Tech stocks have done particularly well recently but there another industries that have grown exponentially and the market underestimates them.

Within the £2.2bn BNY Mellon Multi-Asset Growth portfolio, US home builders have been among the top performers of the past 12 months, with relative contributions higher than Microsoft’s.

The fund has achieved top-quartile performance over 10, five and three years and is co-managed by FE fundinfo Alpha Manager Bhavin Shah, Simon Nichols and Paul Flood – the same team behind the highly successful and popular £3.4bn Balanced fund.

Below, Flood discusses the underestimated tailwinds for US home builders, the sectors he sees as opportunities and those he avoids, and why he favours UK gilts over US treasuries.

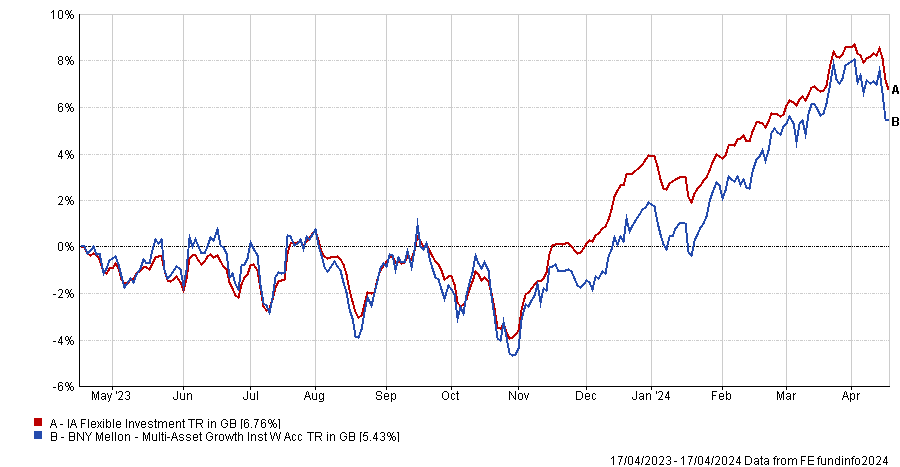

Performance of fund against sector and index over 1yr

Source: FE Analytics

Can you sum up your investment process?

We're investing in companies that have long-term structural thematic support, proven business models and attractive valuations with bias towards growth companies or companies in sectors where we think there's a cyclical opportunity.

It’s a very flexible product as we can invest everywhere and we aim to get the broadest views around the house. We’re willing to take more aggressive stances and to be zero weights in some industries, as we’ve been in the past for bonds, for example.

When did you increase your fixed income allocation?

We've had very little in bonds for a long time, until the past 12 to 18 months, when they have started to become more attractive and got a yield and a return on them. The allocation still remains fairly low, however, at 10%.

Because the growth element of the fund is going to be driven by our equity allocation, we want bonds that work when there's more volatility and down-trending growth in the global economy, which is why the vast majority is in government bonds.

We've got some Australian, New Zealand and US Treasuries as well as UK gilts. We're favouring gilts over US Treasuries, given the risks that we see in the long end of the curve in the US, due to the fiscal expenditure and the continued deficit, which we think is a bit of a risk.

What equity sectors are you more bullish on?

We’re always looking at technology because it has the most growth, and industrials as it benefits from fiscal spending. Within that, we favour industries that are exposed to the long-term dramatic changes that we're seeing across global economies as we look to reduce the impact of global warming – so electrification, renewables, decarbonisation.

And it’s not just wind and solar – we think HVAC [heating, ventilation, and air conditioning] technologies are very interesting, as heating and ventilating our buildings represents 25% of global carbon emissions.

Here, we invest in Trane Technologies, which provides equipment that is 20-40% more efficient than legacy systems, so clients can massively reduce their carbon intensity.

What areas do you not invest in?

We’ve had zero in real estate for a long time, where we have fairly negative views from a thematic standpoint.

More and more trade is done online, which is a headwind to the high street – both on the industrials side of real estate but also offices. Even pre-pandemic, the internet was allowing us to be more flexible and we saw that as a headwind.

What have been the worst calls of the past year?

The area that has struggled the most recently was the electric vehicles supply chain. Battery manufacturer Samsung SDI was the biggest detractor to relative performance at -1%, alongside chemical manufacturer Albemarle.

With those stocks and our position in physical nickel, the EV supply chain cost the fund 2.6% in relative performance versus the IA Flexible sector.

Asian life and health insurers AIA and Prudential also cost the fund 1.5% in relative performance, but we continue to believe they are well placed over the longer term, given the ageing populations.

What has done well instead?

Our top holding is Microsoft, which did extremely well and added 0.55% of relative performance, but it wasn’t our top performer, which was US home builder Toll Brothers. It added 1.1% of relative performance.

So not a growth stock?

Surprisingly, yes. The market massively underestimated the changing business model of house builders in the US. Because they overbuilt in the financial crisis, there's been a huge under-build since then.

Generally speaking, it's not the same industry that caused the last crisis to cause the next, and US housing companies have moved away from having all the land development on their balance sheets. Instead of buying it, they take options on it, which is less balance-sheet intensive.

Interest rates are a massive headwind for moving into existing housing, as people want to avoid re-mortgaging at higher rates, so we’re seeing many more renovations instead. Houses are being built for the post-pandemic workforce that is moving out of California towards Texas, out of cities and into the suburbs.

Another tailwind comes from the fact that the US is the second little piggy, it builds its house out of wood, and so there is a replacement cycle unlike in Europe, where we build our houses out of brick.

What do you do outside of fund management?

Running and cycling help with the stress of the job and give you time to think away from screens.