People adopting a healthy lifestyle by drinking and smoking less is arguably a good thing but it put a dent in the Liontrust UK Growth fund last year. Shares in British American Tobacco and Diageo fell 23% and 20%, respectively, in 2023 and cost the fund 1% of performance each.

Anthony Cross, head of the Economic Advantage team at Liontrust Asset Management, is keeping faith with Diageo. He looks for companies with intangible assets such as large-scale distribution networks that are hard to replicate and favours international consumer goods companies such as Diageo and Unilever. The big unknown for Diageo is how widespread the take-up of American diabetes and weight loss drugs will be, given that people who take these drugs consume less alcohol.

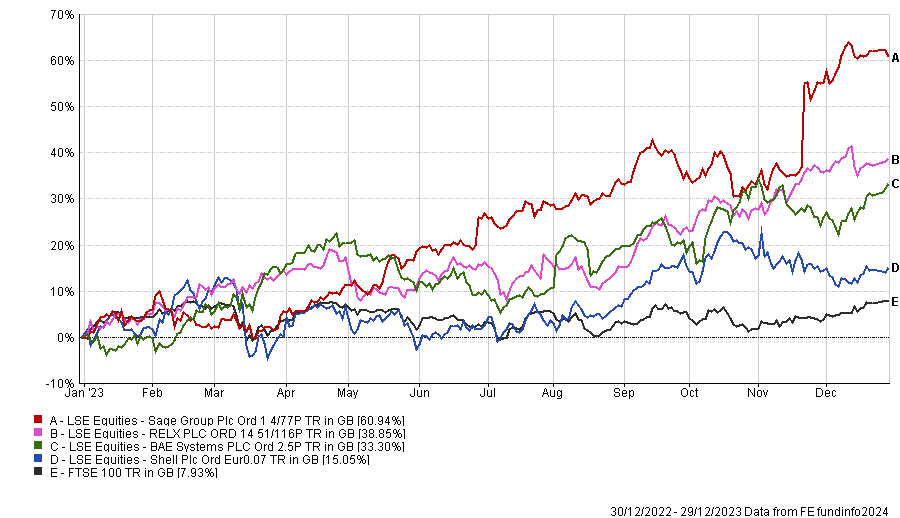

The fund’s strongest recent performers are companies that specialise in data and software tools. Sage, which provides accounting software and cloud-based services, was on a tear last year climbing 61%, while RELX, which supplies analytics and decision tools for the medical, legal and government sectors, rose 39%.

Cross manages the £1bn Liontrust UK Growth fund with Julian Fosh, Matt Tonge and Victoria Stevens. The large-cap iteration of the Economic Advantage investment process, it has achieved top-decile performance for the past decade, earning Cross and Fosh a nomination for FE fundinfo’s Alpha Manager of the Year award.

Cross told Trustnet why he doesn’t think he can add value by making macro calls and why intangible assets drive long-term returns.

What is the UK Growth fund’s investment process?

The process starts with the hunt for businesses that have strong barriers to competition through intangible assets. Three intangible assets are the gateway into any of our funds: intellectual property, distribution and high recurring revenues (more than 70% of a company’s income should be recurring).

Stocks must have at least one of these factors but several of our holdings have two or three. Sage is rich in intellectual property and data-driven distribution and more than 90% of its turnover is recurring income.

Once stocks are through the gateway, we look at other intangible assets such as brands, customer relationships, franchises, licences and culture, which are difficult for competitors to copy and give companies pricing power.

Our companies have an average 12% cash flow return on invested capital versus 7% for the broader market. It’s a really nice test for us as to whether those barriers to competition are actually working.

Finally, when we buy these businesses for the first time, they need to be cheaper than the market on a number of standard measures, such as free cash flow yield, dividend earnings and price-to-earnings ratios, to make sure we’re skewing the odds in our favour.

Why should investors buy the UK Growth fund?

This is the fund to own if you want large-cap exposure. The UK Growth fund has 70% in the FTSE 100, 20% in FTSE 250 stocks, 7% in small-caps and 3% in cash.

There are 44 positions in the portfolio. Most companies go in at 2% plus their index weight so some of our holdings can be quite big. We own 8% in Shell and AstraZeneca, 5-6% in BP and 4% in Diageo.

What you’re going to get with this fund is a quality footprint and compounding. It also has a nice international flavour if you’re a bit bearish about the UK, given that 82% of our companies’ sales come from overseas versus 76% for the FTSE All Share.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Which stocks were your best and worst performers last year?

Shell, Sage, BAE Systems and RELX each added 1% of performance to the fund last year. With RELX and Sage, not only were they delivering on earnings but you’ve got that general data excitement going on, so they enjoyed an increase in their price to earnings ratios.

Performance of shares vs FTSE 100 in 2023

Source: FE Analytics

We bought Sage five years ago on a free cash flow yield that was larger than the market. Everyone had given up on Sage at that point; people thought its customers would move to competitors.

Sage has a strong base of clients using its accounting software who are unlikely to change providers. We thought the stickiness of its distribution network would enable the company to migrate to more cloud-based products, which is what happened. Sage is delivering high-single-digit to double-digit organic growth. If growth slows down it could underperform so we have taken profits and trimmed our exposure.

In terms of detractors, British American Tobacco and Diageo each cost us 1% in 2023. The jury is still out with Diageo. It performed well during the successive lockdowns but since then people are drinking less and there has been a cost-of-living crisis.

Diageo also had a stocking problem in Latin America, where the wholesale market was overstocked and demand was not pulling through. This led to a profit warning with a brand new set of management.

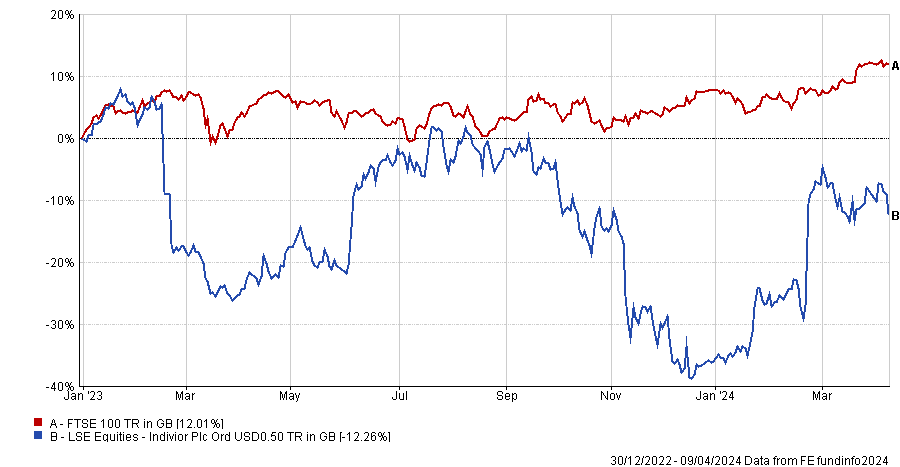

Invidior cost us 0.8% last year but it has performed strongly this year, adding 0.5% to the fund already. Invidior had some dangling liabilities and litigation issues which were biting last year and it faced pressure from competitors, but this year the business has performed well and it has dealt with the litigation.

Invidior vs FTSE 100 since 1 Jan 2023

Source: FE Analytics

What are your highest conviction investments?

We have most conviction in some of the small-cap stocks from a valuation perspective. Gamma Communications provides phones and conference call systems to small and medium-sized businesses. It has gained some larger enterprise and government clients and is expanding into Europe, which is quite underdeveloped when it comes to cloud-based telephone systems.

Market research provider YouGov has faced a tough backdrop with declining media spend but it has a strong brand and terrific data sets and could grow a lot more in America.

Future, a mid-cap digital publishing business, is trading on a price-to-earnings ratio of 5x and has a double-digit free cash flow yield. Its magazines, from Country Life to TechRadar, earned revenues from affiliate marketing during lockdown, but since the pandemic, purchasing habits have changed and revenues have dropped.

How much attention do you pay to the broader macroeconomic backdrop?

We don’t attempt to predict where inflation, interest rates or foreign exchange are travelling because we don’t think we could add any value doing that.

Our companies themselves are always thinking about interest rates, currency movements and political upheavals in the countries they are supplying. One has to rely on businesses themselves doing their homework in terms of where they want to be exposed and what the dangers are.

What do you do outside of fund management?

I live near Perth in Scotland and I have a cottage further north. I’m a big believer in having a hinterland to put things back into perspective so I go fishing, which is a head-clearer and I enjoy skiing.