HSBC Asset Management has launched a new range of exchange-traded funds (ETFs) offering actively managed exposure to major equity markets, marking its entry into the active ETF space.

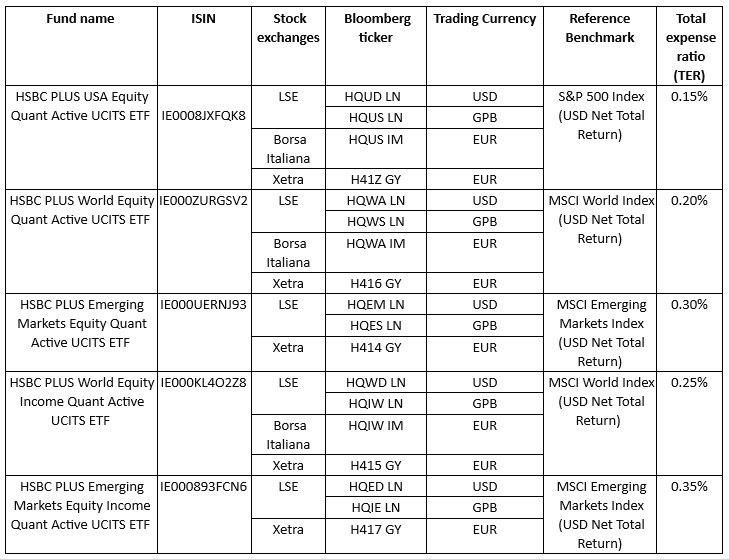

The HSBC PLUS Active ETF range consists of five funds targeting both growth and income across the US, global and emerging markets. Each fund follows a factor-based stock-selection model developed by HSBC’s quantitative equity team.

Three of the ETFs offer core equity exposure, while two are designed to deliver an income premium relative to traditional market-cap benchmarks. The investment process screens stocks for characteristics such as value, quality, momentum, low volatility and size, aiming to maximise exposure to the strongest signals while managing portfolio risk.

The funds will be listed on the London Stock Exchange and available to retail and institutional investors in the UK. Costs range from 0.15% to 0.35%, depending on the market and strategy.

Source: HSBC AM

Olga de Tapia, global head of ETF and indexing sales, said: “The active ETF market is enjoying strong interest from investors, and we are pleased to introduce our suite of funds in this space as part of our efforts to bring innovative and relevant investment tools to market.”