For many parents, the thought of their child starting university comes with a financial knot in the stomach – tuition fees, living costs and the prospect of student debt can make higher education feel like an overwhelming expense to prepare for.

While loans remain the default option for most students, some parents are choosing to start saving early and new analysis shows that even small, regular contributions from birth can make a major difference by the time a child reaches 18.

According to modelling by trading platform IG Group, parents who invest £3 a day from the birth of a child could accumulate enough to cover projected tuition costs in full.

Chris Beauchamp, chief market analyst at IG, said: “With tuition fees running into the tens of thousands [of pounds], many young people are starting their adult lives burdened with debt – a tough reality especially in today’s uncertain jobs market. But parents who start early can help change that.”

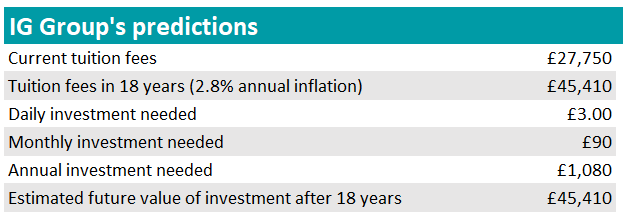

Tuition fees currently stand at £27,750 for a standard three-year course but parents are too well aware that they are unlikely to remain at this level over the coming two decades – in fact, IG predicts a growth to £45,410 in 18 years’ time, in line with a projected inflation of 2.8% a year.

But all new parents need to tackle this challenge is £3 a day, the IG study shows, (or £90 a month and £1,080 annually), invested into a global equity index tracker for 18 years.

If investment returns will average at 7.35% per year, as the MSCI Global Index Tracker’s performance has averaged over the past 18 years, by their child’s 18th birthday, they will have exactly enough to cover the inflation-adjusted tuition costs.

The table below shows the monthly and annual contribution required and the modelled future value after 18 years. This is an example of what experts call ‘compounding returns’.

Source: IG Group

“Compounding is one of the most powerful tools at the disposal of investors with time on their side,” Beauchamp continued.

“While it’s impossible to predict investment returns and future economic conditions, if the market repeatedly provides us with one lesson, it’s that investors who start early and remain consistent despite market conditions reap considerable rewards in the future.”

IG’s figures depend on a number of assumptions. Future equity returns may diverge from historical averages, inflation could exceed 2.8% and the model does not account for other university-related expenses.

The analysis is intended as an illustration of how disciplined, long-term investing by parents could materially reduce future student borrowing.

These figures come at a time when students in England entering repayment in the 2024–25 financial year faced an average loan balance of £53,000 upon first becoming liable, according to data from the Student Loans Company – an increase of around 10% over the prior year.

The organisation also predicts that the outstanding loan book will continue to grow, potentially reaching £500bn (in 2023-24 prices) by the late 2040s, so the earlier parents start saving, the greater the potential to ease the financial burden on their children.