We might be on the verge of a resurgence in small and mid-caps if the post-Liberation Day returns are anything to go by, according to asset managers.

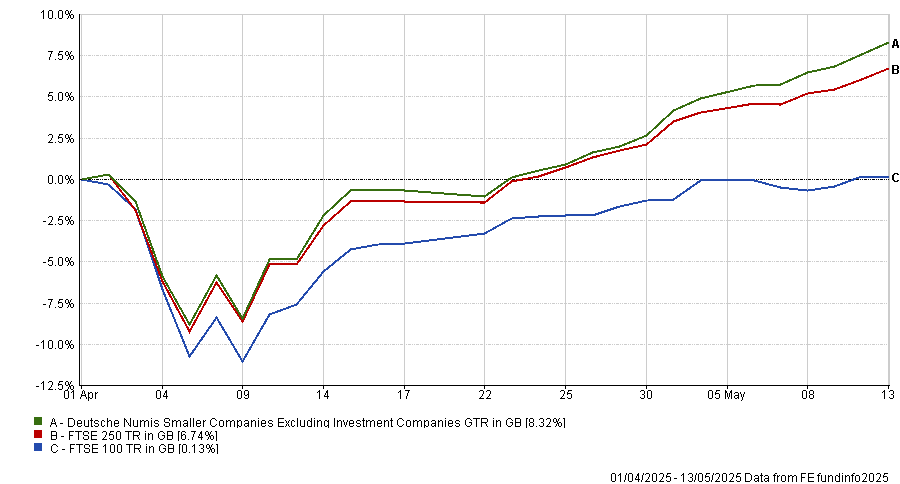

The mid-cap FTSE 250 and small-cap Deutsche Numis Smaller Companies Excluding Investment Trusts indices have trounced the FTSE 100 since US president Donald Trump announced his sweeping punitive tariffs in early April.

This is a reversal from the past half a decade, with the average investor achieving better returns by tracking the FTSE 100 since 2020 than by going down the market capitalisation spectrum.

Alexandra Jackson, manager of the Rathbones UK Opportunities fund, attributed this to several factors. Mid- and small-caps are far more domestically driven, with around 50% of their revenue based in the UK compared to 30% of the FTSE 100.

As a result, domestic companies have suffered due to the poor macroeconomic environment of the past five years, which paired “downbeat and confusing messaging” from the government with a longer-than-expected interest rate-hiking cycle in 2022.

However, since 2 April, the tides have turned, with the FTSE 100 up by 0.2% while the FTSE 250 and Deutsche Numis indices have surged by 8.3% and 6.7% respectively.

Performance of UK indices since 2 April

Source: FE Analytics

Below, managers discuss what is driving this recent rally and if it can be sustained over the long term.

Why have mid-caps bounced?

Firstly, experts pointed to the headwinds facing the FTSE 100, which has helped the FTSE 250 to outperform. Tim Lucas, manager of the BNY Mellon UK Equity portfolio, said fears of a recession in the US and broader market uncertainty are a crucial part of this.

With US president Trump flip-flopping on tariffs and international relations, there is much uncertainty for companies that do a lot of business globally, such as the multi-national businesses that dominate the FTSE 100.

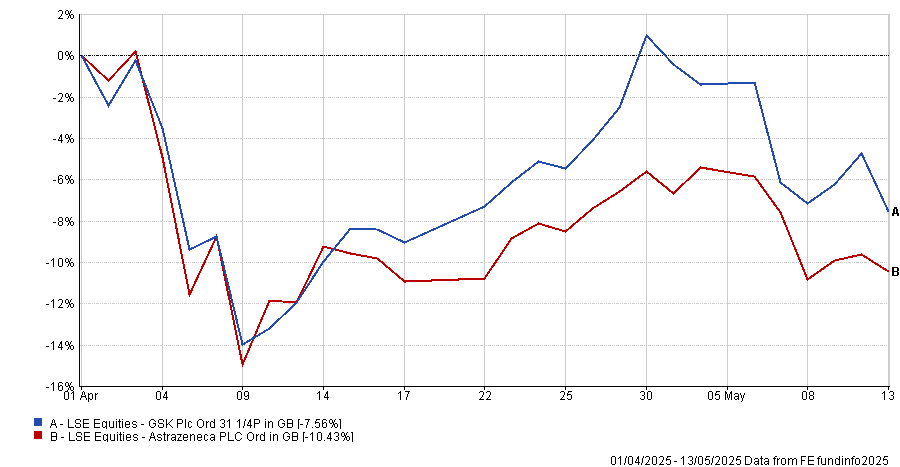

For example, businesses such as pharmaceutical giants AstraZeneca and GSK, which have around 40-50% of their revenue in the US, are still down since ‘Liberation Day’ despite a rally in the FTSE 100 over the past month.

Stock prices of UK equities since 2 April

Source: FE Analytics

Rebecca Maclean, manager of the Dunedin Income Growth Investment Trust, said UK mid-caps are comparatively cyclical and service-oriented, meaning they are less exposed to this uncertainty.

“If you are an investor concerned about global trade and global GDP growth, there are a lot of opportunities in these more domestic businesses right now," she said.

Additionally, UK small and mid-caps are the cheapest part of an already discounted market. She explained the UK market is trading 20% below its historical average, with the FTSE 250 trading at a further 20% discount, making it very attractive to cost-conscious investors.

Alex Paget, fund of funds manager at VT Downing Fox, concluded that increasing uncertainty around Trump's approach, along with historically low valuations in mid-caps, has caused a shift in investors' priorities.

“We have no idea how the next few months will play out, but this general market reset could be what is needed for small and mid-caps to start doing well again," he added.

What still needs to happen?

However, Jackson warned that “one month is not enough” to conclude that we are on the verge of a resurgence in UK mid- and small-caps. Increased inflows into the UK would be essential for this rally to persist over the long term, she said.

The rise of passive investing has led to money pouring into the largest stocks, often away from mid- and small-cap names, she explained. As long as these remain “bereft of inflows”, a sustained rally will be difficult to achieve, she said

Andrew Jones, manager of Janus Henderson UK Responsible Income, added that the biggest challenge to a resurgence “is that consumers have no confidence in the home market".

The UK consumer is in a relatively strong position and has successfully “rebuilt their balance sheets” in recent years. With more in their pocket, people therefore have a higher ability to spend, which should benefit those companies linked to the domestic economy.

Unless unemployment rises materially, "which we do not expect", FTSE 250 businesses could benefit from a significant rise in domestic spending this year, contributing to further outperformance, he said.

However, this will not happen overnight and there will need to be significant evidence of this taking effect before investors start to come onboard.

“I think it will take a bit longer for it to come through, but this the start of a gradual evolution for the asset class.” He concluded.