Exchange-traded funds (ETFs) are often used to gain tactical exposure to themes, which is exactly how James Hart, co-manager of the Witan Investment Trust, is using them.

In particular, in the Witan portfolio, he is holding two at the moment, the Vanguard FTSE 250 ETF and an S&P equally weighted biotechnology ETF.

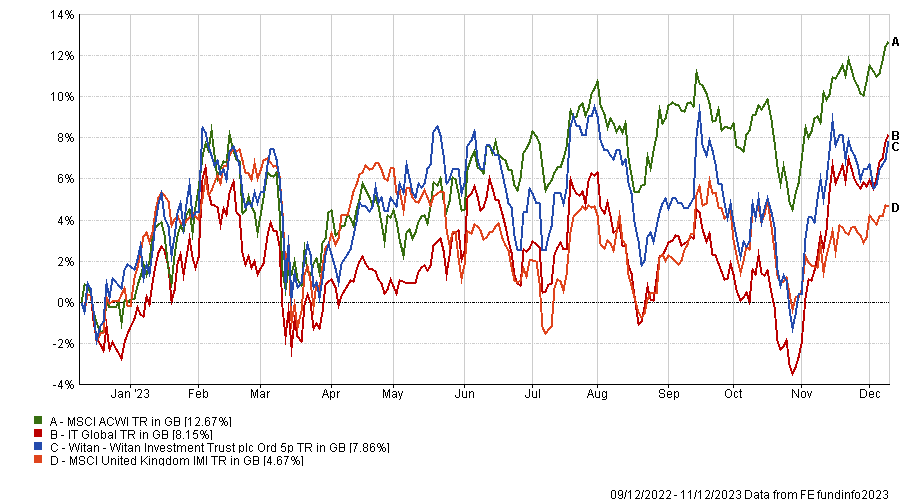

Performance of fund vs sector and index over 1yr

Source: FE Analytics

As active global managers, Hart and co-manager Andrew Bell are free to invest in UK mid-caps and US biotech companies directly, so why did they choose to go down the ETF route?

There’s more than one reason, Hart explained. The FTSE 250 has been “a dreadful relative performer” and the managers hope to be buying it at the right time. But there’s a second advantage to it, which is that roughly 35% of the index is made up by investment companies.

“For starters, we wanted to increase our exposure to the UK mid-cap space, a part of the market that we felt was the most attractive equity market on a five-year view,” he said.

“But also when we're buying it, not only are we buying UK mid-caps, we're also buying into a basket of investment companies that are trading at historically wide discounts.”

The tracker replicates the performance of the index by direct ownership of all the underlying securities in matching proportions and made up 1.1% of the trust’s £1.6bn of assets under management (AUM) as of October 2023.

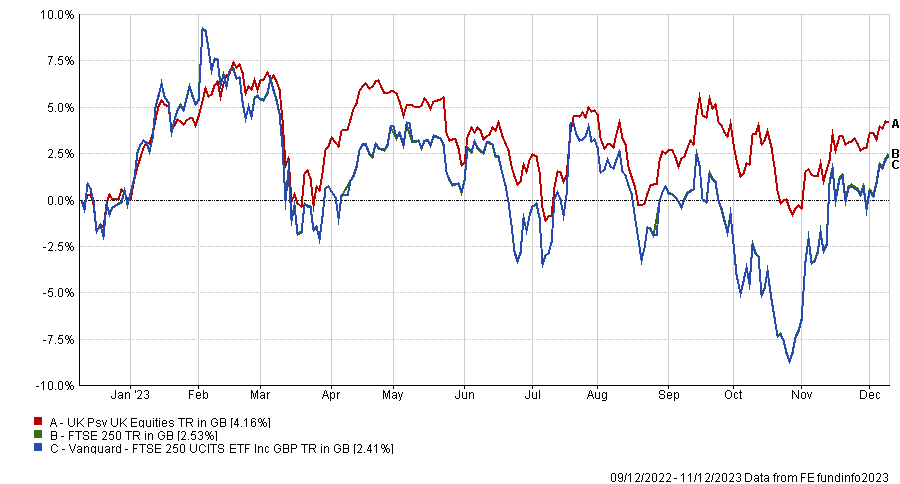

Performance of fund vs sector over 1yr

Source: FE Analytics

As for biotech, the Witan team chose an equally-weighted ETF, using an equal weight to all the index constituents because, as Hart explained, by buying a market-cap weighted ETF of biotech, you end up with two or three “massive” companies that drive returns and “very little benefit” from owning the tail of hundreds of companies that are much smaller.

Another reason for picking an ETF was that it's “significantly more liquid” than going in through an investment company route, and this position is “a more tactical one than owning some investment companies” in the portfolio.

The liquidity will leave the managers to move in and out of the position more quickly, to which one might ask: if the goal is swiftness, why not use futures?

“Futures we typically use for our very short-term tactical basis, they are an easy way to get exposure quickly for example when the market has a really big sell off, which we think is unjustified,” Hart explained.

“That will buy us time to think about which managers we want to allocate money to. It's a really quick tactical asset allocation, a matter of weeks, as opposed to ETFs, which we are buying for the longer run. But it's not something that we do very often.”

The trust bought Japanese index futures back when former prime minister Shinzo Abe was elected.

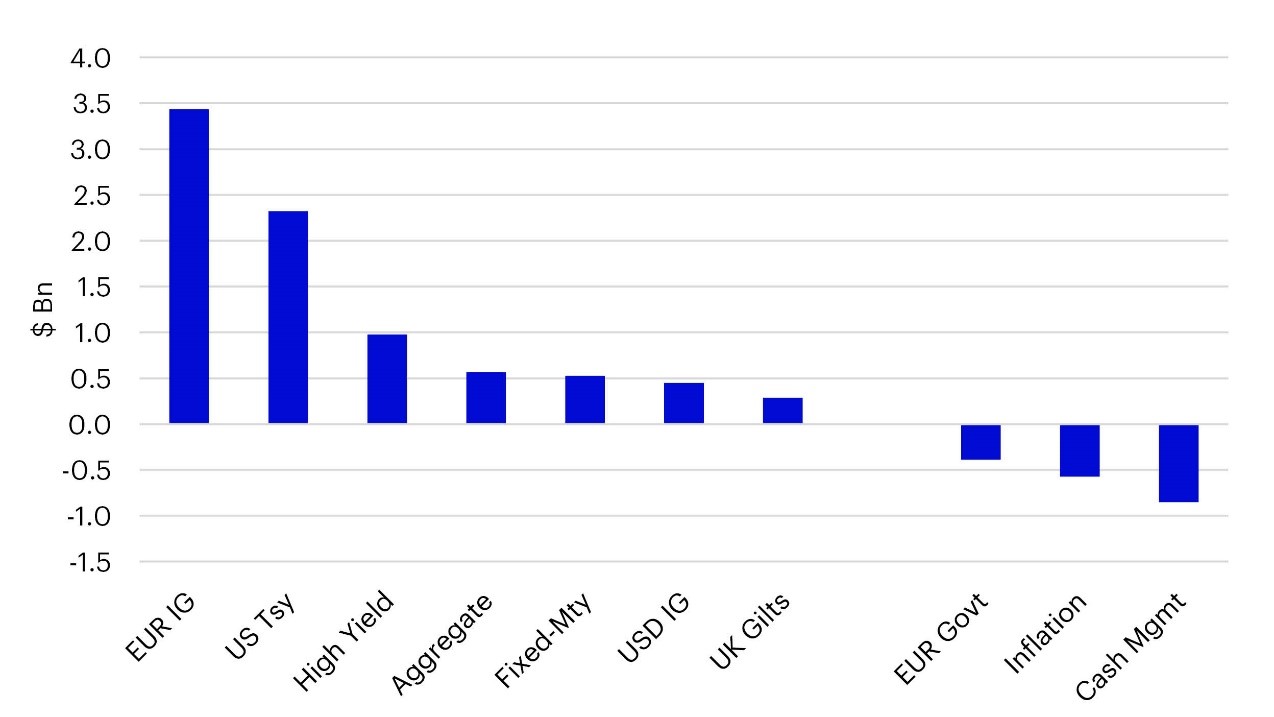

Another area where investors have been favouring ETFs is fixed income, which in EMEA alone added $7.1bn of net inflows in November 2023, according to data from Invesco.

Top and bottom fixed-income ETF categories in November 2023

Source: Bloomberg, Invesco, as at 30 Nov 2023

Paul Syms, head of EMEA ETF Fixed Income and Commodity Product Management at Invesco, believes this trend is likely to continue into the new year.

“Fixed income markets performed strongly in November, and returns are unlikely to be as strong going forward,” he said.

“However, the end of the hiking cycle is likely to allow bond markets to continue to perform well in the months ahead.”