Funds investing US equities, tech stocks and uranium miners are among those making the highest returns since markets started to recover from the Liberation Day sell-off, FE fundinfo data shows.

Markets were rocked on 2 April – so-called Liberation Day – when US president Donald Trump unveiled trade tariffs on much on the world and later embarked on a tit-for-tat series of hikes with China.

However, risk assets started recovering from 9 April, when the US announced a 90-day delay on most tariffs to allow time for trade deals to be negotiated. Last week, the UK was the first country to clinch a trade deal with the US, then markets rallied yesterday when the US and China agreed to slash tariffs.

Between 2 April and 9 April, the MSCI AC World fell 9.5% in sterling terms but it has rallied 12.8% since the tariff delay was announced (aided by a 3% jump yesterday after the US-China deal).

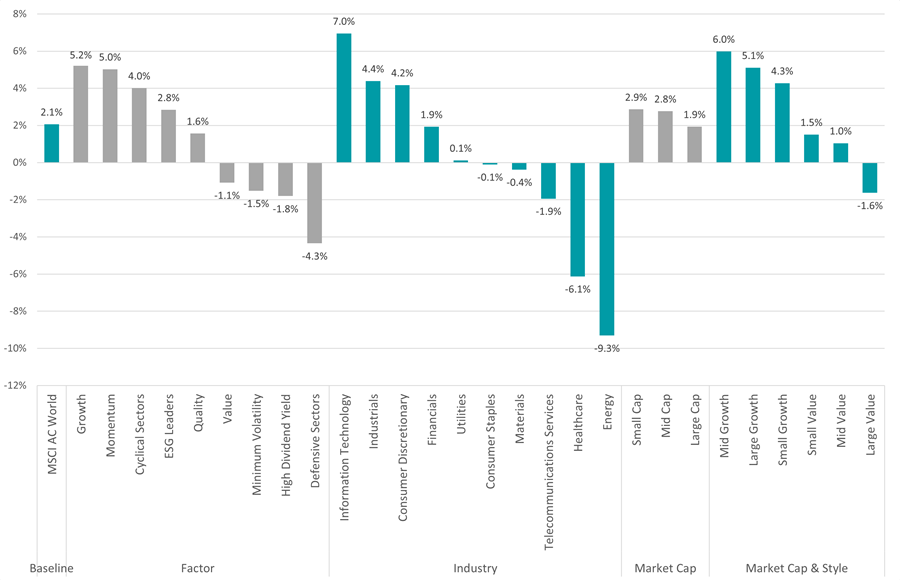

This means that global equities have gained 2.1% since Liberation Day, led by growth and tech stocks – the same areas that led the falls when the tariffs were first announced.

Performance of MSCI AC World and sub-indices since 2 Apr 2025

Source: FinXL

The impact on funds has been just as noteworthy. Between 2 April and 9 April, 90% of the funds in the Investment Association universe made a loss but this has since reversed and 88% have made a positive return since 9 April’s tariff delay.

This means that 75% of funds have made a positive return since Liberation Day – an outcome that many commentators at the time (including this journalist) would have thought very unlikely.

FE fundinfo data shows there are 20 peer groups where every fund is in positive territory since 9 April, including IA UK All Companies, IA UK Equity Income, IA UK Smaller Companies, IA Mixed Investment 40-85% Shares, IA Global Equity Income and IA China/Greater China.

IA Global just missed out with 99% of funds in the black while the stat for IA North America is 98%.

However, it’s worth remembering that many of these sectors had 100% of their members posting losses in the week after Liberation Day.

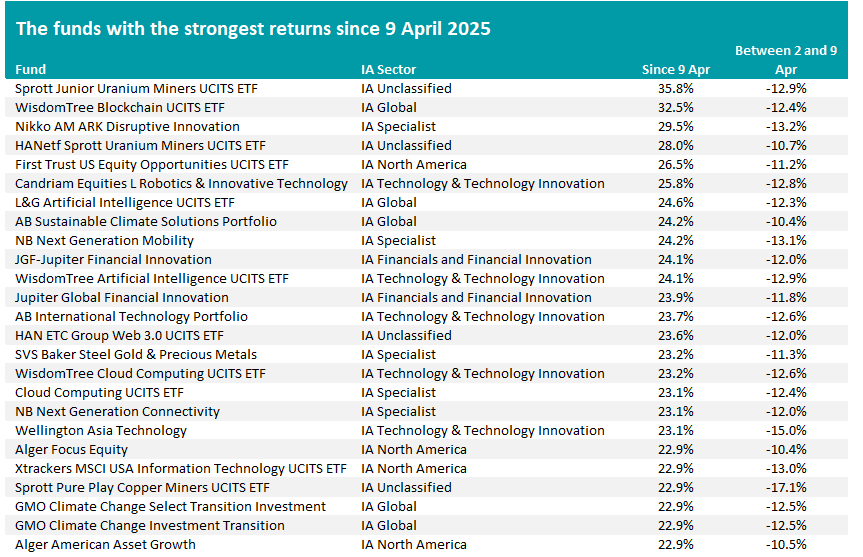

But which funds have made the biggest gains since the 90-day tariff delay reassured markets and sparked a jump in investor sentiment?

According to FE Analytics, the average fund in the IA Technology and Technology Innovations sector is up 15% since 9 April, followed by IA Financials and Financial Innovation (up 14.1%), IA UK Smaller Companies (up 13.9%) and IA European Smaller Companies (up 13.4%).

As the table below shows, many of the individual funds with strong returns are relatively niche strategies, rallying hard as investor sentiment improved but taking heavy losses when markets panicked.

Source: FinXL

Among the best performers are Sprott Junior Uranium Miners UCITS ETF and HANetf Sprott Uranium Miners UCITS ETF. Uranium and its miners have outperformed the wider stock and commodity markets in recent years, supported by growing interest in nuclear power and a supply deficit.

Uranium prices hit a record high in February and have since come off their peak but were relatively stable when stocks, bonds and other commodities were hit with Liberation Day volatility. However, its miners were still caught up in the sell-off.

Jacob White, ETF product manager at Sprott Asset Management, said: “In a market increasingly gripped by macroeconomic volatility and rising correlation across asset classes, uranium is quietly distinguishing itself, holding firm where others have cracked.”

Other themes can be seen in the list of the strongest funds during the rally, including the resurgence of tech stocks.

Nikko AM ARK Disruptive Innovation, Candriam Equities L Robotics & Innovative Technology, AB International Technology Portfolio and WisdomTree Artificial Intelligence UCITS ETF are among the top performers.

Tech stocks led the market for a considerable amount of time but started to struggle in the past few months as investors worried about excessive valuations and weakening growth.

They were hit hard when it looked like Trump’s widespread tariffs could derail the US economy but have rallied strongly after the 90-day delay was implemented and trade deals started to emerge.