Company takeovers can be an important driver of returns for investors but also represent a prospective danger lurking in the UK’s acquisitions-hungry market, according to experts.

Takeover activity in the UK picked up noticeably in the past few years, with the FTSE 250 particularly targeted by so-called “clever money” – private equity or trade buyers who see value where investors don’t want to look.

Ben Mackie, portfolio manager at Hawksmoor, said: “These deals, which are happening at 40%, 50% premiums to undisturbed share prices, are an indication of the value that exists in the UK. If public investors aren't interested in that value, then private market investors will take advantage.”

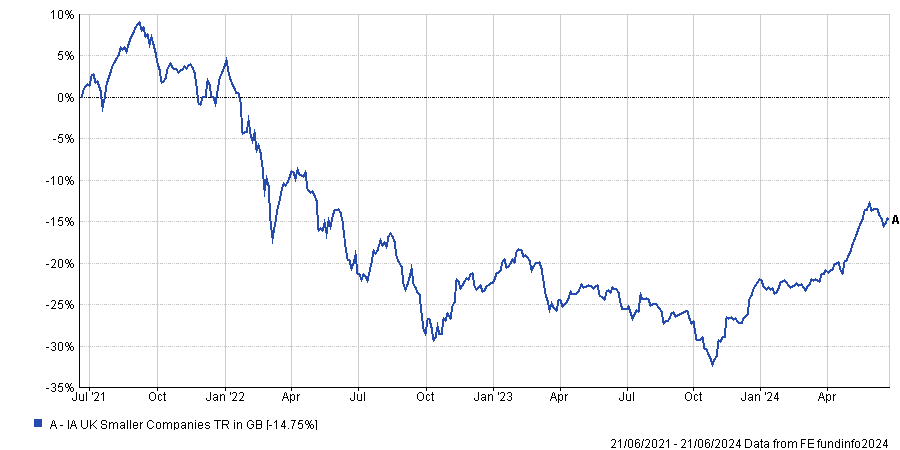

The small-cap end of the UK market in particular has had a terrible run in 2022 from which it has yet to recover, prompting a fund sell-off that still persists today. Pension funds have also turned their back to the domestic market.

Performance of sector over 3yrs

Source: FE Analytics

While takeovers have usually been seen as a blessing that could revitalise an unloved sector, there are enough setbacks for Mackie to describe it as a “double-edged sword”, leading to a smaller public market and a shrinking opportunity set for those who invest in it.

The situation is exacerbated by share buybacks and a reduced number of companies coming to market in the first place.

“If this trend continues, you end up with a small-cap market that doesn't exist in 10 or 15 years’ time,” said Mackie. “That's quite an extreme outcome, but if the trends that we've seen in the past couple of years continue then that might become a reality.”

On this background, UK equity managers find themselves in a tricky position and end up selling companies for cheaper than their intrinsic value.

“If a stock’s intrinsic value is £2 a share and it's currently trading at £1, in theory managers have a big potential upside. But if their funds are selling off because everyone hates the UK and the stock is depressed, it’s tempting when clever money comes along and offers to buy it for £1.50,” he said.

“It’s a 50% uplift on your share, you get liquidity and a lovely boost in your performance. But you're selling something that you still believe is a big discount to the true intrinsic value.”

Alex Wedge, FE fundinfo alpha Manager of the Liontrust Special Situations fund, agreed, also describing takeovers as a “double-edged sword”.

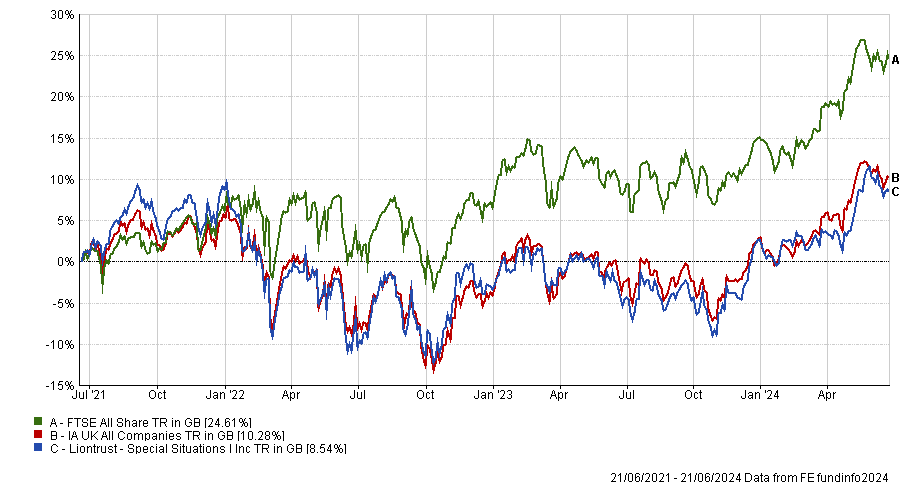

Performance of fund against sector over 3yrs

Source: FE Analytics

“While we take a case-by-case approach to evaluating the merits of any incoming bid, there are wider considerations around the health of the UK market,” he said.

“The main examples are the de-equitisation caused by increased acquisition activity and fewer companies coming to market. But the outflows from UK equities are partly to blame for this dynamic, and we have been vocal supporters of policy change.”

That said, Wedge was “encouraged” to see some green shoots in the UK of late, such as Raspberry Pi, which came to market this month and the Liontrust UK Smaller Companies Fund bought a position in.

The Labour party manifesto committing to increase investment from pension funds in UK markets was also a boost, he noted.

Not all were concerned, however. Mark Niznik and Will Tamworth, co-managers of the five FE fundinfo Crown-rated Artemis UK Smaller Companies fund, were happy to have extra cash from the sale to move on to other opportunities. Their fund has had 29 takeovers in the past five years, at an average premium of 50%.

Performance of fund against sector and index over 3yrs

Source: FE Analytics

“We need to recognise that, whilst it might be galling to sell shares for below what we see as ‘intrinsic value’, this may be in the interests of our investors if we are able to reinvest the proceeds in companies that are being valued at an even greater discount to intrinsic value,” they said.

“Despite all the recent takeovers, there is still plenty of choice. The talk of small-caps not existing in a few years is based on the narrow FT Small Cap index which ignores the small-caps in the FTSE 250 index, the Fledgling index and those on the AIM market.”

The managers also weren’t fazed by the dormant IPO (initial public offering) market, which has struggled as companies have refrained from listing into a market where there is little investor appetite.

“When valuations are low – something that is good for long-term investors – it makes sense that the number of takeovers exceeds the number of IPOs. When valuations correct, as we would expect them to, we would expect a growing number of IPOs thus replenishing the opportunity set. The number of IPOs has always been cyclical,” they said.