The market outlook going into next year is uncertain. Growth is expected to slow across developed market economies and recent rate hikes will bite into consumer confidence. Some investors are pivoting towards quality names with resilient earnings.

Yet quality comes in different forms. For Hugh Gimber, a global market strategist at JPMorgan Asset Management, it boils down to three factors – profitability, financial risk/solvency and earnings quality – although qualitative factors such as the tenure and experience of the management team are also taken into account.

Chris Elliott, a fund manager at Evenlode, meanwhile looks for businesses with high returns on investors’ capital that can “persist well into the future”, meaning they can remain dominant and continue to take market share. Their three key ingredients are: structural market growth, a competitive advantage, and high levels of investment in improving that competitive advantage.

Below, fund managers for whom quality is a cornerstone of their investment process highlight stocks that should fit the bill for investors who want to prioritise earnings resilience next year.

Consumer staples and discretionary

One high quality company worth considering is Home Depot, which has improved the consistency of its earnings by gaining wallet share from professional contractors. Since 2012 professional customers have gone from 30% to 50% of its sales, which have doubled in the past decade.

Cameron Shanks, an equities investment analyst at Aegon Asset Management, said: “The professional contractor is price sensitive but, above all, values the convenience of being able to collect a specific part in store when needed. Home Depot has delivered high on-shelf availability through heavy investment in its distribution network and inventory management technology.

“Over time, the company has also moved to capture more professional spend through investments in services such as trade credit and tool rental.”

The Aegon Global Equity Income fund holds Home Depot, whose shares should do well once interest rates start to fall and the housing market picks up, Shanks said.

James Knoedler, a fund manager at Evenlode, also highlighted luxury goods brands Hermes, which stands out for limiting supply to keep its prestige.

Elliott mentioned L’Oreal, which maintains its competitive advantage by keeping pace with changing consumer habits, for instance by working with influencers. It is branching out into the tech space, developing ways for customers to try on virtual makeup online.

Technology

The technology sector houses many high quality companies with the potential to grow much faster than the broader economy.

Stephen Yiu, chief investment officer of the Blue Whale Growth fund, expects Microsoft to grow at least 15% a year compared to world GDP growth of 3-5%. “That’s a significant growth runway on a high quality company,” he observed.

Microsoft’s business model is based on subscriptions and its end customer base of large enterprises tend to be more resilient. They would continue to pay for Microsoft’s products even in a steep economic downturn, Yiu explained.

Knoedler also highlighted Google parent company Alphabet. It has successfully embedded Google within other companies’ ecosystems, becoming “essential to other people’s profitability”, so the cost of switching to another search engine would be prohibitively high. For instance, Google now accounts for around 20-25% of the operating profit of iPhone company Apple through traffic acquisition costs.

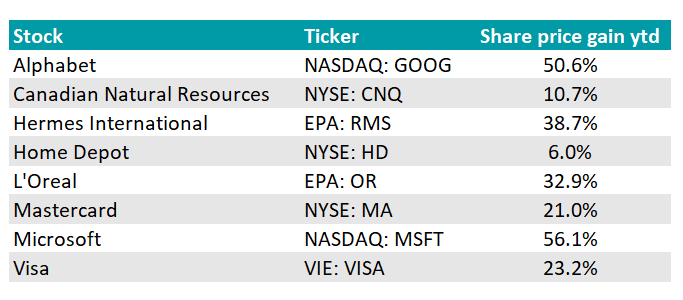

Performance of quality stocks year to date (to 12 Dec 2023)

Source: Google Finance

Financials

Mastercard and Visa are high quality companies with pricing power, strong balance sheets and sticky end customers, according to Knoedler.

He said credit card companies have been investing in developing value-added services such as fraud detection and white-labelled loyalty schemes, as well as more seamless processes to pay bills online.

“They rebate a lot of their fees and commissions back to the banks which issue them. That’s super high margin revenue to the banks,” Knoedler explained. “It’s important to remember that the consumer facing banks would really struggle profitability wise without the networks and those banks are critical to the functioning of the economy.”

Energy

Although energy companies tend to be cyclical and sensitive to the economy, Gimber said some energy companies are appearing in the high quality basket due to the strength of their earnings over the past couple of years.

Canadian Natural Resources is one of the Blue Whale Growth fund’s top 10 holdings and Yiu described it as “one of the highest quality companies in the world.”

The average energy company has a reserve life (how long a company can keep production stable using its current reserves) of about 10 years, whereas Canadian Natural Resources has a reserve life of 30-40 years.

It has higher free cash flow conversion than its competitors because it does not need to reinvest as much of its profits into maintaining and increasing its reserves, so it can afford to pay dividends and buy back shares, Yiu explained.