It has been a slow start to the year for UK stocks, which have lagged all other major indices, but the FTSE 100 broke through 8,000 last week, suggesting the tide could be turning, according to analysts at Peel Hunt.

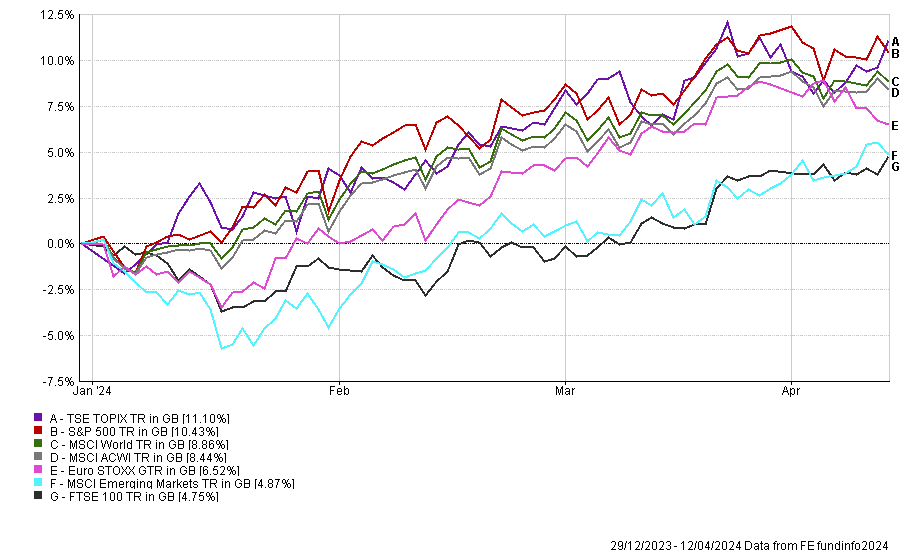

Although the main UK index is last among other major markets over the year to date, as highlighted by the chart below, there are reasons for optimism.

“We see some exciting opportunities to gain access to the UK equity recovery in some well-established trusts with excellent long-term track records trading on attractive valuations,” they said.

Performance of indices over YTD

Source: FE Analytics

One option is Law Debenture, which has been in the top or second quartile of the IT UK Equity Income sector in each of the past five calendar years. Last year it made 8.1%, placing it in the top five of the 19-strong sector.

Although the discount “remains relatively narrow at 2%” the proposed dividend for this year has risen to 4.9% and a 10-year dividend compound annual growth rate of 7.9% make it “an attractive proposition”, the analysts said.

Law Debenture combines an investment trust with an independent professional services (IPS) business that provides structured finance services, pensions trustee advice, corporate secretarial services and other business critical activities.

“Over the past decade, the independent professional services business, which represents 20% of net asset value (NAV), has funded more than 30% of Law Debenture’s dividends,” they added.

The trust, which is a corporate client of Peel Hunt, has the highest five-year dividend growth in the UK equity income sector, supported by its “unique structure”.

“The consistent growth and cash generation of IPS facilitates an unconstrained investment approach, accessing the full opportunity set in an undervalued UK equity market,” they said.

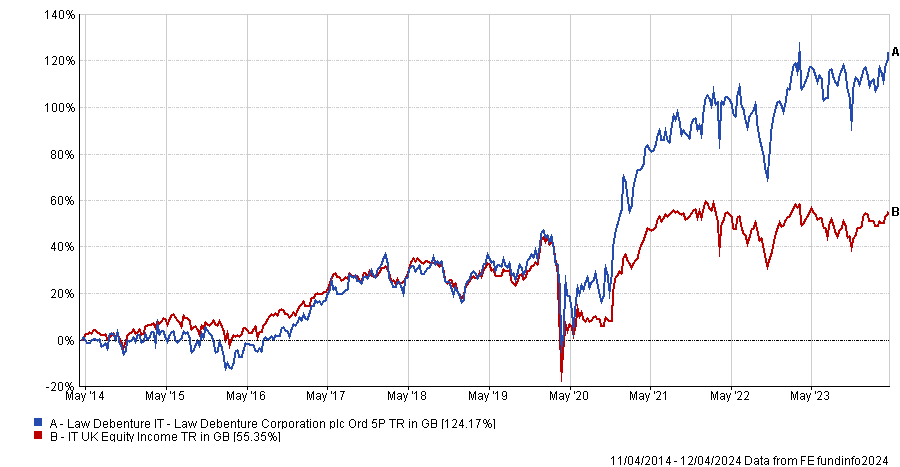

Performance of fund vs sector over 10yrs

Source: FE Analytics

At £1.1bn, it is one of the largest trusts in the sector and the equity portion of the portfolio is managed by FE fundinfo Alpha Manager James Henderson and Laura Foll.

They have a “contrarian, value-focused investment style” and have propelled the trust to the top of the sector over five and 10 years – making 124.2% over the decade.

“For the past 10 years the IPS business has contributed 34% of Law Debenbture’s revenues and, given the recurring nature of this income stream, this provides the scope for the equity portfolio to be invested unconstrained by yield criteria,” the analysts sad. “This is a significant competitive advantage for a trust operating in the UK Equity Income sector.”

For investors looking to take on more risk, UK mid- and small-caps have been hit harder than the FTSE 100 and are even more out of favour than their large-cap peers. If sentiment is changing, there could be a more rapid rebound in this area of the market.

One such name that could benefit from the UK becoming more popular is Aberforth Smaller Companies, a value strategy.

“The trust has a strong track record, including through years of growth outperformance. Since inception in 1990, it has delivered an annualised NAV total return of 11.4%, 1.8 percentage points higher than the Numis Smaller companies (ex-Investment Companies) index per annum,” the analysts said.

It focuses on the smallest companies in the UK markets where the discount to global markets is particularly stark, with the underlying price-to-earnings (P/E) ratio of the trust’s holdings at just 6.9x, which is a “near record low”.

“Historical evidence suggests that it should support a future five-year annualised return of more than 20%,” the analysts forecast.

Despite their low valuations, just 20% of the stocks in the portfolio have net debt to earnings before interest, tax, depreciation and amortisation of more than 2x – suggesting the majority have strong balance sheets.

“The value in UK small caps is beginning to be recognised and M&A has been a key source of recent returns for Aberforth Smaller Companies,” the analysts noted.

Current valuations give investors a good entry point, they argued, with the current discount of 13% slightly above its 12-month average of 12%.

“As international and domestic buyers alike begin to realise the returns on offer at the small-cap end of the UK equity market, there could be scope for discount narrowing,” they concluded.