Parents are more cautious with their children’s junior ISAs than they are with their own stocks and shares accounts, despite evidence that this is the wrong way around, according to data from interactive investor (ii).

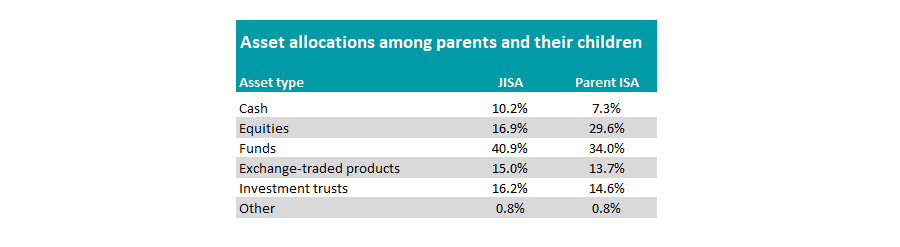

Some 10% of all junior ISA investment accounts with ii is sitting in cash, higher than the average stocks and shares ISA (7.3%), while JISAs have significantly less in direct equities (16.9% versus 29.6% in ordinary ISAs).

Instead, JISAs have more in funds (40.9% vs 34% for parent ISAs), investment trusts (16.2% versus 14.6%) and exchange-traded products (ETPs) (15% versus 13.7%).

Source: interactive investor

Myron Jobson, senior personal finance analyst at ii, said: “Parents may be more cautious when managing their child's investments because they feel a greater sense of responsibility and duty to protect their child's financial future. But investment risk is relative – what may be considered risky for a child may not be perceived as risky for a parent."

Typically parents make fewer trades with their child’s savings – just two per year – and prefer to invest monthly rather than with a lump sum.

Parents are usually recommended to be bolder with a junior ISA early, as there is a long period of time for the money to make returns, meaning stocks and equity-heavy funds are preferred.

“The higher weighting to cash among JISAs therefore might raise some eyebrows, but this could be for good reason. If the child is nearing the age of 18 when they can access the funds, parents might opt to hold cash to ensure the money is readily available for immediate needs like university costs,” Jobson said.

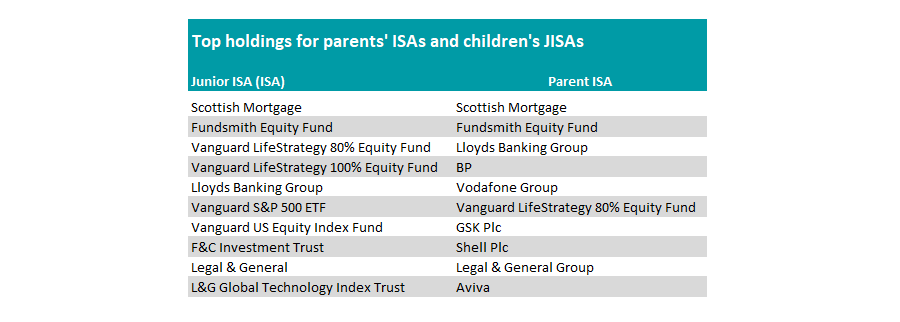

There are some strong similarities to the types of funds invested in both children’s and parents’ ISAs, however, with Scottish Mortgage investment trust the most popular choice.

It is one of five investments to appear in the list of the top 10 most-owned assets for each investor, as the below table shows.

Source: interactive investor

Fundsmith Equity is in second for both parents and children, while Vanguard LifeStrategy 80% Equity fund and the shares of Lloyds Banking Group and Legal & General also have a place on both lists.

“One key difference is the popularity of funds and trusts. They dominate the list of most-held investments among JISA customers, accounting for eight of the top 10 – five of which are passively managed (versus only one for parents' ISAs),” Jobson said.

“When investing for themselves, parents seem to favour UK dividend paying blue-chip stocks, which account for seven of the top 10 most held investments.”

This suggests they prefer investments with the potential to supplement their income, he concluded, which could be used to help fund near-term expenses such as school fees or family holidays.