No-one can outperform all the time. Even the most experienced fund managers go through periods when their investment style is out of favour. They have to dig deep and stick to their knitting throughout challenging years and appeal to their investors to keep the faith, before hopefully reaping rewards when their portfolios swing back into favour and the benefits of their experience can be brought to bear.

This is something FE fundinfo Alpha Manager Nick Train and his WS Lindsell Train UK Equity fund are enduring at the moment.

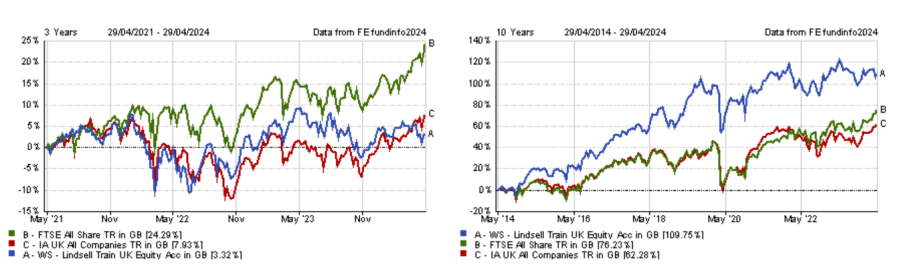

The UK equity fund has rewarded investors with returns far in excess of the FTSE All Share since he launched it in 2006.

However, the £3.8bn fund has been going through a rough patch in recent years. Indeed, Train’s UK equity portfolio has lagged its benchmark in each of the past three calendar years.

Adding salt to the wound, the fund has not participated so far in the recent strong resurgence of the UK equity market and is down 1.5% year-to-date.

As a result, investors may be losing patience and ponder whether WS Lindsell Train UK Equity still deserves a place in their portfolio. Therefore, Trustnet asked experts why the fund has underperformed and what investors should do next.

Performance of fund over 3yrs and 10yrs vs sector and benchmark

Source: FE Analytics

Why has the fund struggled in recent years?

A peculiarity of WS Lindsell Train UK Equity is that it bears little resemblance to the FTSE All Share.

While the UK index is known for its exposure to value stocks in the energy, mining and financials sectors, Train’s process has more of a quality-growth bias, with an emphasis on companies boasting high return on equity and low capital intensity.

Jason Hollands, managing director at Bestinvest, said: “A key contributor to the period of underperformance is that the fund’s process leads it to owning strong brand franchises, with high weightings to consumer goods, as well as healthcare and business software.

“The fund does not hold companies that are highly sensitive to macro factors, and which have limited control over their pricing, and this means it has had zero exposure to the energy sector, which rallied significantly as economies reopened from the pandemic and on the back of the war in Ukraine.”

Another specificity of the fund is its high concentration, with the top 10 holdings accounting for 81.6% of the portfolio.

Therefore, the fund is highly dependent on the fate of a few key holdings. In the past, this enabled Train to comfortably beat the benchmark, but it has turned into a headwind in recent years.

Rob Morgan, chief investment analyst at Charles Stanley, said: “Having thrived in the low interest rate post-financial crisis era, when the market rewarded his ability to identify resilient growing businesses with long-term cash flows, Train’s style has been less well-suited to the more recent environment of higher inflation and interest rates.

“Good quality companies with steady but unexciting growth have suffered in the same way as bonds as interest rates have risen. In addition, some individual stock picks have detracted, and as the fund is very concentrated this has had a more significant effect than it would have done with a more diverse portfolio.”

Buy, hold or fold?

For Darius McDermott, managing director of FundCalibre, the question investors should ask themselves before taking any course of action is whether they believe UK value stocks will continue to outperform or not.

“If you do, this fund is not for you,” he said.

“But if you believe in the long-term quality compounding way of investing, this fund has an excellent long-term track record and would be a buy.”

Gavin Haynes, co-founder of Fairview Investing, suggested current investors should hold, citing the fund’s focus on data/analytics, software and luxury/premium consumer brands as reasons to keep faith in the fund’s prospects.

He also praised the high level of conviction, which is something he “wants to see” in active management.

Although WS Lindsell Train UK Equity recently landed in Bestinvest’s Spot the Dog report, Hollands also believes investors should stick with the fund, as its process and philosophy have delivered for investors over the long-term and “there is no reason to believe that it won’t prove successful in the future”.

He added: “I think the underperformance of recent years is largely down to the manager’s style being out of step with recent market leadership, not errors of judgement. Investors should keep faith in the fund.”

Morgan went one stage further and suggested increasing exposure to the fund ahead of prospective better times for Train’s style.

He said: “An environment of subsiding inflation and lower interest rates should suit it, but ultimately the manager’s stock picking will be highly influential on performance given the concentrated nature of the portfolio.”

However, Morgan stressed his preference for Finsbury Growth & Income – the investment trust version of WS Lindsell Train UK Equity – as it is trading on an 8% discount, which is outside of the board’s target of 5%. Therefore, share buybacks aiming at closing the gap may offer investors a small performance edge.

“More importantly, the investment trust structure is the optimal way of investing in a Nick Train portfolio owing to his concentrated and low turnover approach. With a fixed pool of capital, the trust isn’t under as much negative flow pressures that have hit UK open-ended funds necessitating managers to offload stocks,” Morgan concluded.