Surging market volatility and heightened uncertainty mean that most of the US equity funds that made last year’s biggest gains slid to the bottom of the performance table in 2025, according to Trustnet research.

Uncertainty hangs like a shadow over the US. Since president Donald Trump’s inauguration, he has imposed reciprocal tariffs on all major trading partners, paused said tariffs, feuded with the Federal Reserve and kicked off a trade war with China, sending shockwaves through equity and bond markets.

Rob Morgan, chief analyst at Charles Stanley Direct, said: “The second presidency of Donald Trump has certainly been a colourful one for investors so far. That colour being mostly red.”

Trustnet examined how the best-performing funds in the investment association (IA) last year have done so far in this year of heightened volatility. We looked specifically at the performance of the top-quartile funds of 2024 in each sector.

In the IA North America sector, 41% of 2024's highfliers are crashing back down to earth, falling from the top to the bottom quartile. Additionally, 34% have slid into the third quartile, meaning 75% of 2024’s best US funds are now underperforming.

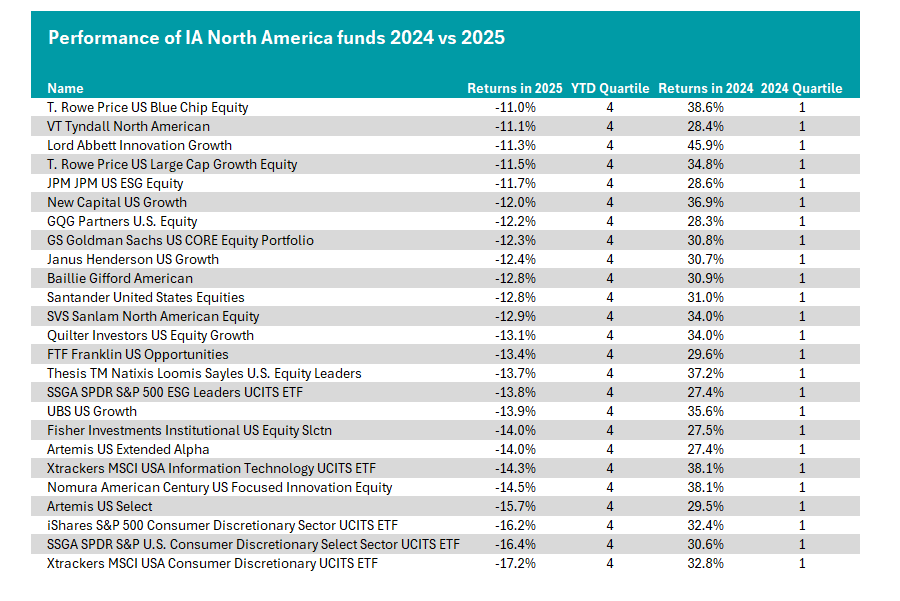

The table below shows the 25 funds that were in the top quartile in 2024 but fell into the bottom quartile in 2025.

Source: FE Analytics

Several passive products are struggling as the S&P 500 has been on a mostly downward trend since Trump’s inauguration. Despite rallying recently, the S&P 500 is still down 7% year-to-date, a sharp downturn from its status as the best-performing market in the past year.

The Lord Abbett Innovation Growth fund is having a particularly challenging start to the year. At the end of 2024, the fund was up 45.9%, the third-best performing portfolio in the entire sector. As of 6 May it is down 11.3%, a total fall of 57% from its peak. This may be the result of holding six of the Magnificent Seven within its top 10 allocations, all of which have posted negative returns so far this year.

Other big names that had a poor start to the year include the £2.6bn Baillie Gifford American fund, which is co-managed by FE Fundinfo Alpha Manager Tom Slater, who also runs the £11bn Scottish Mortgage Investment Trust. It is down 12.8% this year, having made a 30.9% gain in 2024.

Morgan noted the US equity market has been suffering because of uncertainty around tariffs, as many are afraid that the US consumers and businesses will be the ones feeling the pinch through higher prices.

Darius McDermott, managing director at Chelsea Financial Services, added that this market rotation indicates the danger of blindly picking funds based on past performance.

“Much of recent performance, both this year and last, has hinged on whether you are underweight or overweight the Magnificent Seven (Apple, Nvidia, Microsoft, Tesla, Alphabet, Amazon and Meta). Sentiment has shifted from an aggressive risk-on stance to a risk-off-possible-recession-coming stance,” he explained.

Even beyond these mega-cap tech names, McDermott argued the US was in "unmistakable bubble territory" in 2024, which is now starting to burst. For example, sectors such as consumer staples also had “eye-watering valuations”, with both Costco and Walmart trading at higher valuations than five of the Magnificent Seven last year.

The US market was so highly valued that the best North American funds had much further to fall when the situation finally turned, McDermott concluded.

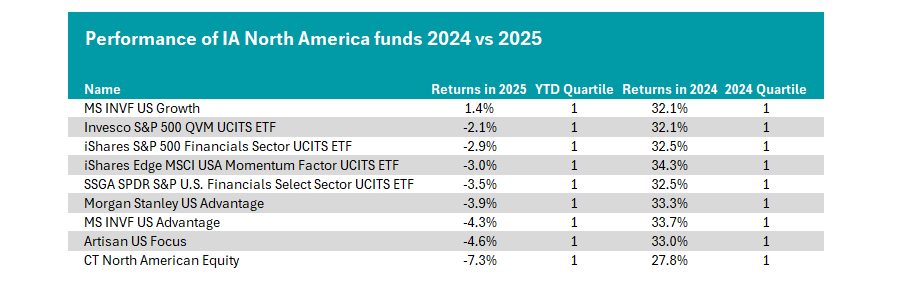

However, despite a rough start to the year, nine funds have held their ground, delivering top-quartile results in both 2024 and 2025, as seen in the chart below.

Source: FE Analytics

The $3.2bn MFS INVF US Growth is up 1.4%, making it the only top-quartile US fund of 2024 to post a positive return this year. It is led by a six-strong team at Morgan Stanley and features Tesla as the only member of the Magnificent Seven in its top 10 holdings. It has recovered much better from ‘Liberation Day’ than the average IA North American fund, which is down 9%.

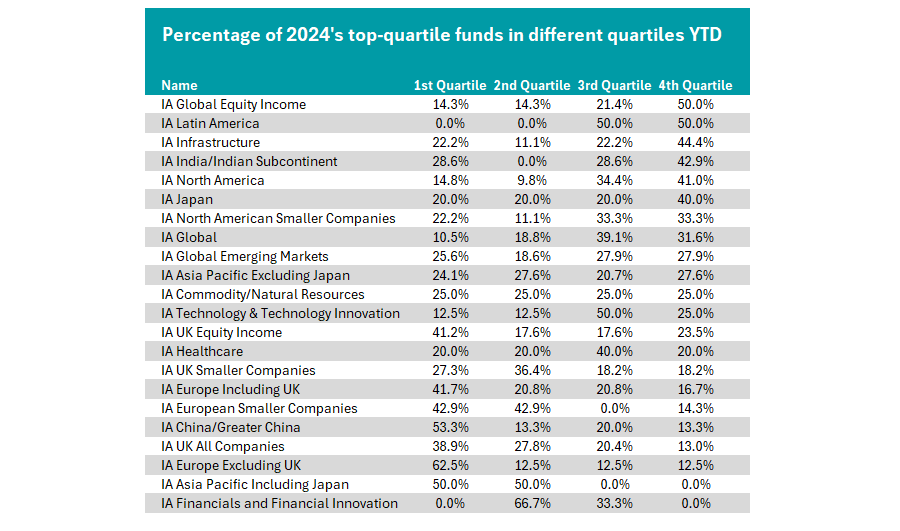

More broadly, IA North America is not the only sector where last 2024's winners have become this year’s losers. Four other sectors (IA India/Indian Subcontinent, IA Infrastructure, IA Latin America and IA Global Equity Income) experienced a larger percentage of their funds falling into the bottom quartile this year, as seen in the chart below.

Source: FE Analytics

Both IA Latin America and IA Global Equity Income particularly struggled, with half of the top-performing funds of 2024 falling into the bottom quartile so far this year.