Baillie Gifford has bought shares in controversial taxi company Uber for the first time, with managers of the Monks investment trust taking a stake in the business.

The firm has held competitors, such as Lyft, but has shied away from Uber until now. FE fundinfo Alpha Manager Helen Xiong explained the company has historically been a “good product but a terrible business”, but expressed confidence in chief executive Dara Khosrowshahi, who took the helm in 2017.

The trust had the opportunity to invest in Uber when it was private and again when it first listed but has “always passed” on the opportunity as the team “could never quite get comfortable with the cultural side of things” and the way the business operated.

However, Khosrowshahi has “changed that and cleaned up the culture” and also “addressed a lot of the low-hanging fruit”, meaning it is now “not just a good product but also a good business”, the Monks deputy manager said.

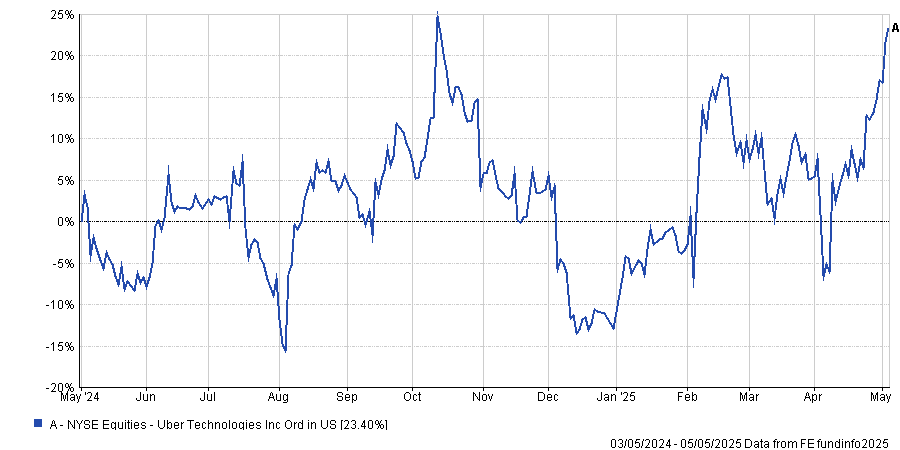

Perhaps more importantly, Uber has been trading on a more reasonable valuation so far in 2025. Shares peaked in October 2024 and dropped sharply heading into this year, giving the Baillie Gifford team a chance to pick up the stock. Since then, it has rocketed back to its all-time high, as the below chart shows.

Share price of Uber Technologies over 1yr

Source: FE Analytics

Many have questioned the company’s viability in a world of autonomous driving, with the likes of Tesla and Waymo creating self-driving taxi services.

“We have gotten a lot more comfortable with that and Uber has the potential to be quite a significant player in that environment. The scepticism around that question right now is giving us an opportunity,” said Xiong.

Uber is part of a plan by Monks’ managers to upgrade the portfolio over the past year, buying cheaper stocks that have higher growth forecasts than incumbent portfolio holdings.

“The portfolio is now trading on a very modest valuation premium to the market for a much superior growth profile and I think that provides a strong platform to deliver for shareholders,” said Xiong.

“We’ve been using the market volatility to upgrade the portfolio and there has been no shortage of opportunities. We have bought a lot of companies even this year including Uber, where we think the market is underappreciating its potential to become a major player in the autonomous economy.”

Another recent purchase is Salesforce – part of the trust’s thrust into artificial intelligence (AI), which as a theme makes up around a quarter of its assets across the supply chain spectrum.

Previously owned by Baillie Gifford in another fund but subsequently sold, this purchase marks the Edinburgh-based firm’s re-entry into the cloud-based software developer, which is perhaps best known for its customer-relationship management (CRM) systems.

“A lot of the [AI] winners to date have been hardware, such as Nvidia, and the hyperscalers. It has been a very narrow set of winners,” said Xiong.

After the development of the initial technology, the next phase will be its implementation. At present, this has focused on AI being an answer engine, used as an alternative to traditional search engines such as Google, she said, something akin to “an AI assistant, if you like”.

“The next stage, and we are probably there already, is AI collaborators. Rather than asking AI a question you collaborate with it to produce something,” the Monks deputy manager said.

After that is ‘agentic AI’, which is using the technology as an autonomous agent to do stuff for users. Salesforce is looking into this as a way to sell “digital labour”, which she said could have “huge potential” for the business.

On the firm’s website, it advertises Agentforce, which it describes as able to allow customers to “boost productivity with AI agents that assist with tasks and take action”.

Both purchases are examples of why she does not believe that incumbent players in industries will be wiped out by start-ups with advanced technology.

While this is a possibility, as she believes AI will be a “democratising, broadening force” across industries, there should be a “competitive advantage” to those with strong distribution and data.

“It could be the new start-ups that really benefit, but we think there is a world in which the incumbents benefit,” she concluded.