The disparity between the valuations of the cheapest and most expensive stocks is historically wide globally but especially so in the US.

Wide spreads are indicative of uncertainty, according to Sam Witherow, a portfolio manager in JPMorgan Asset Management's international equity group. The gap between cheap and expensive stocks has been wide since the pandemic but the pockets of cheapness have shifted, reflecting an evolution in the sources of uncertainty.

“The baton of controversy has been passed from one group of stocks to another,” Witherow said. “Rolling controversy has played through markets.”

At the start of the Covid-19 pandemic, valuations of the “work from home losers” such as restaurants and airlines, were “in the doldrums”, he explained. Then the baton passed to stocks that were “crimped by huge rises in energy prices”. Next, as interest rates rose, companies hit by the higher cost of borrowing were discounted.

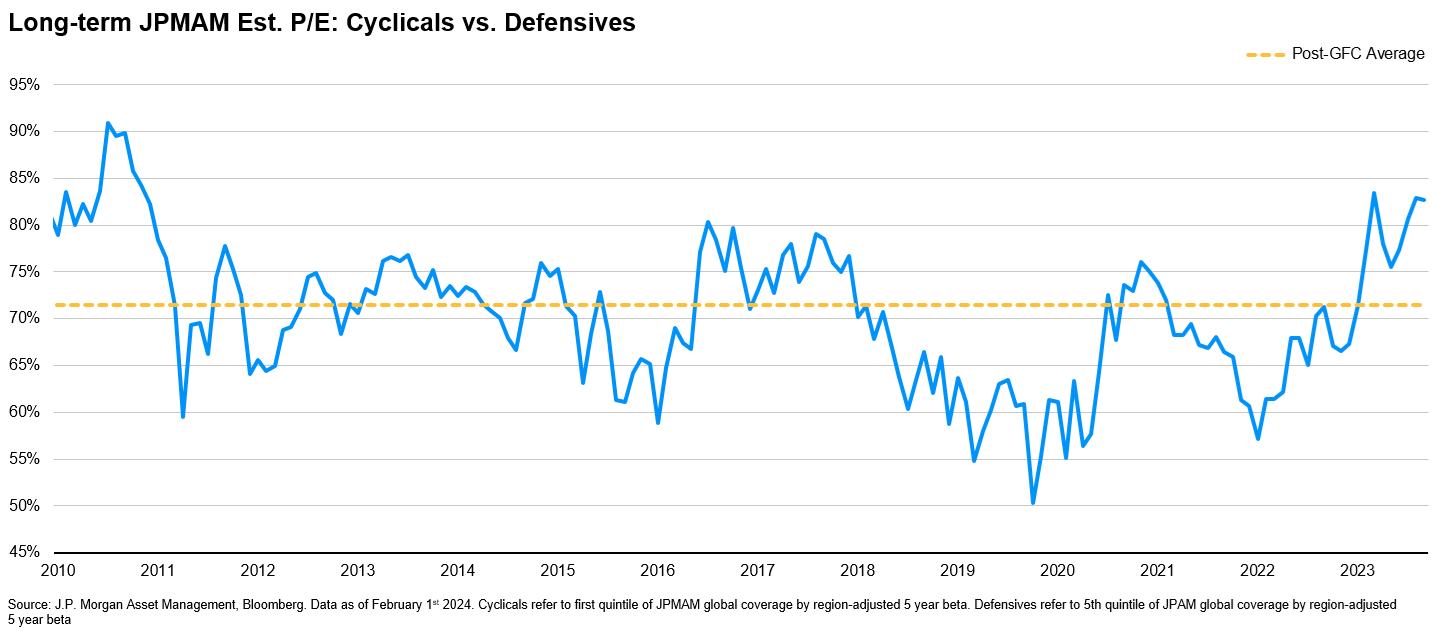

Today, “historical defensives” are cheap, such as utilities and consumer staples. “They don’t have the jazzy artificial intelligence (AI) story,” he pointed out, describing them as “boring stocks”.

In the past, income investors flocked to these sectors for their dividends but now, with bonds and cash offering decent yields, their relative attractiveness has diminished.

As a result, consumer staples are “getting more and more attractive” given their cheap valuations. Coca-Cola is one of the £730m JPM Global Equity Income fund’s top 10- holdings.

Boring defensive stocks are attractively valued compared to cyclicals

“The market is getting its head around this transfer and tricky hand-off between price-led growth to volumes-led growth,” Witherow continued. In other words, companies that hiked up prices in the past couple of inflationary years are starting to lose market share as consumers find cheaper alternatives elsewhere, so they are having to become less aggressive with price hikes and promotions.

“There’s always a pocket of controversy somewhere that we’ll exploit,” he added. “Now the opportunity is in boring stocks.”

Utilities are the JPM Global Equity Income fund’s biggest active overweight, with a 7% allocation, representing an overweight relative to the MSCI AC World benchmark of four percentage points.

The fund owns four utility companies in the US, where electrification has been “turbocharged by data centre demand”. These companies are paying dividends of 4% and are trading on 15-16x earnings, which is a post-financial-crisis low point. “A 4% yield compounding at 7% is a really nice total return from a regulated asset,” he explained.

He also holds a couple of utilities in Europe, where the grid needs to be reorganised to be fit for purpose and to incorporate renewable energy.

Exploiting these revolving pockets of controversy has paid off for the JPM Global Equity Income fund, which is the third-best performer in the IA Global Equity Income sector over 10 years, fourth over five years and seventh over three years to 11 June 2024.

Performance of fund vs benchmark and sector over 10yrs

Source: FE Analytics

That being said, sector allocations are tilts, not large bets. Witherow and the fund’s co-managers Michael Rossi and Helge Skibeli (an FE fundinfo Alpha Manager) endeavour to keep sector and regional exposures broadly similar to benchmark, believing that their expertise lies in stock section, not macro calls.

The fund aims to deliver a yield that is 20-50% higher than the broader market, plus an income that is compounding faster and, finally, fewer dividend cuts than the broader market.

Witherow expects the portfolio to deliver 8% dividend growth per annum for the next five years, which is about 50 basis points higher than the MSCI AC World index benchmark.

JPM Global Equity Income is slightly underweight the US, where dividends in general are lower than the UK and Europe, but its underweight is much smaller than most global equity income funds, Witherow said.

He thinks the Magnificent Seven, which dominate most global benchmarks, warrant their valuation premiums because of their superior earnings growth. Now that several of them have started to pay dividends, they also fall within his remit.

Meta Platforms, Alphabet and Salesforce all initiated dividends this year and Witherow bought shares in Meta the day it announced its dividend. It is currently the fund’s fifth-largest holding.

Microsoft is the global equity income strategy’s largest holding and although it pays a modest yield, it has strong potential for dividend growth, he noted.

Witherow is concerned, however, that consensus expectations for corporate profitability are too lofty and too complacent. Margins have come down since 2022 but are not far off their all-time highs. Companies have multiple challenges to deal with including slowing inflation and slowing real growth but sticky wage inflation, he said, and these challenges are not fully priced in.