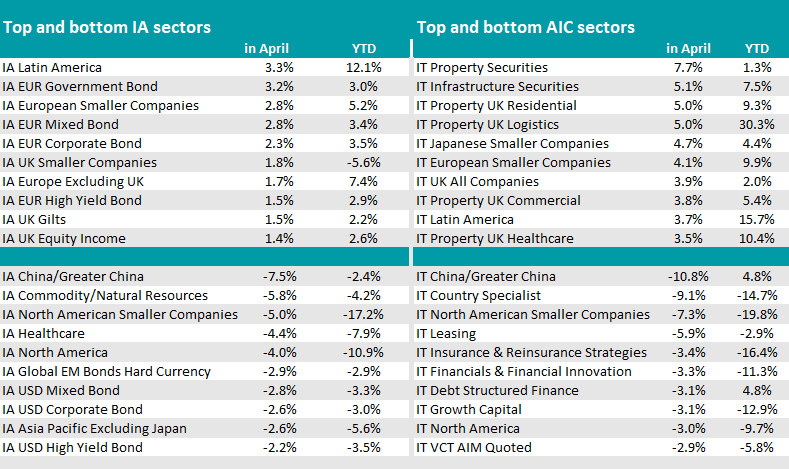

In an April full of US-based news, Latin America stole the limelight, becoming the top performer across all Investment Association sectors – it achieved a 3.3% average return over the month and an unrivalled 12% over the year to date.

Usually, outperformance in this part of the world coincides with a surge in commodity prices, but that wasn’t the case this time around (the IA Commodity/Natural Resources sector fell 5.8% in the period) – a surprise for many experts, including Fairview Investing director Ben Yearsley.

“In a strange month when commodities (except gold) were hit, seeing Latin American funds top the sector table was a bit of a surprise,” he said. “However, the weakness of the US dollar was probably the key factor in propelling the sector up over 3% in April.”

April was also a good month for European government bonds, driven by the sharp fall in yields for German bunds (the IA EUR Government Bond sector was just below Latin America at 3.2%), as well as a good month for Europe in general. The region dominated in the top 10 of IA sectors, as shown in the top left corner of the table below.

European smaller companies were at the helm, with a 2.8% return, while UK small-caps were one percentage point below that. UK equity income funds rounded out the top 10.

Source: FE Analytics

On the right-hand side of the table are investment trusts, where real estate knocked it out of the park, with returns generously above those of funds.

Property and infrastructure companies returned 5% and above, with property securities leading the pack at 7.7%.

Within equities, Japanese smaller companies were six basis points above their European competitors; while the IT UK All Companies sector achieved a dignified 3.9% (but has only grown 2% over the year to date).

The bottom half of the table highlights the worst performers, and both the funds and trusts sides were led by China. There was no surprise there for Yearsley.

“Tariffs of 145% are going to hurt, however there are signs of resilience in the wider economy with growth and consumer spending robust,” he said. “Beijing also has the lever of currency devaluation – not great for investors but good for exports. Renminbi also fell 3.85% against sterling last month.”

But the perpetrator of those tariffs did no favours for his domestic market. Five US sectors were among the month’s worst-performers – IA North American Smaller Companies (-5% in April and -17.2% over the year to date, the worst across all IA universes), IA North America (-4%) IA USD Mixed Bond (-2.8%), IA USD Corporate Bond (-2.6%) and IA USD High Yield Bonds (-2.2%).

The US economy is a mass of contradictions, as Yearsley noted.

“The total unpredictability of Donald Trump’s policies has shrunk the US economy by an annualised 0.3% in the first quarter of 2025 (the first negative reading since 2022), while US consumer sentiment fell by 32% in April to levels not seen since the recession of 1990. A fall in GDP was expected as many companies rushed to import goods in March prior to tariffs being announced,” he said.

“Interestingly, however, there has been a surge in investment, especially from the private sector. In other positive news, the Federal Reserve’s favoured measure of inflation fell to the lowest level in four years to 2.6%. Consumer spending also grew 0.7% in March.”

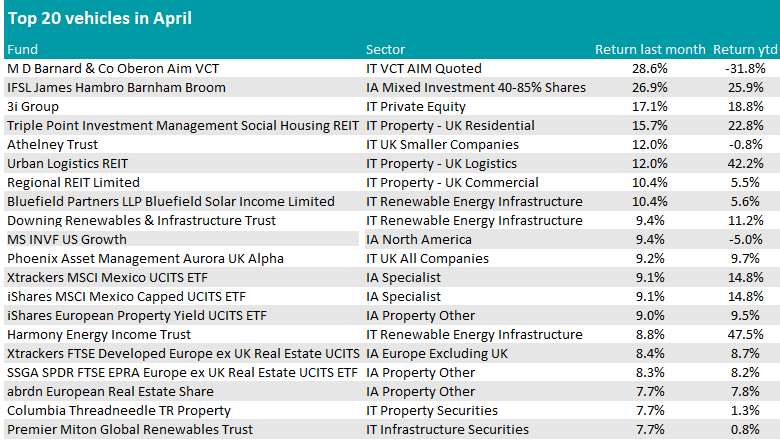

Looking at the best-performing funds and trusts, the patterns are similar. A number of property trusts made an appearance, including 3i Group, the Urban Logistics REIT and Columbia Threadneedle TR Property, alongside a number of European Real Estate funds and exchange-traded funds (ETFs).

Source: FE Analytics

Another trend was Mexico’s outperformance, as two MSCI trackers demonstrated.

Bucking the trend of US underperformance, the MS INVF US Growth had a positive April, surging 9.4%, but it remained in negative territory over the year to date (-5%).

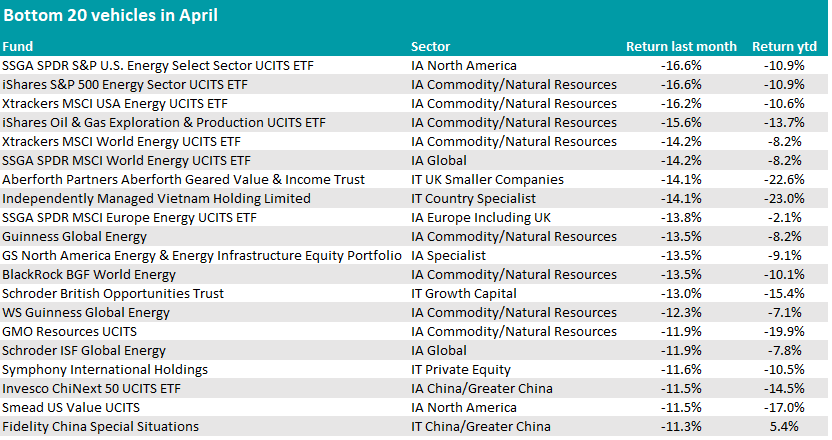

Renewable Energy Infrastructure funds also outperformed, whereas oil and gas strategies plummeted, taking over the list of worst performers, as illustrated below.

Source: FE Analytics

This is a tough investing environment, said Yearsley, where doing nothing is “a decent option”.

“In times of extreme volatility, sitting on your hands is often the best strategy. Those who panicked and sold out early in April may well have seen losses in many asset classes but in most cases, with the clear exception of China, losses were largely erased by the month-end,” he concluded.