“Scottish Mortgage is not for everybody”. That was the message from Tom Slater, manager of the highly popular investment trust, who defended the portfolio’s volatility in recent years.

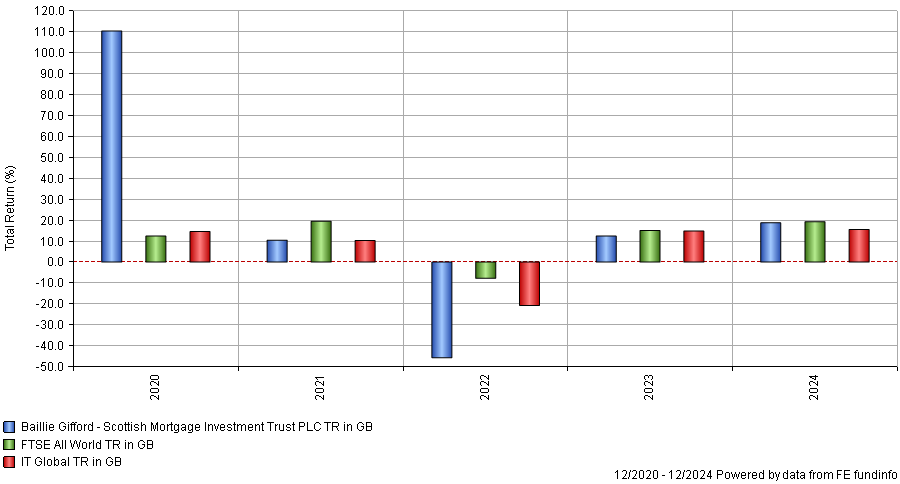

The growth trust has been a rollercoaster for investors, topping the charts in 2020 with a 110.5% return. Since then it has been less stellar, producing below-average returns in 2021 and 2023 against its IT Global sector and making a 45.7% loss in 2022 – the worst performance of its peer group.

Performance of trust vs sector and benchmark over 5yrs

Source: FE Analytics

Despite this, Slater said he “makes no apology” for the trust’s volatility, adding that this trust – and equities in general – may not be suitable for investors who are concerned about big price drops.

“There are less volatile instruments you can invest in,” he said. “You have to accept volatility in equity markets and be return-seeking rather than risk-minimising.

“One thing the board has really helped us with over the past 20 years is identifying what we do in people’s portfolios and why they should own Scottish Mortgage. But the flipside of that is why some people shouldn’t own Scottish Mortgage,” he continued.

“I think that is almost the test for any fund: whether there is a certain set of people that it is appropriate for and others that it is not.”

He pointed to the trust’s track record of picking winners over the long term as justification for his belief. The trust has invested £65m into chipmaker Nvidia over its lifetime but has pulled out some £1.5bn.

There was a similar gain from car manufacturer Tesla, where a total investment of £322m has resulted in the trust netting a £4.5bn return.

Slater’s rationale has been tested recently in the “uncertain world” we now live in. US president Donald Trump’s ‘Liberation Day’ tariffs and subsequent rollback of measures spooked markets and caused elevated volatility. This, coupled with the outbreak of war across the world and a sluggish economy could give investors pause for thought.

But Slater said investors should not overreact and should take their time rather than making rash decisions.

“What I think is really important is that you make slow decisions not fast ones. It is easy to get spooked by the market into making decisions too quickly without gathering enough evidence and taking your time and being sure what you want to do,” the Scottish Mortgage manager said.

“Broadly you see people destroy so much value by selling low and buying high. If I look through some of the companies whose share prices were hit the most on Trump’s ‘Liberation Day’, those share prices are back to where they were the day before the announcement.”

While narratives can be noisy – and market reactions can be furious – investors need to “step back” and “think about the long-term trends”.

It is for this reason the trust continues to back its winners, such as SpaceX, which is the largest position at nearly 8%, and Mercado Libre, which stands at nearly 6% of the portfolio.

“Where we find these exceptional growth companies, we’re prepared to back the management teams for the long run. Where we see the opportunity growing and the likelihood of success increasing we will let those positions become big positions,” said Slater.

“We think that is how you make long-term returns in stock markets. It is the small handful of big winners that you manage to hold onto, that you don’t chip away at in the name of risk reduction or risk control but instead you carefully analyse the upside and you stay true to those positions.”

As such, he does not “try to guess” what the impact of tariffs will be, instead accepting that he does not know the answer and that the “situation is just too dynamic”. “The economy is a complex system and predicting outcomes is almost impossible,” he said.

One way the manager can reduce risk is through diversification. Not only does the trust look across the globe, but it is also willing to dive into private markets to find the best returns.

This latter part was key to Scottish Mortgage’s success in the 2010s and will continue to be a staple part of the portfolio. Indeed, Slater noted that he no longer considers whether a company is public or private, instead looking at the quality of the business.

“One evolution of the approach over the past 15 years is that we have had to go into private companies to maintain our opportunity set. There are a number of companies that would have listed in another era, which are not public today,” the Scottish Mortgage manager said.