Kate Morrissey, head of HSBC Asset Management’s $13bn World Selection fund range, is leaving to pursue an opportunity elsewhere. Nicholas McLoughlin, head of managed solutions funds, is replacing her.

Morrissey has spearheaded the World Selection funds – a series of multi-asset portfolios catering to different risk levels and providing diversification across asset classes, currencies and regions – since 2019.

She has spent more than 20 years at HSBC, initially in discretionary wealth management before moving over to the asset management division in 2011 as a senior fund manager in the global bond team.

During her career, she has launched new funds, expanded the client base, improved the funds’ performance and ratings, and enhanced the integration of environmental, social and governance factors into HSBC AM’s multi-asset solutions.

McLoughlin was appointed head of managed solutions funds in December and will now become the lead portfolio manager of HSBC AM’s flagship risk-profiled, multi-asset solutions. He was previously global head of multi-asset research and senior portfolio manager, and he will continue to be responsible for multi-asset research.

McLoughlin initially joined HSBC Asset Management as an asset allocation strategist in 2011 before moving to Norges Bank Investment Management in 2015 and then returning to HSBC two and a half years later.

HSBC AM said its team-based approach and its investment process for the World Selection funds will remain unchanged.

The World Selection range has proved popular with investors and its medium risk iteration, HSBC World Selection Balanced Portfolio, has gathered £4.8bn in assets under management.

The portfolio held 55% in global equities as of 31 March 2024 with the remainder in a variety of bond strategies, as well as small allocations to commodities, listed infrastructure and property. The portfolio uses a range of HSBC AM funds and iShares exchange-traded funds as building blocks.

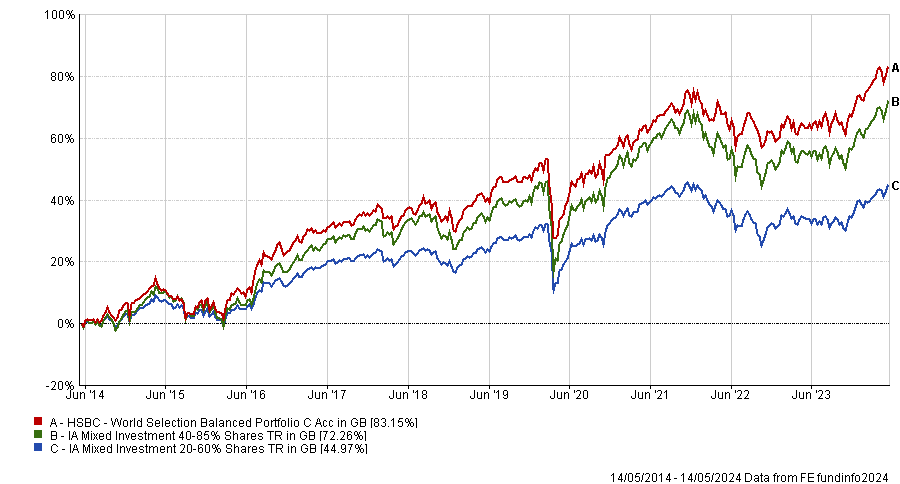

This medium risk fund is not managed with reference to a sector or benchmark but it has consistently outperformed the IA Mixed Investment 20-60% Shares and 40-85% Shares sectors over one, three, five and 10 years.

Performed of fund vs IA Mixed Investment sectors over 10yrs

Source: FE Analytics