Was it all just a bad dream? Did it really happen? These are questions investors may well be asking themselves when they look at global markets today.

It has been six (ish) weeks since Donald Trump’s ‘Liberation Day’, when the controversial US president announced a swathe of punitive tariffs, imploding the post-World War Two economic order.

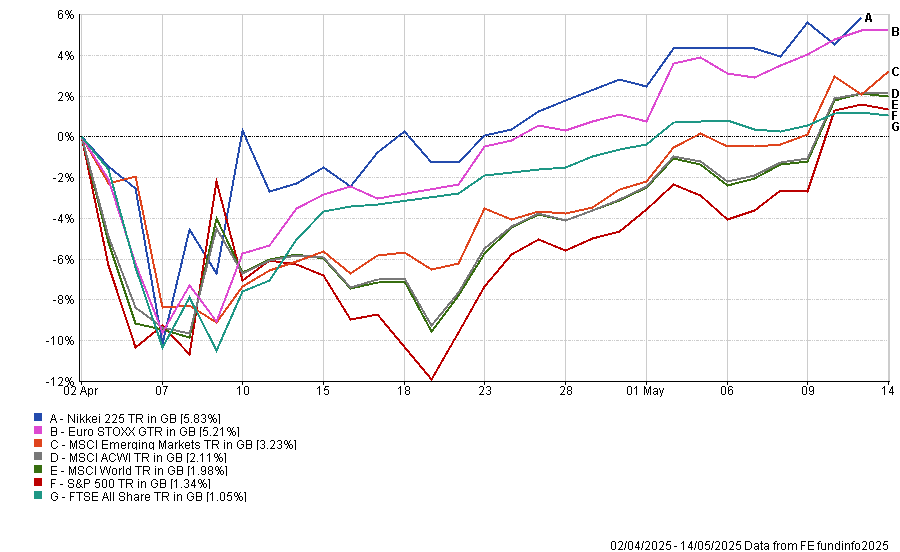

Markets panicked – as they are wont to do – with many of the world’s leading stock markets tumbling in the following weeks. The S&P 500, for example, took three weeks to hits its nadir, some 11.9% lower in sterling terms.

Fast forward to today, however, and every major market is back above their pre-Liberation Day levels, with the Japanese Nikkei 225 the best of the bunch, up 5.8%.

The UK is the worst place to have been invested, with the FTSE All Share up just 1%. Even the S&P 500 has recovered to a 1.4% return.

So was it all just a bad dream? Well, investors have certainly become more confident in recent weeks and there are good reasons for this.

Trump has rolled back on most of his largest tariffs, reducing the sweeping charges to a baseline 10% charge. Then there is China, where the president imposed some of the highest tariffs. The Asian powerhouse responded with charges of its own, before there was an economic ceasefire of sorts last week, with both countries backing down to more reasonable levels.

This has seemingly kickstarted the latest market recovery, but investors should remember that all of this is temporary.

Performance of indices YTD

Source: FE Analytics

The tariffs imposed on Liberation Day remain in play, they have just been paused for 90 days – a deadline that is fast approaching. While the UK and US have made a deal in the interim, there is a huge swathe of countries for America to still negotiate with. Similarly, the tit-for-tat, back-and-forth tariff exchange with China has been put on hold, but is far from over.

Trump and his government will need to master ‘the art of the deal’ if we are to avoid a huge cliff edge in a couple of weeks.

While investors may believe the worst is over – and it certainly seems that way given the marked turnaround in markets over the past couple of weeks – to suggest we are out of the woods would be farcical.

The president has shown that his decisions change on a whim – sometimes it seems by the minute, let alone the day. So while the recovery is welcome, it is far from permanent.

However, this is not a doomsday post, telling everyone to sell out of their holdings and buy gold, bonds or other defensive assets in an effort to hunker down (although those with a nervous disposition may wish to take the recent recovery as an opportune time to de-risk).

Instead, it is a reminder of the benefits of looking through the short-term noise. There will be more market wobbles under president Trump and it could come over anything, whether it be tariffs and trade wars, his views on geopolitical tensions or his attempts to make Canada the 51st state.

But if the past few weeks are anything to go by, markets will recover. So for those with the stomach to do so, staying invested is the best way forward.