As Warren Buffet famously said: The first rule of investing is to never lose money, and the second to never forget the first rule. That’s why investors should always consider not only where the opportunities lie but also the traps.

On that note, below is a collection of five expert opinions on what investments might be better avoided in the new year.

Downing’s Evan-Cook: The Magnificent Seven

As we move into 2024, Simon Evan-Cook, who runs the multi-asset range of funds at Downing Fox, said he and the other managers at the firm have “largely agreed” that they shouldn’t be investing in the ‘Magnificent Seven’.

This set of seven stocks (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta and Tesla) drove the performance of the S&P 500 in 2023. Yet some think they may have reached peak valuations and are due a re-rating.

“When we look through our own portfolios’ exposure to these US mega-cap tech companies, we see a very low weighting compared to that of an equivalent market tracker. More specifically, of the thousand-plus stocks we effectively hold, not one of them is Meta or Tesla,” said the manager.

“Current market conditions bear an uncomfortable resemblance to those that existed in 1999, which preceded a very long, tough run for the market’s largest, most popular stocks. So, if we don’t need to have exposure to these companies – and given no shortage of opportunities elsewhere; we don’t – then I’m happy to avoid them as we roll into 2024.”

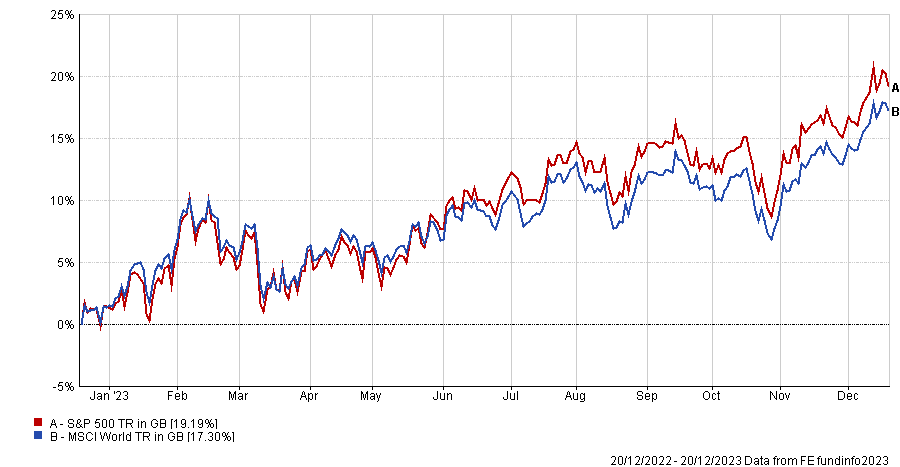

Performance of indices over 1yr

Source: FE Analytics

Rathbone’s Coombs: UK cyclicals

As investors might decide to avoid the magnificent seven or move away from other areas that are considered overpriced, the temptation might arise to move into cheaper (or relatively cheaper) asset classes. But David Coombs, manager of Rathbone multi-asset portfolios, suggested treading “with extreme caution”.

“As we move into 2024, we hear many calling for a rotation into cheaper asset classes given the outperformance by US large tech companies again in 2023. There is some sense to this, given the gap in valuations between small- and large-cap indices and the FTSE 100 will again receive attention,” he said.

“However, we would proceed with extreme caution on so-called cheap (or dare I say) value assets. There remains the significant risk of a global recession and an even greater risk of a deep recession in the UK. Against this backdrop, we are likely to avoid UK domestic cyclicals, especially those with high levels of debt or low free cash flow yields.”

Capital resilience is key at this time in the cycle. Having said that, the manager added it might be worth starting to compile a list of the strongest in those areas to purchase them when the recession noise is at its loudest.

“Buying those in the trough of a cycle is likely to result in significant excess returns. Good luck with the timing,” he concluded.

Fidelity’s Efstathopoulos: High-yield bonds

One area where Fidelity International multi-asset portfolio manager George Efstathopoulos remains more cautious on as we begin 2024 is high-yield bonds. Traditionally a useful tool to provide “a healthy level of income” in an investor's portfolio, the recent rally of equities and bonds has left them looking “too expensive for the risks involved”.

“Company defaults will rise as economic growth continues to be slowed by high interest rates, and this will negatively impact the high-yield market,” he said.

“For investors who do want the extra income that high yield bonds provide, we would recommend shorter-dated bonds, which should perform better in any periods of market stress.”

Liontrust’s Husslebee: Cryptocurrencies

Cryptocurrencies have provided significant gains for speculators this year and remain “a topical subject” according to John Husselbee, head of the Liontrust multi-asset investment team, despite not being suitable for investors.

“To us as investors, they serve no other economic purpose except for speculation and then they have several vulnerabilities, including their high volatility, lack of yield and the difficulties around valuing them,” he said.

“They also have insufficient historical data, which means that they are very difficult to model in a meaningful way. Asset classes with at least 20 years’ worth of data enable us to understand how they perform in different economic environments and correlate with other asset classes.”

Price of Bitcoin over 1yr

Source: Google Finance

If anyone needed even more reason to avoid them, the manager highlighted how they could be vulnerable to legislation or regulation.

Chelsea’s McDermott: Latin America, India

Finally, Darius McDermott, managing director of FundCalibre, said 2024 could be the right time to rebalance.

“While it is always important to keep a diversified portfolio, investors should rebalance from time to time. Often the areas that outperform one year will underperform in the subsequent period,” he said.

“We saw that with tech this year, where the Nasdaq soared 42% after a very challenging 2022. Both Latin America and India had stellar returns in 2023, so now it might be time to take profits.”