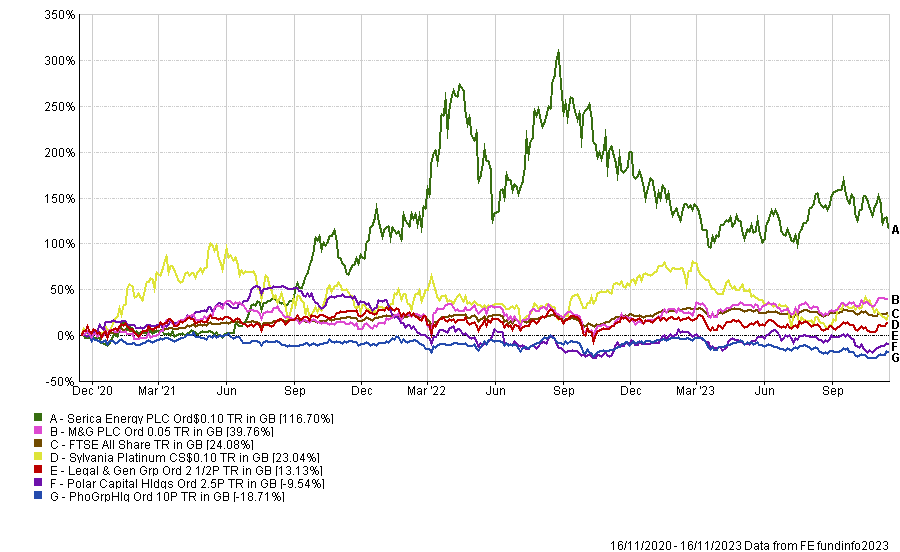

Turning to stocks, there are two insurers on the list: Phoenix Group and Legal & General. Allen said the trend of companies outsourcing defined benefit pension funds to insurers will continue as they seek to take risk off their balance sheets, and the broader retirement market should grow.

Allen also put forward two fund managers: Polar Capital, an equity house known for its thematic funds, and M&G, which manages a variety of asset classes but is arguably best known for fixed income.

He said M&G is attractively valued, especially given the high dividend, while Polar Capital is a beta play: if the overall equity market turns around then Polar Capital’s shares should perform well. Its dividend is not covered but should be able to pay it from retained earnings.

Lastly, Allen highlighted two commodity companies, Serica Energy and Sylvania Platinum, whose share prices have fallen significantly from previous highs. Serica has suffered from the government’s energy price cap.

Sylvania is almost a recycling play and is at the “spicier end” of the list. The South African mining concern owns the rights to produce platinum and other metals from the chrome tailings of former mines. Its share price is correlated to the prices of platinum group metals.

Total return of stocks over 3yrs

Source: FE Analytics