Multi-asset funds enable investors to access a diversified portfolio made of primarily equities and fixed income but also alternative assets. As with other sectors, investors can opt for low-cost passive funds but paying extra fees can sometimes lead to superior returns.

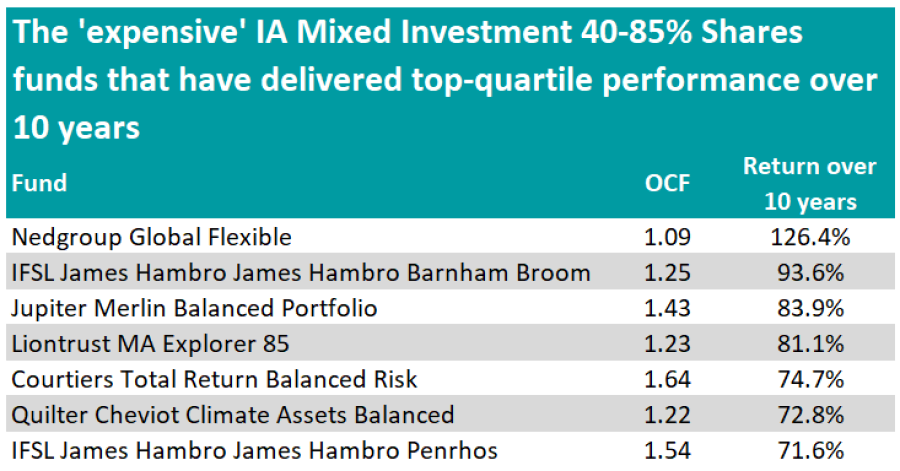

Below, Trustnet looks at the ‘expensive’ multi-asset funds that have made top-quartile returns over the past 10 years. We have defined expensive as any fund with an ongoing charge figure of 1% or more.

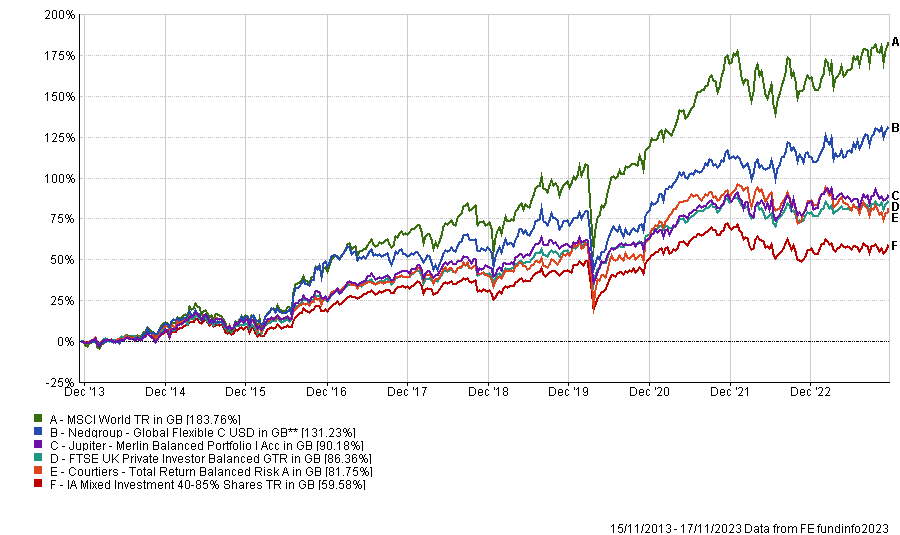

We have also researched each of the three multi-asset sectors separately as they have distinctive risk profiles and therefore different expectations of returns. It is, however, worth noting that no multi-asset fund has outperformed global equities over 10 years.

We start with the IA Mixed Investment 40-85% Shares sector, which is the riskiest of the three sectors due to the higher proportion of equities in the mix. Yet, it is also the sector where investors can expect the highest level of return as a result.

The best performing expensive fund in this sector in the past decade has been Nedgroup Global Flexible, which charges 1.09%. The fund invests predominantly in US equities, European equities as well as cash and cash instruments and asset-backed bonds.

The most expensive fund that still made a top-quartile return is Courtiers Total Return Balanced Risk which has returned 74.7% over that period while charging 1.64%. The fund has 76.2% of its allocation in equities and 21.5% in bonds with the remaining in other asset classes.

Performance of funds over 10yrs vs sector and benchmarks

Source: FE Analytics

Other expensive top performers include Jupiter Merlin Balanced Portfolio, managed by FE fundinfo Alpha Manager John Chatfeild-Roberts, David Lewis, Amanda Sillars and George Fox.

The fund is based on the investment philosophy that preservation of capital is as important as capital growth. To achieve this, the managers follow a conviction-led approach without reference to any benchmark when building the portfolio.

Analysts at Square Mile said: “Over the years, this has largely been achieved by using a simple and common sense approach and without exposure to more complex investments or instruments.

“Overall, we hold this team in high regard and consider this a strong offering for investors seeking a product run by experienced and proven investors, with a strong long term record of managing multi-asset fund of funds portfolios who have successfully delivered on the fund's expected outcome since launch.”

Source: FE Analytics

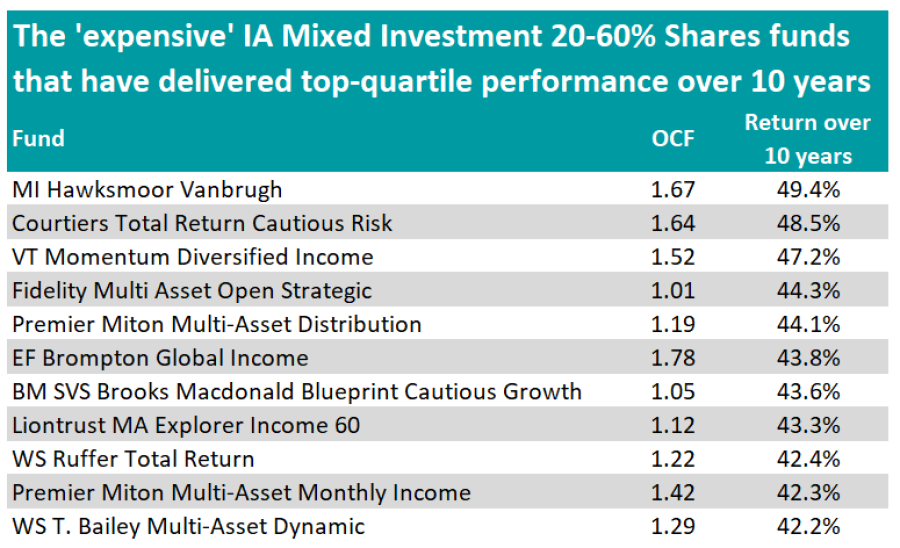

In the IA Mixed Investment 20-60% Shares sector, the most expensive best performer over 10 years has been EF Brompton Global Income. The fund has a 49.4% allocation to equities, 40% to fixed-income, 8% to cash and 2.6% to alternative assets, according to its latest factsheet.

MI Hawksmoor Vanbrugh has, however, been the best performing expensive fund of the period, returning 49.4% to investors. The fund aims to generate positive real returns but also takes capital preservation into consideration.

Equities make up 39.7% of the fund, with the UK and Japan being the largest geographies, while fixed income accounts for 36.8%, real assets 16.5%, private equity 6.1% and cash 0.9%.

Performance of funds over 10yrs vs sector

Source: FE Analytics

Premier Miton Multi-Asset Distribution is another of the expensive funds achieving a top-quartile return over 10 years in this sector. It is a fund of funds with a valuation aware focus, enabling it to pick up bargain investments while limiting the downside potential due to the lower point of entry.

Analysts at Square Mile said: “Over the years the team has demonstrated a good ability for selecting managers who can deliver superior risk-adjusted returns and this has been a key influence in the fund meeting its objective.”

Historically, Premier Miton Multi-Asset Distribution has favoured active management, selecting funds whose underlying portfolios significantly differ to their benchmark. The fund is, however, aiming to introduce passive funds as well as funds from the Premier Miton stable in the portfolio to reduce fees and remain competitive in the market.

Nonetheless, Square Mile analysts do not believe this change will prevent the managers’ ability to reach their objectives over the long term.

Source: FE Analytics

In the IA Mixed Investment 0-35% Shares sector, Fidelity Multi Asset Open Defensive is the only expensive fund to achieve top-quartile performance over 10 years. It charges 1.02% and has returned 28.4% to investors over that period.

The fund’s largest allocation is to investment grade bonds, with sub-investment grade bonds making up 9.3% of the portfolio. It also has some positions in UK and US equities and holds gold.

Performance of fund over 10yrs vs sector

Source: FE Analytics

It is worth noting that the past decade favoured risk assets such as equities. As a result, the IA Mixed Investment 0-35% Shares sector has underperformed the other multi-asset sectors. This is because they take a more cautious approach, with a limited exposure to risk assets.