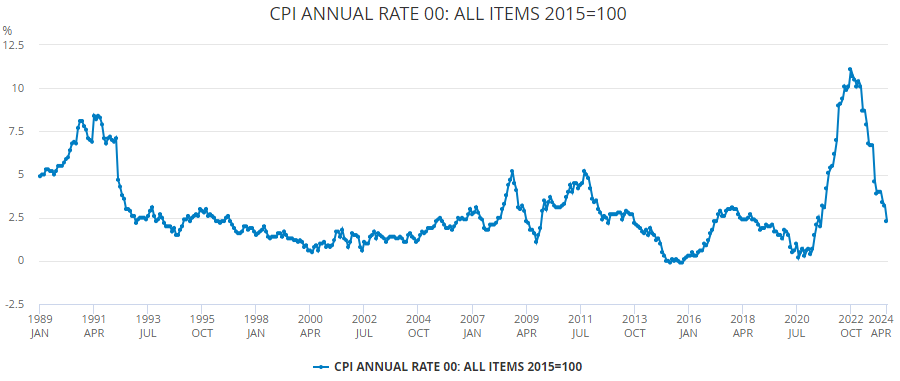

UK inflation dropped back to 2.3% in April, hovering just above the Bank of England’s 2% target, according to figures from the Office for National Statistics.

The main reason for the rapid drop in the consumer prices index (CPI) from the previous month’s 3.2% was falling energy costs on the back of Ofgem’s 12% reduction in the household bills cap, with the 27.1% fall in gas, electricity and other fuel prices being the largest on record.

It marks a sharp decline from the 11% inflation figures seen just two years ago, although the 2.3% figure is slightly above expectations, with 2.1% mooted by many, according to Isabel Albarran, investment officer at Close Brothers Asset Management. This was largely due to an upswing in motor fuel prices.

Source: The Office for National Statistics

Hetal Mehta, head of economic research at St. James’s Place, added that the monthly pace shows “significant inflation remains in the system”.

“Services inflation [unchanged at 6%] is still too rapid for comfort and higher energy prices in recent months are yet to fully feed in,” he said, while Zara Nokes, global market analyst at JP Morgan Asset Management, noted that this was “a lot hotter than its latest projections”.

Despite this it is still the closest we have been to the Bank of England’s 2% target since July 2021.

What will the Bank of England do now?

Nokes said the upside surprise in services inflation may “dent the Bank’s confidence that entrenched inflationary pressures are receding” making a June cut less likely.

“In our view a cut in June would be premature; if the economy were slowing we would expect core inflation to follow headline lower, but recent data has shown activity reaccelerating,” she said.

Quilter Investors investment strategist Lindsay James noted the biggest risk for the Bank will be further inflationary spikes in the second half of the year – something that could occur if wag growth (currently 6%) remains high.

“Pay deals and rises are going to come under intense scrutiny should that figure not begin to fall in line with the overall rate of inflation. Furthermore, the global picture shows no sign of helping the Bank of England in its task, with geopolitical risks still very much present and US inflation proving stickier than many would like,” she said.

Albarran suggested the Bank will wait until August for its first rate cut, with the latest CPI data going “some way in providing the evidence they need to justify an impending cut”.

Not all were as convinced. Mehta said: “For the Bank of England, the data is not conducive to a slam-dunk rate cut in the coming months – we expect there to be a continued split on the Monetary Policy Committee for a while.”

The impact on finances

Tom Stevenson, investment director for personal investing at Fidelity International, said mortgages are already pricing in lower interest rates with money markets giving a 40% chance of the first quarter-point cut in rates coming in June and a further reduction to 4.75% by the end of the year.

“For savers who have enjoyed ‘real’ inflation-adjusted returns on their cash for several months the good times may be time limited,” he said.

“Stock markets typically offer the best protection from low levels of inflation. At today’s rate, they have outpaced price growth in nine years out of 10 since the 1970s.”