After long periods of underperformance in China, the UK and, until this year, Japan, some stocks are offering phenomenal value for discerning investors prepared to roll up their sleeves, do a lot of research and take some risk.

Jonas Edholm, co-manager of the SKAGEN Focus fund, said that globally there is a huge gap between the valuations of large-caps and small- to mid-caps. If that were to start correcting, “it could be the mother of all mean reversions”.

Japanese small-caps in particular are demonstrating “absurd cheapness,” he said, partly due to a lack of analyst coverage.

But investors need to avoid the classic ‘value trap’ of buying into something that is cheap for a reason and lacks a catalyst for recovery, so the trick lies in finding opportunities that are likely to experience a reversion, be that an idiosyncratic thesis or a broader sector-wide recovery.

Indeed, Edholm and his co-manager David Harris sell their holdings as a matter of course after three years if the catalyst for recovery in their investment thesis has not played out.

Building on this viewpoint, Trustnet investigates sectors and regions trading at historically attractive valuations.

Chinese equities

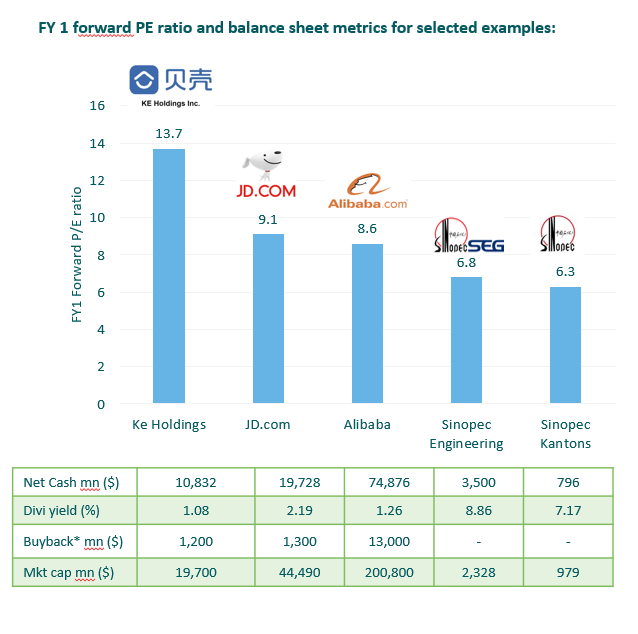

China and Hong Kong offer a wealth of opportunities for value investors, according to Dave Perrett, co-head of Asia Pacific equities at M&G Investments. Some companies are trading at valuations equal to the net cash on their balance sheets “so effectively you’re getting the business for free”.

Profitable companies with low valuations include online B2B trading platform Alibaba and Sinopec Engineering, which is part of China Petrochemical Corporation.

Attractive valuations in China

Sources: M&G Investments, Bloomberg as of November 2023

FE fundinfo Alpha Manager Nitin Bajaj, who runs the £361m Fidelity Asian Values Trust, thinks attractive valuations present a buying opportunity in China and increased his exposure earlier this year.

“Good businesses will not only survive but will likely be in a stronger competitive position post this downturn and by taking market share from their weaker peers,” Bajaj said. “This is probably the best time to be investing in China as we are able to buy good businesses when both expectations and valuations are low.”

Alison Savas, investment director at global equity manager Antipodes Partners, thinks the credit crisis in the Chinese property market will be a drag on the economy next year but that should ease by 2025 and thereafter growth of 4-5% should be sustainable for many years.

“The market is underestimating the firepower of the Chinese household,” Savas said. Household savings amount to about 40% of disposable income – “demand that can be deployed in a better economic environment” – with the potential to stimulate the economy.

Antipodes has about 10% of its global equity portfolio in China, although it has been trimming that position as it spots attractively-valued opportunities in Brazil and Mexico.

Japanese small-caps

Elsewhere in Asia, Japanese larger companies have had a good year but small-caps remain cheap. For instance, some Japanese regional banks are trading at 25-30% of their liquidation value despite the rally this year, Harris said.

Paul ffolkes Davis, who runs the Nippon Active Value fund, said: “The Japanese smaller company equity market remains the most demonstrably cheap of any developed stock market worldwide. Everything in our portfolio could double in value and still be cheap.”

Many Japanese companies are holding onto huge cash reserves, often worth over 50% of their market capitalisation, Davis said, which could be used to spend, invest and create shareholder value.

About 20% of the SKAGEN Focus fund is invested in Japan, where corporate governance reforms are putting pressure on companies to increase their price-to-book value. The fund’s largest position is Japan Post Holdings, a conglomerate trading at 40% of its book value.

SKAGEN Focus also owns Pasona Group, a staffing and recruitment company. It had a 51% stake in Benefit One, which was worth double Pasona’s own valuation. Pasona sold its stake to M3 in November, resulting in a 70% uplift to the SKAGEN Focus fund, which had a 2% position in Pasona.

Biotech

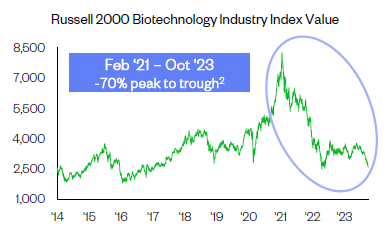

Moving from regions to sectors, one of the most out of favour areas is biotechnology. It has enjoyed a rally in the past six weeks but before that, sentiment languished in the doldrums after a two-year bear market.

The biotech bear market

Source: RTW Investments

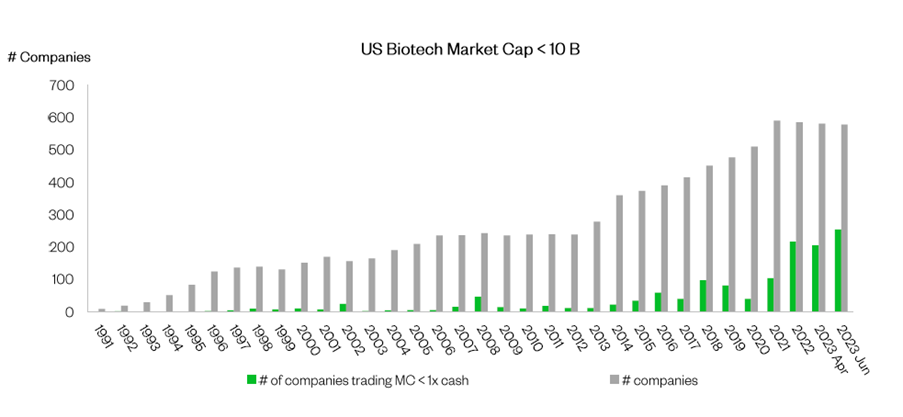

Valuations are trading at the bottom quartile historically for the majority of biotech companies, according to RTW Investments. By October 2023, 35% of sub-$10bn market cap biotech companies were trading below cash.

Biotech companies under a $10bn market cap trading below cash

Source: RTW Investments

Marek Poszepczynski, co-manager of the International Biotechnology Trust, said when even the analysts covering a sector cannot muster up the energy to be optimistic, that is a clear signal a market has reached its bottom. He went to a conference in October where “you could feel the fatigue from the analysts. No-one wants to deal; no-one wants to be there”.

Yet there are signs of recovery. Large, cash rich pharmaceutical companies are facing a patent cliff starting in 2025 so they are looking to replace lost revenue and replenish their pipelines by acquiring biotech companies. For instance, oncology specialist AbbVie recently acquired Cerevel Therapeutics, a neuroscience drug maker, and Immunogen, which pioneered the ovarian cancer treatment Elahere.

Woody Stileman, managing director at RTW Investments, said biotech is in “a golden era for innovation” now that scientists have a much better understanding of the human genome and the causes of disease.

Furthermore, if rates have indeed peaked, that will be a tailwind for growth sectors including biotech.

Poszepczynski and co-manager Ailsa Craig are confident in a rebound so are using gearing to maximise opportunities. The International Biotechnology Trust had 16% gearing by the end of October 2023 which is “quite punchy”, Craig said. “We’ve geared because we recognise the value. It speaks to how positive we are as managers.”