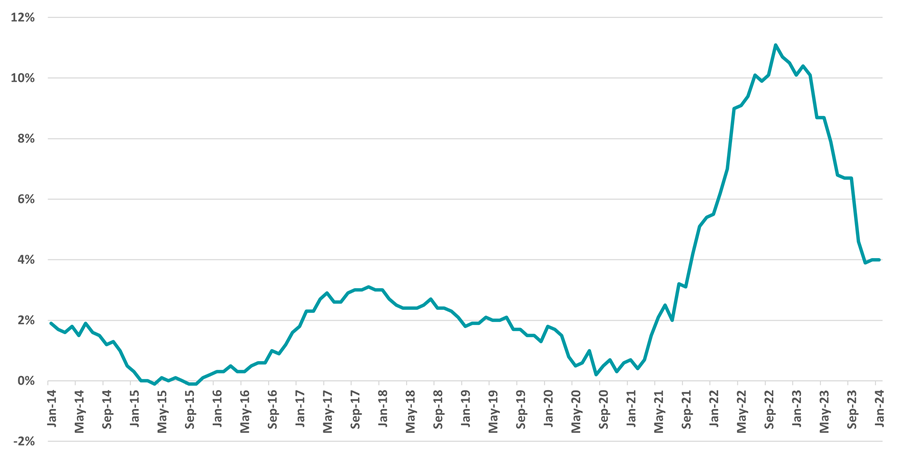

UK inflation remained at 4% in January, according to the Office for National Statistics, slightly below expectations of 4.2%.

It curtails an upward trend after the consumer prices index (CPI) rose from 3.9% to 4% in December, although the current reading remains twice the Bank of England’s 2% target.

Energy costs were the main cause as they remained higher on an annual basis due to the increase in the energy price cap. This was somewhat offset by a slowing in food price growth, an area where the cost-of-living squeeze has been felt most.

UK CPI over 10yrs

Source: Office for National Statistics

Melanie Baker, senior economist at Royal London Asset Management, also highlighted services inflation, which came in lower than expected although it remains at high levels.

George Lagarias, chief economist at Mazars, said: “Quite frankly, I see no reason to be pessimistic about UK inflation. While the headline number remained steady at 4%, it was in line with what markets were expecting, mostly because of the year-on-year effect. Instead of focusing on the annual number, investors should take a closer look at the monthly figure, which shows that prices fell by 0.6% in January, the largest drop in a year.

“For the past five months, prices have are unchanged on average. If the pace is maintained, in the next four months, we will see much better headline numbers, as we put the high inflation figures from February to May 2023 behind us.”

Bank of England policymakers will be quietly pleased with the latest inflation print, according to Fidelity investment director Andrew Oxlade, but there was also a word of warning: the UK’s inflation problem is far from over.

“The January numbers showed strong inflationary pressure feed through from Ofgem’s increase to the price cap on household bills at the turn of the year,” he said.

“Ofgem was responding to rising global geopolitical tensions which have been driving up energy prices. The disruption to supply chains from attacks on container ships may also begin to have an impact on consumer prices in the UK in the coming months.”

Inflation is expected to keep falling in the coming months, he suggested, but the pace of this decline will be important in determining how many rate cuts there will be in 2024.

Baker added most central banks want more confidence and more evidence from the data that inflation is on track to sustainably hit inflation targets before cutting rates.

“As far as it goes, today’s data may not provide as much reassurance as you’d think to the Bank of England given the breakdown of services inflation. Headline inflation looks likely to fall to around 2% over April-June, partly because of cuts in energy bills, but that doesn’t mean it will stay there,” she said.

“I’m still pencilling in rate cuts this year, but not starting until the second half of the year.”