As the global economic landscape braces for volatility in 2024, Emma Wall, head of investment analysis and research at Hargreaves Lansdown, has suggested three defensive funds to guide investors through challenging market conditions.

According to the International Monetary Fund (IMF), global economic growth is projected to slow from 6.1% in 2023 to 3.6% in 2024. Inflation is also expected to remain elevated, with the IMF forecasting an average inflation rate of 5.7% in 2024.

Despite these challenges, there are still opportunities for investors. Defensive investments, such as high-quality corporate bonds and dividend-paying stocks, can help to protect portfolios from changing market forces.

Wall said: "Times of market turbulence can create excellent investment opportunities – and don't worry about getting your timing just right, over the long term it is time in the market, not timing the market, which has been proven to be the best indicator of outperformance.”

The first highlighted for 2024 is the £1.3bn Artemis Corporate Bond fund, managed by Stephen Snowden, an investor with more than two decades of experience in the sterling corporate bond market sector.

The fund aims to outperform the iBoxx Sterling Collateralized & Corporates Index over rolling three-year periods by buying high-quality corporate bonds, typically issued by companies with strong financial fundamentals, which provides a cushion against potential defaults.

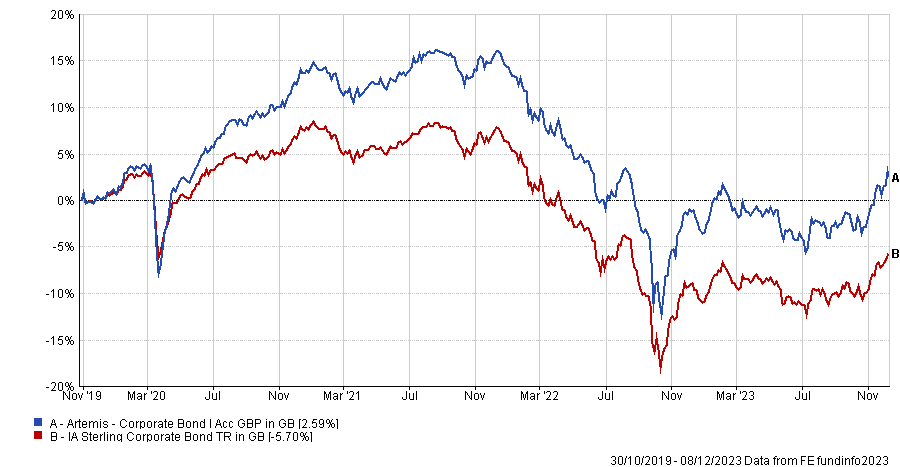

Launched in 2019, the fund has beaten the average IA Corporate Bond peer, returning 2.6% while the sector average has lost investors 5.7%.

Performance of fund vs sector since launch

Source: FE Analytics

Investors can further benefit from the relatively low ongoing charge figure of just 0.37%, demonstrating the fund's commitment to providing value to its clients.

Wall added: "With the potential of recession in 2024, we are mindful of bonds issued by those companies with the worst credit ratings in the high yield category because of the heightened risk of those companies defaulting on their bond payments during a recession.

"At the same time, investment grade corporate bonds often offer a higher yield than their government bond counterparts, which helps to cushion against potential losses should the economy deteriorate.”

Up next, the £3.4bn Fidelity Global Dividend fund is ideal for investors seeking consistent returns. Managed by Daniel Roberts, the fund's diversified portfolio across healthcare, consumer staples, and financial sectors further enhances its stability and risk mitigation.

The fund has been a top-quartile performer in the IA Global Equity Income sector over 10 years, although remains behind the MSCI ACWI benchmark, as the below chart shows.

Performance of fund vs sector and index over 10yrs

The fund yields 2.8%, providing a steady stream of income for shareholders, while its diversified nature across different sectors and geographies helps to smooth out fluctuations in individual markets, reducing overall portfolio risk.

Wall added: “The focus on valuations and income has led Roberts to have a high degree of exposure to Europe and the UK. This also means he will typically be less exposed to the US market when compared to a global benchmark.

"Although we are wary of the fund's Europe overweight, given the macroeconomic backdrop, from a valuation point of view the market looks cheap compared to its long-term history."

Her final selection for those seeking a more flexible investment approach was the Troy Trojan fund, managed by FE Fundinfo Alpha Manager Sebastian Lyon and Charlotte Yonge. It offers a balanced strategy that combines defensive elements with growth potential.

The fund's focus on defensive assets, such as government bonds and gold, helps to mitigate risks in challenging market environments. At the same time, a selective allocation to equities provides the opportunity for long-term capital appreciation.

The past 10 years have not been kind to the strategy, with the fund underperforming the average peer in the IA Flexible Investment sector, although the managers have stressed previously that the fund is supposed to lag during strongly rising markets – as have been the conditions for much of the past decade.

Indeed, in 2018 and 2022 – the only two years of the past 10 when the IA Flexible average peer made a loss – the fund was top quartile.

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

Wall added: "Rather than trying to shoot the lights out, the fund aims to grow investors' money steadily over the long run while limiting losses when markets fall.

"It tries to experience smaller ups and downs than the broader global stock market or a portfolio that's mainly invested in shares."