There are precious few ways to become a millionaire in 25 years, but savvy investors could have managed it by stashing their cash in a host of funds, investment trusts and direct UK equities within a tax-efficient ISA, according to research by AJ Bell.

The ISA was launched in April 1999 with a £7,000 maximum allowance – a level at which it remained until 2008. It gradually increased over the years to £20,000 in 2017, where it has stayed since. But simply maximising your allowance and investing in trackers has not been enough.

Using a full ISA allowance each year would have delivered £835,566 if invested in a global tracker fund, or £585,432 if invested in a UK tracker fund, the research found.

But some investments have taken investors over the coveted million pound mark.

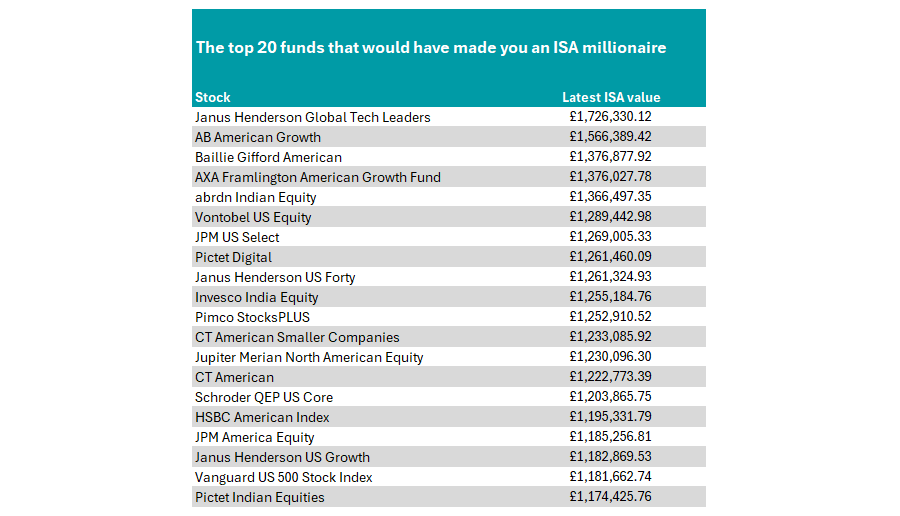

Starting with funds, 50 of them have achieved the feat of making their investors into ISA millionaires, the top 20 of which are listed in the table below.

It is dominated by two major themes – the US and India. The former has been a strong place to invest for the past 15 years, with the market rising on the back of the phenomenal technology giants, which have benefited from low interest rates, weak economic growth and digital advancements including artificial intelligence.

Source: AJ Bell

Laith Khalaf, head of investment analysis at AJ Bell, said: “Clearly the US stock market has been the place to be invested and has delivered exceptional returns to those who have consistently backed it, not least because of the growth of the technology sector, albeit at the second time of asking for long-term ISA investors who bear the scars of the dotcom crash.”

Janus Henderson Global Technology Leaders was the best performer among Investment Association (IA) funds, with a total pot worth £1,726,330.12 today. Global funds have also performed well on the back of the US tech giants rallying, as America accounts for more than two-thirds of global indices. This fund invests specifically in tech, giving it an even more narrow exposure to the sector.

The next three – AB American Growth, Baillie Gifford American and AXA Framlington American Growth fund – are all US-specific portfolios.

In fifth place was abrdn Indian Equity. There were three India portfolios among the top 10, which Khalaf noted was “thanks to exceptional returns from this market”.

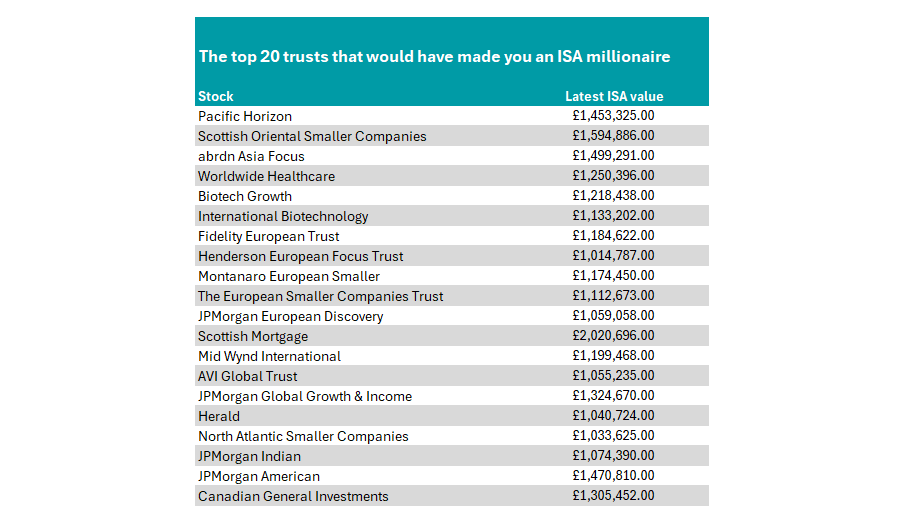

Looking at investment trusts, investors had a wider mix of asset classes available to make the best returns. Here the dominating factor was smaller companies; of the 35 trusts to turn investors into millionaires, 14 had a small-cap mandate.

Khalaf said: “Perhaps more surprising is six of these focus specifically on smaller companies in the UK stock market. The long-term growth trajectory exhibited by the UK smaller companies segment has been remarkable, despite the present negative sentiment which afflicts domestic stocks.

“Smaller companies are also less widely scrutinised than the blue-chips, and consequently skilful active managers can find it easier to unearth hidden gems.”

Source: AJ Bell

Yet there were a whole host of portfolios that made strong returns. Top of the pile was Baillie Gifford’s Pacific Horizon, followed by Scottish Oriental Smaller Companies and abrdn Asia Focus, showing the outsized returns these portfolios have made investing in Asia.

Biotechnology and healthcare were also well represented, with Worldwide Healthcare, Biotech Growth and International Biotechnology the next-best three performers.

There were a gaggle of European trusts on the list – an area of the market that has failed to inspire investors over much of the past 20 years, with Fidelity European Trust tops among them.

Investors were also rewarded for backing the big names such as Scottish Mortgage and Mid Wynd International, which also achieved the feat.

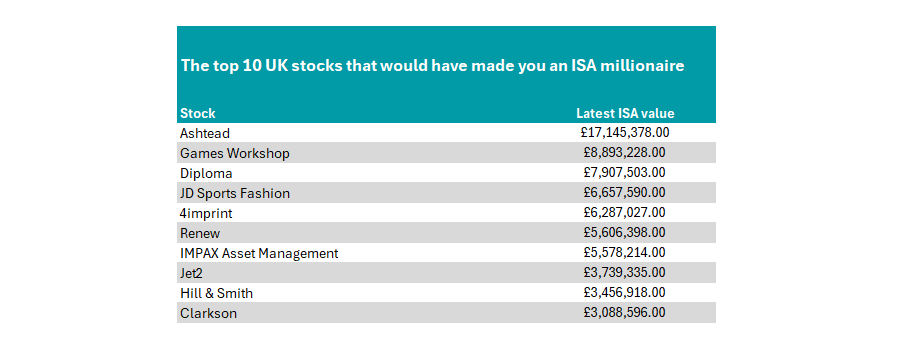

Lastly, turning to the UK stock market, Dan Coatsworth, investment analyst at AJ Bell, said: “FTSE 100 member Ashtead is the standout stock for investors who followed the ‘maximum ISA’ strategy every year since 1999. By Valentine’s Day 2024, the investment would have been worth £17.1m.”

The firm hires out construction equipment, something that has increased in popularity over the years as companies have preferred to rent, rather than buy, their machinery.

“What’s interesting about Ashtead and many other winning names on our list is that gains weren’t achieved every single year. There were plenty of calendar years where investors would have seen a decline in the value of their investment,” he said.

“This highlights the importance of being patient with investing and sticking with a company through good and bad times if you believe it has the right business model and characteristics to prosper over the long term.”

Source: AJ Bell

Others on the list include Games Workshop, which has benefited from a strong brand in a niche market and Diploma – a “boring” company that supplies wires, cabling and other essential items businesses need.

Retailer JD Sports has become a “major force” on the high street, showing that it is possible to thrive in the online world, while Jet2 has achieved the feat despite the travel industry’s rocky Covid years.