The market has become dominated by interest rates and the expectations of future cuts but it is time we as investors learned our lesson – we have no idea what’s going to happen.

Some will undoubtedly have moved their portfolio around based on expectations that inflation is coming down and that central banks around the world will start to withdraw the exorbitantly high rates that have stymied growth and caused a cost-of-living crisis.

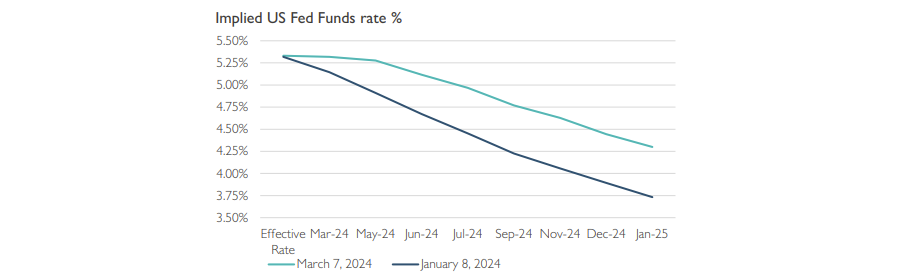

Yet forecasting when these things will happen is foolish. Below are two charts that highlight just how ridiculous this is.

The first shows the implied rate of interest rate cuts from the US Federal Reserve at the start of the year, compared with last week.

In the span of just two months, expectations that rates would end the year at 3.75% (down from the 5%-5.25% range today) look farfetched. Now, ‘experts’ expect them to be around 4.25% by the start 2025.

Source: Waverton Investment Management

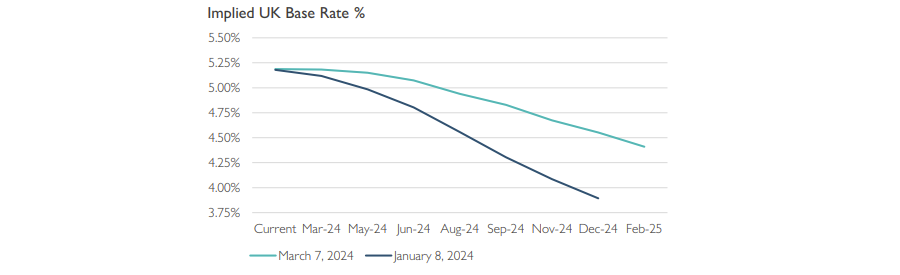

The same phenomenon has taken place in the UK. At the start of the year – with inflation plummeting – there were hopes of a 4% Bank rate by the end of 2024. Today that stands around half a percentage point higher, at 4.5%.

At the start of the year, five cuts were expected in 2024 – a figure which has dropped to three today. The first is anticipated to take place in August.

Source: Waverton Investment Management

Yet William Dinning, chief investment officer at Waverton, said: “Given that the UK economy is, at best, sluggish after being in a technical recession in the second half of 2023, it is possible that the current market projection for policy rates may end up being too pessimistic in the UK.”

This doesn’t seem like it should matter all that much. What’s a rate cut here or there? But it really does. Earlier this week, Jupiter fund managers Adrian Gosden and Chris Morrison explained the mind-boggling impact these prints have on the market.

At the end of last year, the FTSE 250 UK mid-cap index rose 5% in two days on the back of two better-than-expected inflation prints (3% on the November US consumer prices index (CPI) print and 2% on the UK December reading).

Fast forward to January and with UK CPI coming in a whopping 0.1 percentage points above expectations, the market dropped 2%.

So despite preaching fundamentals, focusing on the long term and buying good companies – this year looks like another that will be driven entirely by factors outside investors’ control – namely by central banks, who can’t afford a misstep.

It can be hard to look through all this – particularly as interest rates and inflation have dominated the financial pages for the past 18 months and look set to do so again in 2024.

But remember, investing is supposed to be about sound decision-making and getting rich slowly, so why gamble on the next interest rate decision? This seems counterintuitive at best.

If the experts can change their minds so dramatically in the space of two months, then what chance do the rest of us have of getting it right? It’s clear no one really knows what is going to happen.

Investors should continue to do what they have always done – pick good funds, stocks or investment trusts, put their head down, and ride it out. Yes there will be lumps, and yes the macroeconomic environment will make some picks look silly on certain days or even months, but as long as the rationale for owning an asset is right, it will correct itself eventually.